Point Blank

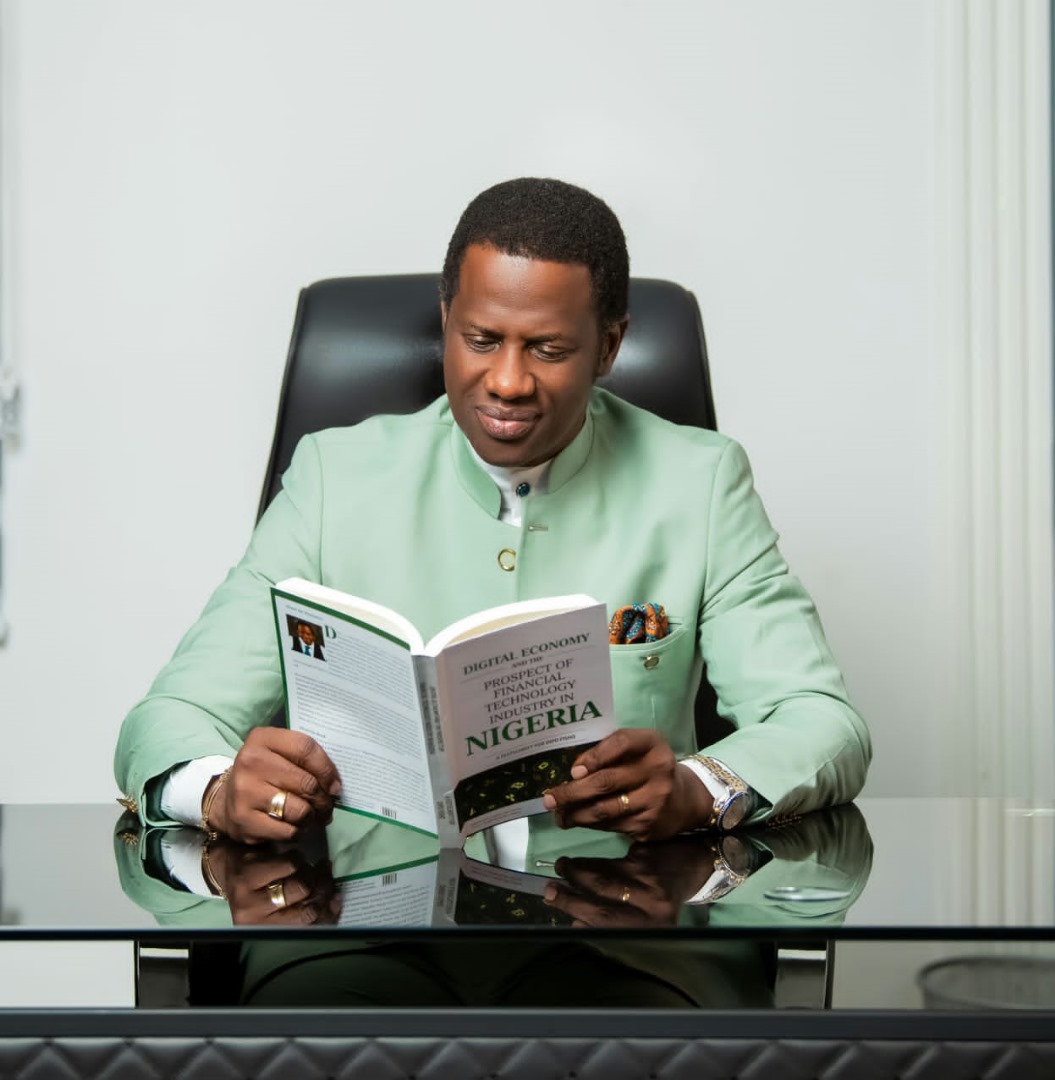

Digital Economy and the Prospect of Financial Technology Industry in Nigeria – A Review

Published

5 months agoon

In those 25 chapters, key conceptual clarifications, as well as key elements in the digital economy ecosystem were cerebrally highlighted. These constitute enablers of Fintech and the features of modern society that signpost digital economy, including mobile banking, robotics, blockchain technology, cryptocurrency, big data, the Internet of Things (IoT), online commerce and distribution, social media and numerous electronic activities in the spheres of education, agriculture and health, among others.

