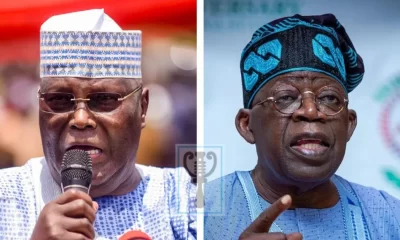

Doyin Okupe has weighed in on the decision of President Bola Tinubu to halt the payment of fuel subsidies continue to elicit reactions from various stakeholders.

According to Okupe, President Tinubu has demonstrated “much determination and courage” in his role.

He made this known on Friday, via a lengthy article on X while recommending that the president take “bolder steps.”

Okupe also claimed that the President had already made two “extraordinary” decisions since taking office on May 29.

“President Bola Tinubu actually hit the ground sprinting; showing much determination, zeal, commitment and courage,” Okupe, a chieftain of the Labour Party (LP), said in the thread.

“He has taken two extraordinarily bold steps by abolishing fuel subsidy and equalising foreign exchange. This without doubt is causing very severe pain and hardship on the populace.

READ ALSO: Tinubu approves establishment of Presidential CNG initiative, targets nationwide adoption

“However, in order to ground these policies properly, and reduce the pain on the populace, the president will still need to take bolder steps.”

Offering suggestions on how to reform the country’s economy, Okupe said Nigeria must quit the Organisation of the Petroleum Exporting Countries (OPEC).

“Nigeria must quit OPEC. In about two decades from now, oil reserves may become meaningless. The present allocation of less than 2 million barrels per day for Nigeria with a population of over 200 million people and its prevailing strangulating economic conditions, given volumes of export to our main foreign exchange earner (90%) is inimical to our growth as a nation and to the wellbeing of the citizens,” he said.

Okupe claimed that Nigeria may lower its oil selling price outside of OPEC while simultaneously increasing its daily shipments to three million barrels and above.

He pointed out that by doing this, accruable forex revenue will rise by up to 200 percent or more, enabling the Central Bank of Nigeria (CBN) to give the banks with more foreign currency.

“In the face of surplus liquidity in forex supply, Naira will gain tremendous value over the Dollar,” he added.

“The present situation whereby the oil majors earn 60% of our accruable revenue from sales of oil leaving Nigeria with only 40% is no longer economically and finan

“The NNPC can no longer serve fully, nor can it meet the full expectations of its obligations to the Nigerian people.

“I am inclined to recommend that the President & his team should take a look and study the Atiku Abubakar model as it concerns the NNPC as a commercial entity.”

Health & Fitness5 days ago

Health & Fitness5 days ago

Aviation1 week ago

Aviation1 week ago

Aviation6 days ago

Aviation6 days ago

Aviation6 days ago

Aviation6 days ago

Aviation6 days ago

Aviation6 days ago

Aviation5 days ago

Aviation5 days ago

Featured3 days ago

Featured3 days ago

Crime3 days ago

Crime3 days ago