Business

Nigeria: Another Looming Hyperinflation Monster

Published

11 months agoon

By

Marcel Okeke

At a time that the wild volatility in Nigeria’s macroeconomic indices appears to be abetting, a trigger to (unwittingly) upset the trend has just been released. This trigger is the avoidable hike in the pump price of Premium Motor Spirit (PMS) or petrol, engendered by the Federal Government’s prevarications over the lifespan of the ‘Naira-for-Crude’ deal.

Under the arrangement struck between the Federal Government and local refiners, crude oil is supplied to the local refineries, and they pay in Naira. While the deal lasted, some local refineries, especially Dangote Refinery, have been able to experience reduction in their cost of operation, leading to cuts in PMS prices at the pump.

Specifically, on two occasions in the first quarter of this year, Dangote Refinery had announced cuts in the prices of its PMS; but by end-March, it had to revert to selling its petroleum products only in dollars. The Refinery in a statement said: “This decision is necessary to avoid a mismatch between our sales proceeds and our crude oil purchase obligations, which are currently denominated in US dollars.”

While the ‘Naira-for-Crude’ deal lasted, Nigerians had begun to heave a sigh of relief, as the Nigerian National Petroleum Company Limited (NNPCL) was also dropping the price of its PMS in response to cuts by Dangote Refineries. This development, a seeming ‘price war’, had not only led to decline in PMS prices but also showed potential to dampen the rampaging high inflationary trend.

Unfortunately, to the chagrin of Nigerians, by the close of the first quarter 2025, as the ‘pilot phase’ of the ‘Naira-for-Crude’ initiative was ending, the Federal Government opted to keep mum on the next steps. In reaction, fuel stations across the country began another round of hiking PMS prices: from N860 per liter to N930 per liter in Lagos and its environs.

In many other parts of the country, prices have hit or surpassed N1000 per liter. And with no official statement from the NNPCL (or the Federal Government) as to whether there would be another phase of the ‘Naira-for-Crude’, and how soon, the petroleum products market has fallen into the capricious manipulations of the capitalist traders (mainly, importers).

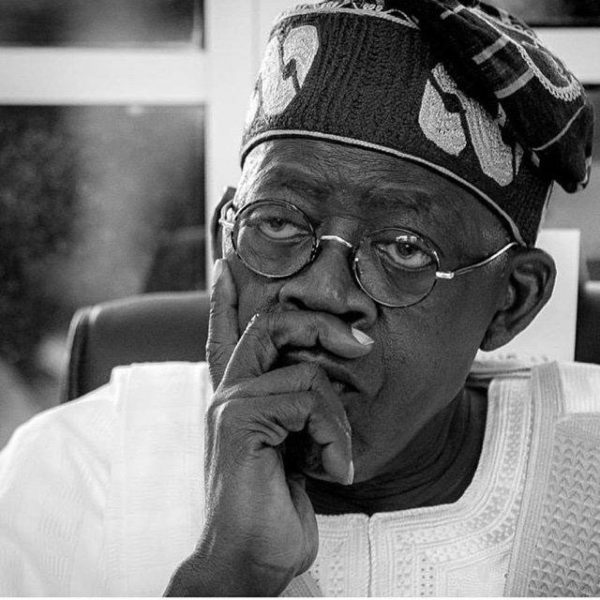

This, certainly, triggers the scenario that was unleashed by the removal of fuel subsidy announced by President Bola Ahmed Tinubu on May 29, 2023 during his inauguration. The quantum jump in the prices of PMS soon fed into all goods and services—leading to runaway inflation. Now, the sudden end of the ‘Naira-for-Crude’ is bound to re-enact the hyperinflationary pressure.

The ‘void’ created by the stoppage of the payment for crude in Naira is, without a doubt, a veritable disincentive to both existing and potential investors in the refining sub-sector of the oil and gas industry. The intrigues and politicking in the PMS business in Nigeria today, only shows that the sector can only harbor giants such as Dangote Refinery. And this only tends to scuttle the competition in the industry.