The World Bank taxonomy of foundational pillars of digital economy was put in context within the framework of Digital Economy for Africa (DE4A) namely: digital infrastructure, digital platforms, digital financial services, digital entrepreneurship, and digital skills. We gleaned from the book about how Covid-19 strengthened digital economy globally.

From the Foreword written by Major General Isaiah Allison (PhD) to the introduction by the Vice Chancellor of Glorious Vision University, (formerly Samuel Adegboyega University) Ogwa, Edo State- a tertiary institution of The Apostolic Church Nigeria, and the incisive treatment by the authour, digital economy is understood as the application of modern communication technologies to the hitherto existing practices in the economy such as production, distribution and trading. Otherwise, it would mean the processes through which goods and services are distributed through digitized culture including online platforms.

From a broad conceptualization, clarification and explanatory offering of FINTECH, the authour equally attempts an informed overview of fintech practices in Nigeria in the context of the global economic systems.

Accordingly, three definitional foci – Core, Narrow and Broad Definition of Digital Economy – were identified, each subsuming the preceding and expanding the scope.

In conceptualizing digital economy, the book offers tens of other definitions and contends that digital economy can also be defined by measurements based on the framework developed through the UN Statistical Commission. This conception which is quite useful and explanatory could focus on products, production, and transactions.

Nevertheless, the pivot of conception is that these practices have been enabled by computing and the Internet, thereby guaranteeing real time access to information and informational resources such as apps, digital wallets and assortment of mobile solutions. Therefore, financial technology (FINTECH) are those apps, software and technologies that are automated to enable individuals, business owners, corporations, institutions and governments to manage and improve their financial activities more efficiently.

This book reiterates the value of money, its origin, the evolution of banking as well as barter and exchange systems in Nigeria, colonial currency, emergence of the Nigerian currency, impact as well as challenges of money in Nigeria.

Expectedly, the book reflects on cashless policy in Nigeria from the perspective of card system, mobile payments, digital wallet and cryptocurrency, exploring the importance and challenges. The authour did not mince words in describing the recent redesign and demonetization of the Naira as ill-advised and disastrous. The book recommends that interest rates and money supply need to be managed in more efficient manner. It further suggests, and objectively so, that the success of cashless policies will depend on realistically addressing the needs of all stakeholders, overhaul of infrastructure and continuous expansion of digital infrastructure with guaranteed data protection.

The book also explored in detail the concept and nature of cryptocurrency, cryptoassets, metaverse and bitcoin and explains their mechanisms and places them in contrasts and describes the computer-generated currencies as valuable for transactions. It reveals how underlying blockchain technology and innovation have helped to demystify the complexities of these digital assets and recommends that “clear, timely and effective regulations” are required to optimize the derivable benefits of these digital assets.

What are the implications of the digital economy culture on business operations? Exploring the key aspects of this intersection, this book documents online presence, commitment to e-commerce, digital marketing, data analytics, agile operations and virtual collaborations, exploration of platform-based business models, empathetic customer engagements and focus on continuous innovation as irreducible actions for businesses that want to flourish in the emergent digital economy.

This new addition to the growing corpus of digital economy literature, gratifies the reality of ICT adoption in retail business, transport and logistics, financial services, education, manufacturing and agriculture, health, media and broadcasting among others as significant.

Of particular interest to me is the authour’s exposition on niche-focused players such as the emergent platforms where he referenced “platforms empowering the education sector to increase access to student loans, grants, and payments to educational institutions.”

It is gratifying that this book devotes Chapter Seven to topics on cybercrime and cyber security. Reiterating that cybersecurity breaches can cause loss of customer information, financial loss, as well as reputational damage, it documents patterns of cyber threats and how to safeguard networks from vulnerabilities.

Yet, in the book, a relative analysis of cloud accounting sealed the relevance of digitalization to accounting practice. Drawing parallels between traditional accounting and modern practices enhanced by digital economy, the book notes that despite the threats to data security and other challenges associated with digtisation, cloud accounting has enabled practitioners to work from any location, ensure maintenance of financial information, and enhance faster processing of tasks, including real time detection of issues.

