Guarantee Trust Bank (GTBank), Unity Bank, and other lenders are being probed by the Nigeria Data Protection Commission (NDPC) for alleged data breaches.

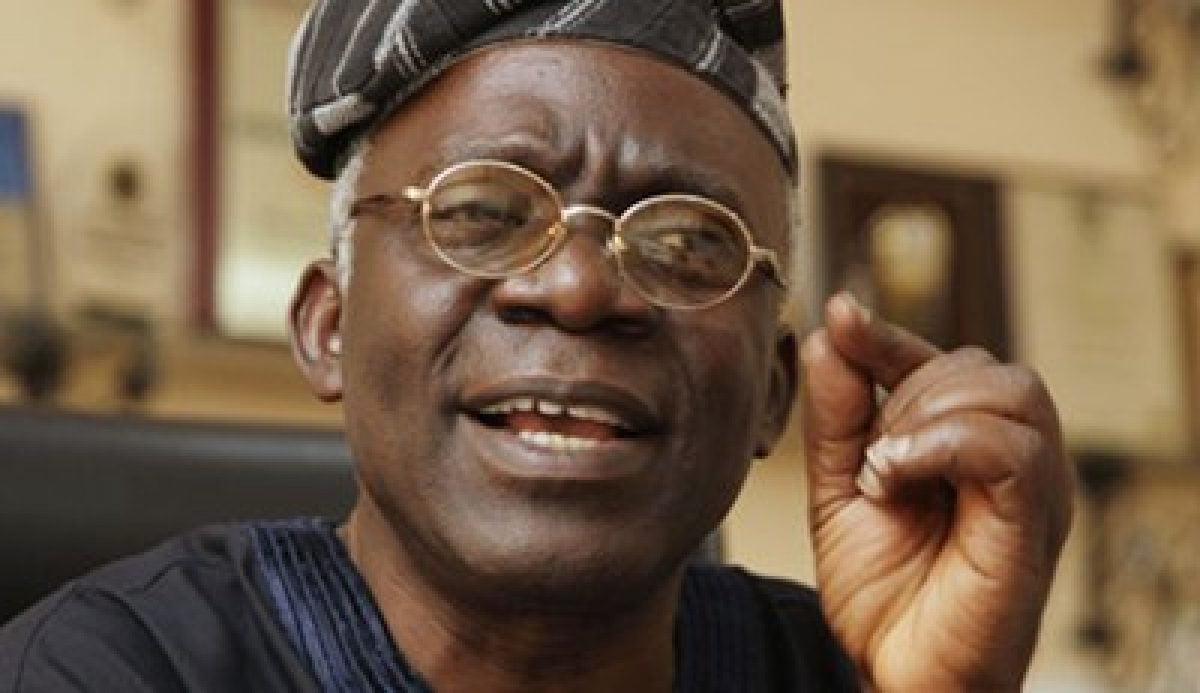

In a statement issued on Thursday, the National Commissioner, Vincent Olatunji, said the NDPC was also investigating Zenith Bank, and Babcock University for the same infraction.

He said the commission has received complaints against the banks over alleged violation of the rights of Nigerians, unlawful data processing, and unauthorised access to personal data.

Olatunji added that the banks would be fined one percent of their annual turnover if found culpable after the investigation.

He said: “In the last few weeks, the NDPC has received complaints of unlawful data processing, unauthorised access to personal data, and violation of data subjects’ rights.

READ ALSO: Access Bank, GTbank, five others top list of banks with most customer complaints in 2022

“Under part 10 of the newly-signed NDPA Act 2023, a data controller with a turnover of N200 billion yearly may pay as high as N2 billion, which represents one percent of the gross revenue.

“Not only that, but offenders also risk up to a one-year jail term. We are currently investigating Guarantee Trust Bank, Fidelity, Unity Bank, Zenith Bank, Leadway Insurance, and Babcock University, among others, for a data breach.”

The NDPC also received complaints against the online lending sector, and this has prompted an investigation into their activities.

“The commission is investigating over 400 complaints in the online lending sector,” the NDPC chief added.

Olatunji also revealed that Soko Loan is already working on a comeback to the digital lending market, “but yet to be approved.”

Health & Fitness4 days ago

Health & Fitness4 days ago

Featured1 week ago

Featured1 week ago

Aviation6 days ago

Aviation6 days ago

Aviation5 days ago

Aviation5 days ago

Aviation5 days ago

Aviation5 days ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

News1 week ago

News1 week ago