ALSO READ: Nigeria’s inflation rate expected to drop to 15% by end of 2025

Coincidentally, the emerging ‘New World Economic Order’ embodied by Donald Trump, President of the United States of America, with its attendant tariff wars, is bound to stack some headwinds against Nigeria. Already, President Trump has slammed a 14 per cent tariff on Nigerian exports; just as he has imposed much higher tariffs against many other countries.

In the ensuing trade war, Nigeria and others like it, will certainly be the grass that will suffer, as the proverbial elephants fight. The tariff war which is bound to affect global supply chains, will redound to high prices of imports for, especially, Nigeria: a largely import-dependent economy. These will include imports of intermediate and finished goods—leading to ‘cost-push’ inflationary trend.

Available statistics show that the US remains one of Nigeria’s major trading partners. In 2024, for instance, Nigeria’s exports to the US totaled US$6.29 billion, mainly consisting of crude petroleum, petroleum gas, and fertilizers, while the US exported US$4.2 billion in goods to Nigeria. Trump’s tariffs on Nigerian goods will certainly alter these statistics—reflecting as decline in Nigeria’s exports to the US, which could lead to reduced export revenue for Nigeria.

All these would be playing out at a time that Nigeria is facing a tight elbowroom at the Organization of Oil Exporting Countries (OPEC), where its export quota is being curtailed. In point of fact, according to Bloomberg report, Nigeria made the biggest oil production cut among OPEC members in March, reducing output by 50,000 barrels per day.

“Nigeria made the cut to maintain an average of 1.5 million barrels per day, in line with its OPEC quota, as the cartel tightened quotas among members,” the Bloomberg report said. The report noted that the cut in Nigeria’s production was due to delays in loading ‘Bonny Light’ crude owing to the recent explosion at the Trans-Niger Pipeline.

The pipeline which is a critical infrastructure for Nigeria’s crude exports, has frequently faced operational disruptions, affecting the country’s ability to meet production targets. The current disruption is coming against the backdrop of the 2025 Federal Government budget that assumes an oil production level of 2.06 barrels per day.

The OPEC quota challenge is also compounded by dropping crude prices, resulting from global tensions triggered by Donald Trump’s tariff threats. Again, this is as against Nigeria’s 2025 budget oil price benchmark of US$75 per barrel.

As President Trump’s multi-country tariff kicks off this April, Nigeria’s N54.99 trillion 2025 budget faces the danger of significant revenue shortfall. Whether by volume or by price, crude oil will underperform the budget projections.

All these mean variegated economic problems for Nigeria, including huge revenue gap, heightened inflation, potential loss of foreign markets, among others. Perhaps, these could induce some paradigm shifts: leading to real economy diversification, and less dependence on imports.

- The author, Okeke, a practicing Economist, Business Strategist, Sustainability expert and ex-Chief Economist of Zenith Bank Plc, lives in Lekki, Lagos. He can be reached via: [email protected] (08033075697) SMS only

Trending

Entertainment5 days ago

Entertainment5 days agoSimi addresses resurfaced 2012 tweets amid online backlash

Health1 week ago

Health1 week agoSCFN, LUTH introduce bone marrow transplants as curative treatment for sickle cell

Health4 days ago

Health4 days agoDeclassified CIA memo explored concealing mind-control drugs in vaccines

Football1 week ago

Football1 week agoHarry Kane nets brace as Bayern edge Frankfurt 3–2 to go nine points clear

Football1 week ago

Football1 week agoLate Flemming header stuns Chelsea as Burnley snatch 1–1 draw at Stamford Bridge

Crime4 days ago

Crime4 days agoSenior police officers faces retirement after Disu’s appointment as acting IGP

Education6 days ago

Education6 days agoPeter Obi urges JAMB to address registration challenges ahead of exams

Crime1 week ago

Crime1 week agoTwo killed, seven injured in early-morning shooting in Richmond’s Shockoe Bottom