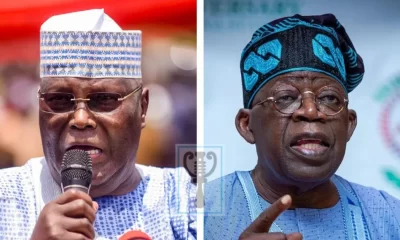

Financial experts have warned that the President Bola Tinubu administration is facing a debt crisis as Nigeria gradually slips into insolvency over the huge debt burden and dwindling revenue.

Over the years, Nigeria has been groaning under the yoke of debt that continues to grow bigger with each passing year.

The Debt Management Office (DMO) had disclosed that Nigeria’s total public debt stood at N87.38tn at the end of the second quarter of 2023.

The figure represents an increase of 75.29 per cent or N37.53 trillion compared to N49.85 trillion recorded at the end of March 2023.

For Financial Analysts, Gabriel Idakolo, the policies of President Bola Tinubu in the past three months helped to stop Nigeria’s drift towards insolvency.

He said, “The new administration of President Bola Tinubu met a debt crisis when he was sworn in on May 29, 2023.

“The immediate policy direction of the government helped in no small measure to halt Nigeria’s ascension to bankruptcy. The debt servicing has almost taken 100 per cent of the nation’s revenue in May, 2023.

READ ALSO: Address escalating insecurity in the FCT, HURIWA tells Tinubu, Service Chiefs

“The federal government resorted to increased borrowing to stabilise the system although additional borrowings at this time is dangerous for our economic survival.”

Similarly, a Political Economist, Adefolarin Olamilkan, noted that the past administration led by President Muhammadu Buhari did not take advantage of the numerous loans it borrowed.

According to him, lack of proper planning on how to utilise the huge amount borrowed is what has put the country in the near debt crisis situation it now finds itself in.

“Here we are, the fear of the huge amount of this debt figure, is scary and there is a projection that it would eventually become a full-blown debt crisis that would ground the entire architect of our revenue sources.

“This debt is going to be a burden on the economy because there is no genuine empirical economic solution to the greater use of borrowings beyond deploying our borrowing to cater for government excess expenditure on non-capital projects and programmes.

Olamilkan noted that to solve the country’s looming debt crisis, fiscal authorities must have an understanding of why they borrowed.

The economist stressed the need for the present administration to stop borrowing in the meantime.

READ ALSO: As Tinubu deploys propaganda and lies in governance

“At this point the current administration of President Tinubu must make good his statement of looking inward to raise funds for critical government projects.

“Similarly, the state government must stay away from further internal and external loans procurement. This may be difficult, but it’s a hard-line position they need to go through for now.

To arrest the drift towards a debt crisis, the IMF said Nigeria must reduce its fiscal deficit by 3 per cent.

In its report ‘How to Avoid a Debt Crisis in Sub-Saharan Africa’, the Fund said Nigeria and Sub-Saharan countries should re-anchoring fiscal policy through a credible medium-term strategy and prepare by undertaking fiscal adjustment to bring debt back to a safer level.

The Bretton Woods Institute also advised the federal government to prioritise the removal of tax exemptions and enhance domestic revenue generation to mitigate their fiscal deficits.

Health & Fitness5 days ago

Health & Fitness5 days ago

Aviation7 days ago

Aviation7 days ago

Aviation6 days ago

Aviation6 days ago

Aviation6 days ago

Aviation6 days ago

Aviation6 days ago

Aviation6 days ago

Aviation5 days ago

Aviation5 days ago

Featured3 days ago

Featured3 days ago

Crime3 days ago

Crime3 days ago