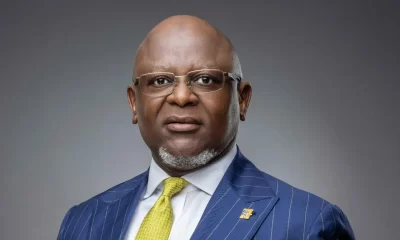

Governor of the Central Bank of Nigeria, Godwin Emefiele, has announced that the country’s inflation rate will rise to 12 percent.

Emefiele who disclosed this at the Businessday post-election economic agenda conference in Lagos, said the rise will not have any effect on the monetary policy stance of the Apex bank.

The CBN insists on maintaining the monetary policy because of the projected inflation rate. The inflation rate stood at 11.31 percent in February 2019, according to statistics by the CBN and the National Bureau of Statistics (NBS).

The possible rise in inflation rate is coming at a time the Federal Government and the legislature have agreed to a minimum wage of N30, 000 for Nigerian labour workers. If or when the inflation rate rises, it may trigger an increase in the cost of living. This is because hike in prices influences inflation rate.

While the projected 12 per cent rise in the inflation rate would encourage CBN to maintain its monetary policy, unfolding conditions and outlooks will influence the Apex bank to make changes in the policy, Emefiele said.

Meanwhile, CBN will maintain its stable exchange rate over the next year despite expected pressures from the volatility in the crude oil markets.

Also, the country’s Balance of Payments would remain positive in the short-term, while Nigeria’s current account balance could improve further if oil prices continued to recover.

According to Emefiele, the factors that led to the economic crisis are still very much visible. On how to overcome the possibility of another recession: Emefiele suggested that there’s a need to;

Increase the country’s policy buffers, including fiscal measure, to increase its external reserve.

Also, diversifying the revenue structure of the Federal Government is of the utmost importance in order to reduce dependence on direct proceeds from the sale of crude oil.

Cheap financing would be provided to boost local production of priority goods in critical sectors of the economy in order to reduce reliance on foreign imports.

Recall that the Federal Inland Revenue Services is also considering raising the Value Added Tax (VAT); although FIRS has since denied the report. If these rises in Inflation rate and VAT eventually occur, then the value of the proposed minimum wage increment becomes ineffectual.

Health & Fitness4 days ago

Health & Fitness4 days ago

Aviation6 days ago

Aviation6 days ago

Featured1 week ago

Featured1 week ago

Aviation5 days ago

Aviation5 days ago

Aviation5 days ago

Aviation5 days ago

Business1 week ago

Business1 week ago

Aviation5 days ago

Aviation5 days ago

Business1 week ago

Business1 week ago