Business

Court freezes health workers union bank accounts over N47 million debt to Access Bank

Published

1 month agoon

On Tuesday, the Federal High Court, Abuja gave an order freezing all the bank accounts of the Medical and Health Workers Union Kankara branch, Katsina state over its failure to pay its N47,012, 567.19 outstanding debt owed Access Bank Plc.

The order was delivered by Justice Inyang Ekwo based on an ex-parte motion filed by the Asset Management Corporation of Nigeria (AMCON) against the union and the Kankara Local Government Council, Katsina State.

In AMCON’s affidavit in support of the motion ex-parte seen by Nairametrics, its staff, Adanna Ilomuanya, maintained that the defendant’s loan is one of the eligible financial assets it acquired from the then Intercontinental Bank PLC (now Access Bank) for recovery.

She contended in the suit marked FHC/ABJ/AMC/04/2024, that despite the notices and demands from AMCON and the bank, the defendants have refused to repay their outstanding indebtedness.

She stated, “The 1st Defendant applied for a loan vide a letter dated 15 of February 2007 together with minutes of meeting of its resolution to obtain the loan facility for its workers and was granted a N43,500,000.00 (Forty-Three Million, Five Hundred Thousand Naira) loan for disbursement to its members(workers) as Agric loans in 2007 by the then Intercontinental Bank PLC (now Access Bank PLC) vide an offer and acceptance letter dated 26 February 2007.

READ ALSO: Court commences trial of suspected fraudster May 30 over N2.7bn theft

“That the 1st defendant further brought an application together with its minutes of meeting dated 23rd April 2007 and 22nd April 2007 to formalize the enhancement of the loan in the sum of N4,000,000:00 (Four million Naira) earlier requested which was granted to it by a letter of offer and acceptance dated 20th March 2007 and guaranteed by Irrevocable payment order issued by the 2nd Defendant and its bankers, Bank PHB dated 13th March 2007 respectively.

“The said application letter, minutes of the meeting, letter of offer and acceptance of the enhancement of N4 million and the Irrevocable standing payment orders of the 2nd defendant and its bankers are hereby attached and marked AMCON- 8,9, 10, 11 and 12 respectively.

“That by the loan agreement it was agreed by parties that the tenor of the loan granted to the 1st defendant was for 12 months with an accruable interest of 19% per annum.

“That within the said periods of repayment, the 1st Defendant commenced repayment and then somersaulted and stopped repaying the loan granted to it, and the outstanding sum and interest crystalized to the present sum.

“ That the total outstanding sum accrued with interest is Forty-Seven Million, Twelve Thousand, Five Hundred and Sixty-Seven Naira, Nineteen Kobo (N47,012, 567.19), being the current exposure together with 15% AMCON interest as the outstanding indebtedness of the 1st & 2nd defendants as at 30th June, 2022, which has crystalized since 2007, and the 1st & 2nd defendants are liable to pay but have defaulted and refused to pay.”

READ ALSO: AMCON struggles to recover N2.2trn injected into banks

AMOCON’s lawyer, Barrister Val. Igboanusi, further submitted that his request should be granted because the federal government is using taxpayers’ money to bail out the banks from toxic debts which the respondent’s debt is allegedly one of them.

He added that if the court does not grant the interim order, the union will never pay its debt.

He then prayed for the following orders, “An Interlocutory order freezing and attaching the Bank Accounts of the Respondents maintained with any of the following Banks: Access Bank Plc; Eco bank Nigeria Plc; Fidelity Bank Plc; First Bank Nigeria Plc; First City Monument Bank Plc; Guaranty Trust Bank Plc; Heritage Bank Plc; Keystone Bank Limited; Polaris Bank Limited; Sterling Bank Plc; United Bank for Africa Plc; Unity Bank Nigeria Limited; and Zenith Bank Plc pending the hearing and determination of the substantive suit.

“An Interlocutory order freezing all bank accounts to which the respondents are signatories in any bank or financial institution pending the hearing and determination of the substantive suit.

“An Interlocutory order restraining all banks and/or other financial institutions in Nigeria forthwith from releasing or dealing in any manner however with monies held in any account to which the respondents are signatories pending the hearing and determination of the substantive suit.

“An order directing all banks and/or other financial institutions in Nigeria to, within seven (7) days of the date of service of this order, file (and to serve to counsel to the Applicant) an affidavit of compliance disclosing with statement on each account howsoever designated, held and/or maintained by the Respondents and all accounts to which the Respondents are signatories for two months before the date of service of this order.”

You may like

AMCON struggles to recover N2.2trn injected into banks

How unbridled borrowing, mismanagement, others crippled Arik Airline—AMCON

Litigation stalling AMCON’s debt recovery efforts—Kuru

AMCON debt recovery committee submits report to Osinbajo

EFCC arrest, detain AMCON MD

Nigeria’s most indebted businessman-politician stripped of all assets, funds in dozen businesses across Lagos, Abuja

Trending

Health & Fitness3 days ago

Health & Fitness3 days agoMalaria Vaccines in Africa: Pastor Chris Oyakhilome and the BBC Attack

Featured1 week ago

Featured1 week agoPolice reportedly detain Yahaya Bello’s ADC, other security details

Aviation6 days ago

Aviation6 days agoWhy some airlines are avoiding Nigeria’s airspace–NAMA

Aviation4 days ago

Aviation4 days agoJust in: Dana airline crash lands in Lagos

Business1 week ago

Business1 week agoDebt servicing gulps 56% of Nigeria’s tax revenue, says IMF

Aviation4 days ago

Aviation4 days agoNSIB begins investigation into Dana Air after crash-landing incident

News1 week ago

News1 week agoOndo APC guber hopefuls reject primary poll

Business1 week ago

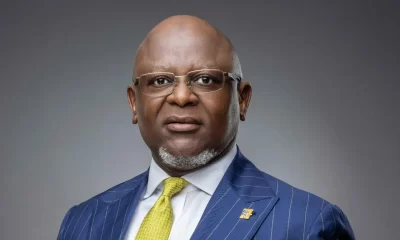

Business1 week agoAdesola Adeduntan steps down as FirstBank CEO