Comments and Issues1 week ago

Comments and Issues1 week agoIfunanya died in the capital city—what hope is there for rural Nigerians?

Comments and Issues1 week ago

Comments and Issues1 week agoThe politics and optics of electronic transmission of election results

Comments and Issues7 days ago

Comments and Issues7 days agoCombating Political Apathy in Nigeria, Reigniting the Nation’s Democratic Spirit

Health6 days ago

Health6 days agoDOJ files expose Gates–Epstein ties in pre-COVID pandemic planning, funding

Football6 days ago

Football6 days agoPremier League defends Leeds goal after Chelsea draw controversy

Education1 week ago

Education1 week agoSit-at-Home: Anambra suspends nine headteachers over pupils’ low attendance

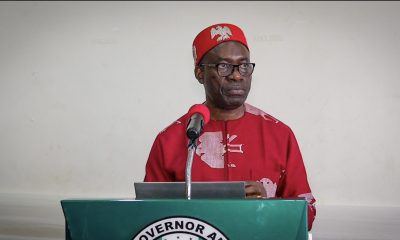

Comments and Issues1 week ago

Comments and Issues1 week agoSenate’s coup against Nigeria’s democracy

Aviation7 days ago

Aviation7 days agoAeroland Travels losses US$333,350.53 to Lufthansa Airlines petitions IGP, Interpol