The book emphasises the imperative of regulation and institutional frameworks as well as collaboration, especially among the Central Bank of Nigeria (CBN), the Nigerian Deposit Insurance Corporation (NDIC), Corporate Affairs Commission (CAC), Securities and Exchange Commission (SEC), Nigerian Communications Commission (NCC), National Information Technology Development Agency (NITDA), National Insurance Commission (NAICOM) and many others, including innovation hubs and incubators. The role of collaboration cannot be over-emphasised. As the book evidenced, the Nigerian Financial Inclusion Strategy would not have been a success nor taken off without the collaboration of CBN and NCC.

The value of data as a guide to several opportunities was discoursed in the concluding section of the book which is devoted to data issues. As asserted in the book, data is the future because it is always a key raw material required for production in a digital economy. Reading this book teaches that data analysis transcends statistics. It includes prognosis about emerging trends, patterns of their evolution and how all that serve as guide for managers and leaders to make informed, objective decisions to enhance success and spur interest in entrepreneurship.

The chapters within this book serve not only as a testament to the remarkable progress the authour has made in understanding the challenges and opportunities presented by the digital economy but also as a roadmap for future innovation and growth. These chapters underscore the pivotal role of innovation and collaboration in navigating the complexities of the digital economy, while offering pragmatic solutions to address the evolving needs of our society.

Each chapter within this book offers a unique perspective on the transformative power of financial technology in Nigeria. From the elucidation of regulatory frameworks to the exploration of emerging trends and technologies, the depth and breadth of insights contained within these pages are truly remarkable. Moreover, the rigorous review process undertaken by scholars, technocrats, and professionals ensures that the information presented is not only accurate but also actionable, providing stakeholders with the knowledge and tools needed to navigate the complexities of the digital landscape.

Therefore, whoever has imposed any barrier on his or her ability to comprehend what FINTECH is, as well as its value both as a requirement and an index of growth and development, should get a copy of this book, read and process it. Despite the extant challenges, the impact of FINTECH in Nigeria’s emergent digital economy sector has been astonishing across all sectors. I, therefore, recommend this book to all who seek information, knowledge and real development of Nigeria’s economy and the role human agency should play to bring it to reality.

ABOUT THE AUTHOUR

DIPO FISHO is an engineer and unrelenting IT expert, an afro-centric business manager/administrator. He has been actively involved in the initiation and management of several businesses traversing e-Payments, Cash-in-Transit, Revenue Collection, Enterprise Solutions/Applications, Asset Management, IT/FinTech Consultancy, Outdoor Advertisements, and the Agriculture and Food Industries.

Dipo is widely recognized as one of the pioneers and change agents in the payment space, representing Brinq Africa Payment Limited from 2013 to 2018. He is currently the CEO of QuickPay Digital Solutions Ltd., EVC of Gralvin Communication and Media Ltd. and also the CEO of Gralvin Foods and Bakery Ltd.

Dipo as the Chairman of QuickPay has so far deployed 5 payment applications (QuickPay App, QuickPay JED App, QuickPay EEDC App QuickPay APL App and QuickPay KEDCO App). Masterfully combining technical prowess with deep industry insights, Dipo Fisho undoubtedly emerges as a titan in the world of finance and technology.

While in Brinq Africa, he built not less than 15 Enterprise Solutions/Applications which include BrinqPOS, BrinqCoop, BrinqBMS, BrinqEst, BrinqMed, BrinqEdu and others.

Trending

Comments and Issues2 days ago

Comments and Issues2 days agoAs Ariwoola takes the judiciary to the top of the grease pole

Business6 days ago

Business6 days agoNMDPRA Chief faces backlash over comment on Dangote Refinery

Business1 week ago

Business1 week agoGlobal cyber outage disrupts flights, Banks, telecoms, Media

Business1 week ago

Business1 week agoKPMG criticizes FG’s 50% windfall tax, foresees legal disputes

Business5 days ago

Business5 days agoZenith Bank retains position as Nigeria’s Tier-1 capital leader

News6 days ago

News6 days agoPhilip Shaibu officially joins APC, dumps PDP

Education7 days ago

Education7 days agoJAMB reacts to allege age limit by ministry of education

Comments and Issues5 days ago

Comments and Issues5 days agoOnanuga and the Surprise from Joe Igbokwe