Police figures show that the amount of money reported lost to cryptocurrency fraud in 2021 so far is already nearly 30 per cent higher than that for the whole of 2020.

According to the figures, some 146.2 million pounds (200.7 million dollars) had been lost to cryptocurrency fraud since the start of this year, Action Fraud figures show.

The average loss per victim was just over 20,500 pounds, with 18 years to 25-year-olds accounting for 11 per cent of reports.

More than half of the victims were aged between 18 and 45.

People will often be promised high returns by criminals on social media.

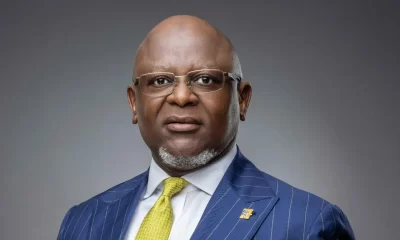

Bogus celebrity endorsements are a tactic often used by criminals advertising fake investment opportunities, including cryptocurrency.

Often, fake testimonials are accompanied with a picture of a well-known figure to help the investment seems legitimate.

Between April 2020 and March 2021, Action Fraud received 558 investment fraud reports which made reference to a bogus celebrity endorsement with 79 per cent of reports mentioning cryptocurrency as the commodity they invested in.

Temporary Detective and Chief Inspector Craig Mullish from City of London Police said, `Reports of cryptocurrency fraud has increased significantly over the past few years, which is unsurprising given everyone is spending more time online.

“We would encourage anyone thinking about making an investment to do their research first and to stop and think before making an investment as it could protect you and your money.’’

Many firms advertising and selling investments in crypto assets were not authorised by the Financial Conduct Authority (FCA).

This means that if someone invests in certain crypto assets, they will not have access to the Financial Ombudsman Service (FOS) or the Financial Services Compensation Scheme (FSCS) if something goes wrong.

Mullish, however, advised people to check the FCA register to make sure they were dealing with an authorised firm and check the FCA’s warning list of firms to avoid.

Health & Fitness3 days ago

Health & Fitness3 days ago

Featured1 week ago

Featured1 week ago

Aviation5 days ago

Aviation5 days ago

Business1 week ago

Business1 week ago

Aviation4 days ago

Aviation4 days ago

Aviation4 days ago

Aviation4 days ago

Business1 week ago

Business1 week ago

News7 days ago

News7 days ago