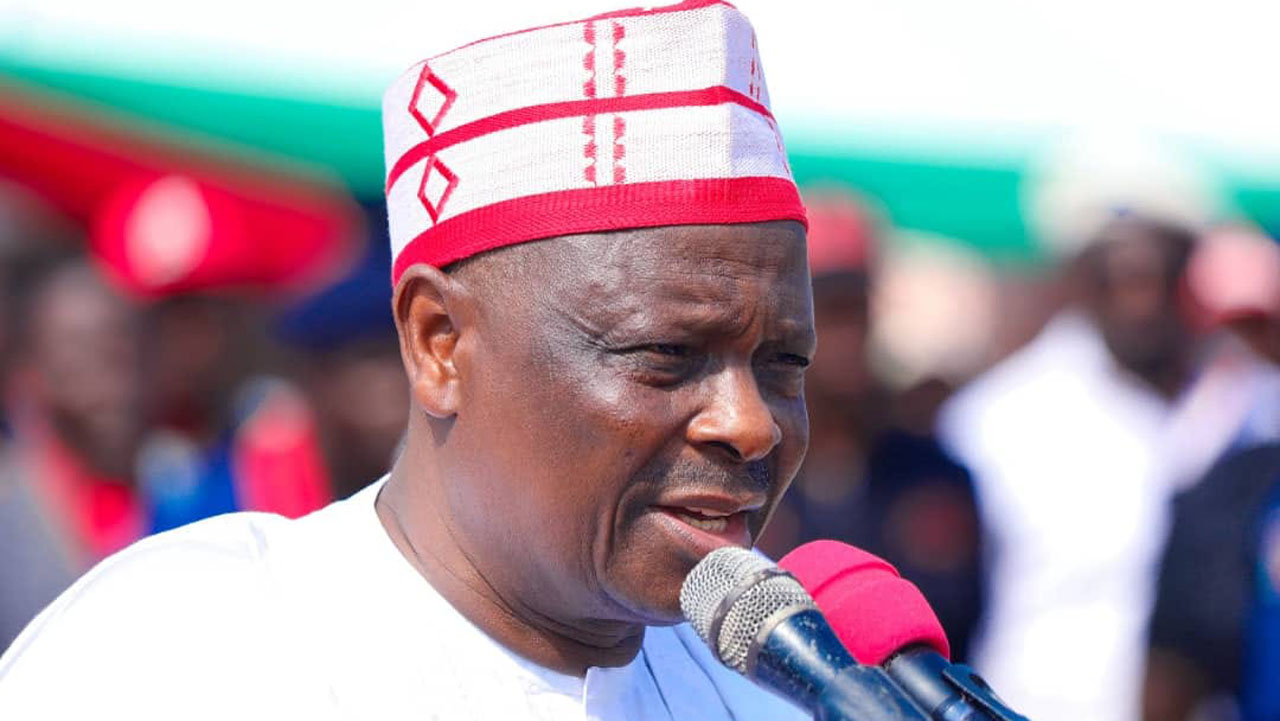

At a convocation ceremony for Skyline University held at the Ammani Centre, Nassarawa GRA in Kano State, Rabiu Kwankwaso, former governor of Kano and 2023 presidential candidate of the New Nigeria Peoples Party (NNPP), delivered a sharp critique of proposed tax reform bills, urging the national assembly to reject any legislation that could disadvantage the northern region.

Kwankwaso expressed concerns over what he described as efforts to marginalize the north, alleging interference from political interests centered in Lagos.

He accused the current administration, led by President Bola Tinubu, who hails from Lagos, of playing a decisive role in the emirship dispute in Kano and pushing policies that could centralize economic power in the southwest.

“The Emir has just been installed at this difficult time in our country, especially in this part of the country, northern Nigeria,” Kwankwaso stated.

“Today, we can see very clearly that there is a lot of effort from the Lagos axis to colonise this part of the country. Lagos wouldn’t allow us to choose our Emir. Lagos has to come to the centre of Kano to put their own Emir.”

Highlighting broader economic implications, Kwankwaso alleged that many business owners in northern Nigeria had been compelled to relocate their corporate headquarters to Lagos.

READ ALSO: Senator Kwankwaso: A Tale of Power, Betrayal, and Political Consequence

This shift, he argued, allowed the southwestern state to collect taxes at the expense of northern economies.

“We are aware that the Lagos young men are working so hard to impose and take away our taxes from Kano and this part of the country to Lagos,” Kwankwaso asserted.

He painted a picture of a region grappling with deep economic challenges, including insecurity, poverty, and an exodus of economic resources. “This part of the country today is suffering from a serious economic crunch, insecurity, poverty, hunger, and diseases,” he said.

Kwankwaso’s warnings align with a rising tide of resistance from northern leaders.

He called on national assembly members to remain vigilant, drawing parallels to past policies that he claimed harmed the region’s economy.

Citing the offshore/onshore dichotomy legislation from President Olusegun Obasanjo’s first term, Kwankwaso alleged that similar legislative actions had historically tilted economic advantage away from northern states.

“We are witnesses to what happened during the first term of Olusegun Obasanjo from 1999 to 2003, where our members of the national assembly were bribed into collecting a huge sum of money to support onshore/offshore in the country. That law put a huge blow on our economy in northern Nigeria,” he reminded his audience.

The tax reform bills, submitted to the national assembly by President Tinubu on October 3, have become a flashpoint for political and regional tension. The proposed legislations include the Nigeria Tax Bill, the Tax Administration Bill, and the Joint Revenue Board Establishment Bill.

READ ALSO: Economist faults Tinubu’s $75 oil price benchmark in Nigeria’s proposed N47.9trn 2025 budget

One of the most controversial aspects is the call to repeal the existing Federal Inland Revenue Service (FIRS) Act, replacing it with the Nigeria Revenue Service.

On October 28, the Northern States Governors Forum (NSGF) issued a collective statement opposing the reforms, stressing that the proposed changes would disadvantage northern states economically.

The national economic council (NEC) also joined the opposition, urging President Tinubu to retract the bills to allow for comprehensive consultations.

However, Tinubu rejected calls for withdrawal, stating on November 1 that the bills were essential for enhancing the tax framework and improving the quality of life for Nigerians.

Economists and policy analysts have weighed in on the debate, offering varied perspectives.

Dr. Ibrahim Bako, a development economist, noted, “The proposed reforms aim to modernize tax collection, but the concerns of regional imbalance are valid and must be addressed to ensure fair implementation.”

Professor Aisha Bello of the Centre for Economic Policy in Kaduna added, “Kwankwaso’s concerns are rooted in the north’s historical context of underdevelopment. While tax reforms can stimulate growth, they need to be designed with inclusivity to prevent regional disparities from widening further.”

Kwankwaso’s vocal stance underscores the growing scrutiny over economic policies perceived to favor one region over another, fueling broader discussions on equitable governance and resource distribution in Nigeria.

Health7 days ago

Health7 days ago

Crime1 week ago

Crime1 week ago

Latest1 week ago

Latest1 week ago

Latest6 days ago

Latest6 days ago

Health6 days ago

Health6 days ago

Business1 week ago

Business1 week ago

Football1 week ago

Football1 week ago

Football1 week ago

Football1 week ago