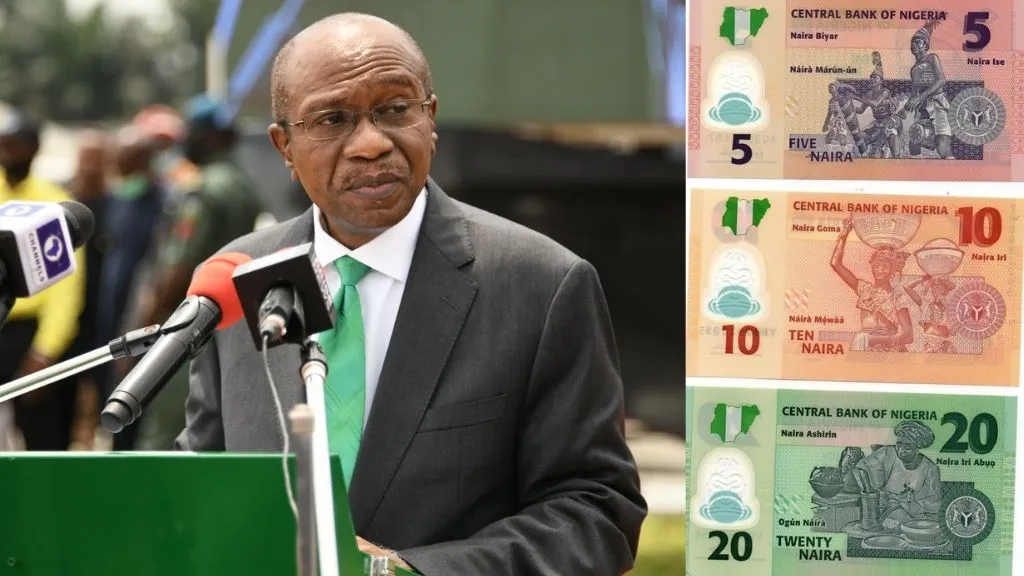

The continuous weakening of Nigeria’s legal tender — Naira — in both parallel and official markets, in the past weeks, has put the Central Bank (CBN) Governor, Godwin Emefiele, under the attention and harsh scrutiny of the public.

The naira has been on a free fall in recent weeks, depreciating to N430 per dollar at the official market, known as the Investors and Exporters forex window, and N710/$ at the parallel market popularly called the black market.

When Emefiele assumed duty as the head of the country’s apex financial institution in June 2014, many Nigerians expected clear-sighted efforts that would define the country’s economic landscape.

READ ALSO: Forex: CBN urges Nigerians to shun speculative activities

The continuous crash of the naira, however, portends really bad news for Nigeria on his watch, not only for inflationary pressures on the economy but for businesses, especially importers. The depreciation of the local currency has negatively affected businesses — most especially importers.

Many business owners complain about how they’ve been unable to access the foreign exchange from commercial banks, which can only satisfy customers’ requests based on allocations from the apex bank.

Owing to the increased public outcry, the Senate during the week resolved to invite Emefiele. He was asked to appear before the Senate in plenary and address the lawmakers behind closed doors.

It also mandated the Senate Committee on Banking, Insurance, and Other Financial Institutions to assess the impact of CBN intervention funds meant to support critical sectors of the economy.

Unfortunately, the CBN has been long hit by scarcity of foreign currencies, especially the US dollar, as oil earnings, Nigeria’s major area of sourcing foreign exchange, dwindled due to a series of issues.

Since CBN’s clampdown of AbokiFX (the website that curates parallel market exchange rate) last year, buyers and sellers of forex have struggled to find a reference point for what the actual exchange rate should be.

But the country’s apex financial institution has often maintained that the parallel market is not the true reflection of the naira.

It also argued that the non-remittance of dollars to foreign reserves by the Nigeria National Petroleum Corporation (NNPC) was largely responsible for the naira’s free fall in the official and parallel markets.

“Considering Nigeria’s heavy dependence on oil exports for foreign exchange earnings and government revenue, the impact of the oil market crash severely affected the government’s naira revenue and other macroeconomic aggregates including economic growth.

Hence, the rate of exchange between the naira and other currencies has widened over the past few years.” the CBN said in a statement.

READ ALSO: Why Naira is unstable against Dollar, others – Peter Obi

A recent announcement that Nigerians buying dollars with naira will be “arrested” made by Emefiele had sparked mixed reactions.

The warning by the CBN Governor was to those who sought to convert the naira from their accounts into foreign currencies for election campaigns and not those who seek to exchange the currency for legitimate purposes such as payment for tuition and other personal expenses.

Although, analysts have argued that there is also a huge demand now for forex among students who want to pay their school fees and that most students resort to buying from the black market because of the long queue at the bank as a result of limited availability of foreign exchange.

They also blamed the continuous weakening of the naira on rising import bills, dollar savings, and the accumulation of cryptocurrencies by Nigerians who have lost confidence in the local unit due to its massive devaluation against the greenback currency.

Health & Fitness6 days ago

Health & Fitness6 days ago

Aviation1 week ago

Aviation1 week ago

Aviation7 days ago

Aviation7 days ago

Aviation7 days ago

Aviation7 days ago

Aviation7 days ago

Aviation7 days ago

Aviation6 days ago

Aviation6 days ago

Featured4 days ago

Featured4 days ago

Crime4 days ago

Crime4 days ago