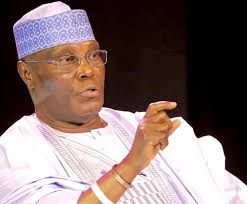

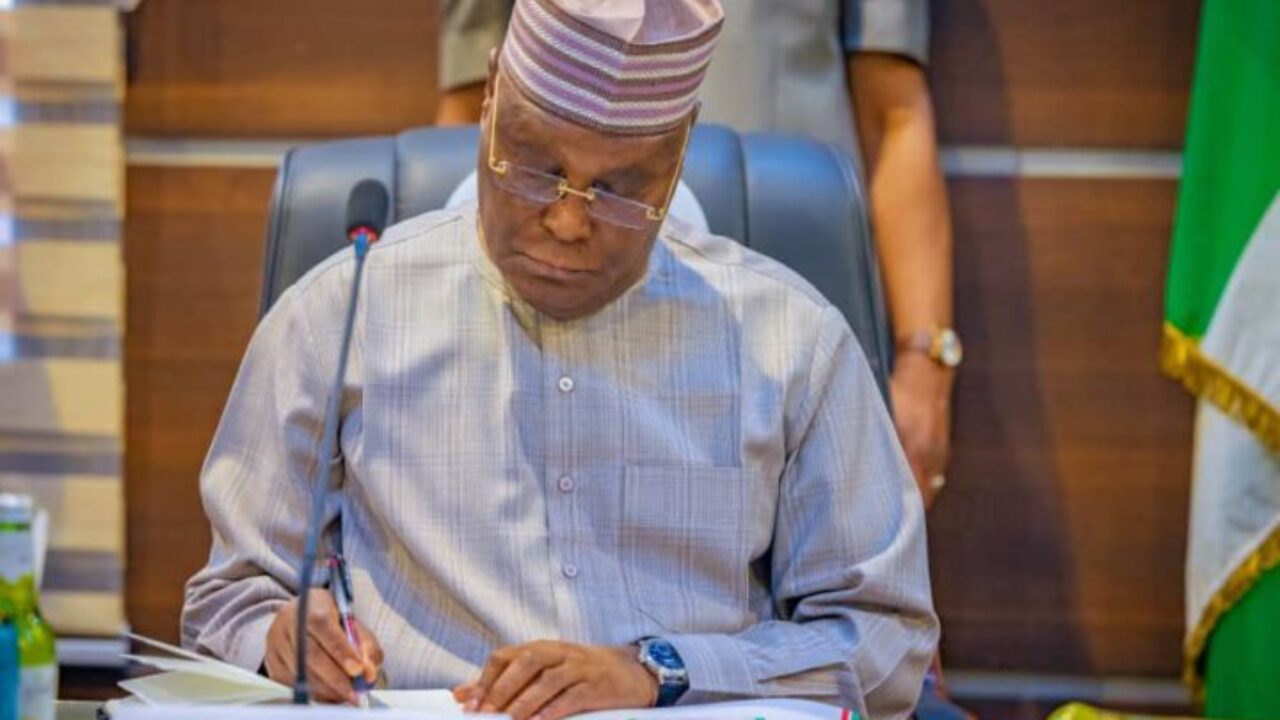

Former vice President Atiku Abubakar, on Wednesday, opposed plans by the federal government to deploy N20 trillion pension funds to finance critical infrastructure in the country.

Atiku, 2023 presidential candidate of the Peoples Democratic Party (PDP), noting the “disturbing disclosure by the Finance Minister and Coordinating Minister of the Economy, Wale Edun, as he addressed State House correspondents after the Federal Executive Council (FEC) meeting at the Presidential Villa on Tuesday, 14 May, said that the minister provided no useful details, such as the percentage of the funds to be mopped up from the Pension Funds, for example.

Atiku, unequivocally declared: “Even at that, this move must be halted immediately! It is a misguided initiative that could lead to disastrous consequences on the lives of Nigeria’s hardworking men and women who toiled and saved and who, now, survive on their pensions having retired from service.

“It is another attempt to perpetrate illegality by the Federal Government.

“The government must be cautioned to act strictly within the provisions of the Pension Reform Act of 2014 (PRA 2014), along with the revised Regulation on Investment of Pension Assets issued by the National Pension Commission (PenCom).

“In particular, the Federal Government must not act contrary to the provisions of the extant Regulation on investment limits to wit: Pension Funds can invest no more than 5% of total pension funds’ assets in infrastructure investments.

“I note that as of December 2023, total pension funds assets were approximately N18 Trillion, of which 75% of these are investments in FGN Securities.”

Atiku in a statement on Wednesday, asserted: @atiku

My attention is drawn to a disturbing disclosure by the Finance Minister and Coordinating Minister of the Economy, Wale Edun, as he addressed State House correspondents after the Federal Executive Council (FEC) meeting at the Presidential Villa on Tuesday, 14 May.

There is, according to the Minister, a move by the Federal Government to rev up economic growth by unlocking N20 trillion from the nation’s pension funds and other funds to finance critical infrastructure projects across the country. The Minister has indicated that although “the initiative is expected to attract foreign investment interest over time”, domestic savings are his ‘immediate focus’ for now.

He provided no useful details, such as the percentage of the funds to be mopped up from the Pension Funds, for example. Even at that, this move must be halted immediately! It is a misguided initiative that could lead to disastrous consequences on the lives of Nigeria’s hardworking men and women who toiled and saved and who now survive on their pensions having retired from service.

It is another attempt to perpetrate illegality by the Federal Government. The government must be cautioned to act strictly within the provisions of the Pension Reform Act of 2014 (PRA 2014), along with the revised Regulation on Investment of Pension Assets issued by the National Pension Commission (PenCom).

In particular, the Federal Government must not act contrary to the provisions of the extant Regulation on investment limits to wit: Pension Funds can invest no more than 5% of total pension funds’ assets in infrastructure investments. I note that as of December 2023, total pension funds assets were approximately N18 Trillion, of which 75% of these are investments in FGN Securities.

There is NO free Pension Funds thst is more than 5% of the total value of the nation’s pension fund for Mr. Edun to fiddle with.

AdvertisementThere are no easy ways for Mr. Edun to address the challenges of funding infrastructure development in Nigeria. He can’t cut corners. He must introduce the necessary reforms to restore investor confidence in the Nigerian economy and to leverage private resources, skills, and technology. -AA

Comments and Issues2 days ago

Comments and Issues2 days ago

Business6 days ago

Business6 days ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business5 days ago

Business5 days ago

Education7 days ago

Education7 days ago

News6 days ago

News6 days ago

Comments and Issues5 days ago

Comments and Issues5 days ago