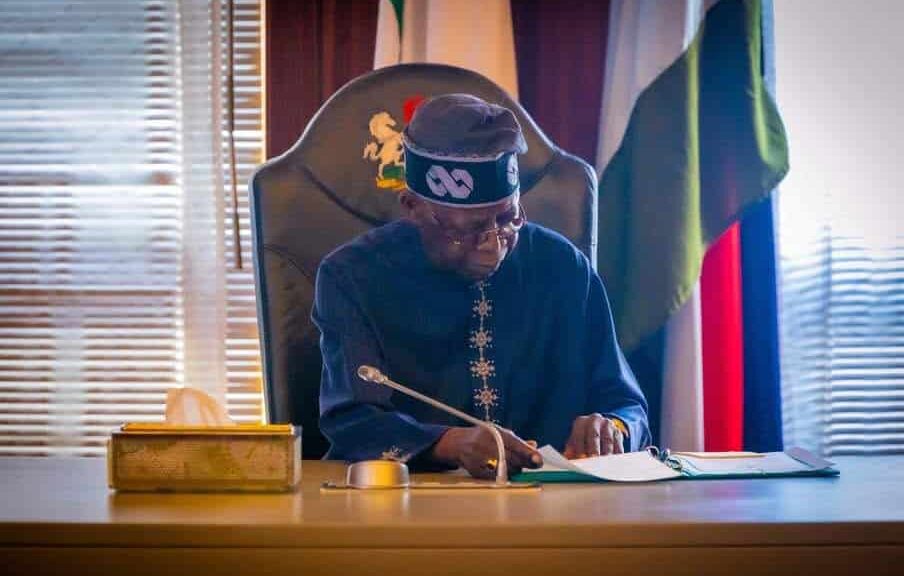

The Federal Government of Nigeria is set to prioritize debt servicing over capital expenditure between 2025 and 2027, according to the newly approved 2025–2027 Medium-Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP).

The projections indicate debt servicing costs will total N50.39 trillion over the three-year period, surpassing the N48.93 trillion allocated for capital projects.

This significant shift highlights growing concerns over the country’s fiscal sustainability as debt servicing expenses are expected to surge by 26.7%, rising from N15.38 trillion in 2025 to N19.49 trillion in 2027.

Comparatively, in 2023, the government expended N8.56 trillion on debt servicing, making the anticipated 2027 figure a 127.7% increase within four years.

The forecast shows that debt servicing will consume 34.06% of Nigeria’s total annual expenditure during this period, while capital spending will increase marginally by only 0.18%, from N16.48 trillion in 2025 to N16.51 trillion in 2027.

This disproportionate growth reveals a worrying trend that could exacerbate the nation’s infrastructure deficit and hinder economic advancement.

An analysis of the fiscal breakdown for 2025 indicates that capital expenditure will represent 34.44% of the total budget, slightly ahead of the 32.11% allocated to debt servicing.

However, by 2027, debt servicing is set to climb to 37.2% of the total budget, while capital expenditure drops to 31.51%.

READ ALSO: Amid revenue struggles, Nigeria’s foreign debt servicing soars by 108%

The MTEF/FSP report justifies the rising debt servicing costs as a consequence of Nigeria’s substantial debt levels and increased interest rates, which followed adjustments of the Monetary Policy Rate (MPR) to 27.25% as of September 2024.

The document states: “The provision for debt service will increase significantly due to the size of the country’s debt and higher interest rate on borrowing… Efforts will be geared towards promoting a debt restructuring strategy to free up resources for increasing government spending on critical infrastructure.”

For 2026, debt servicing costs are set to rise slightly to N15.52 trillion, while capital expenditure will see a decrease of 3.28% to N15.94 trillion.

By 2027, the disparity grows sharply, with debt servicing jumping 25.58% to N19.49 trillion compared to a mere 3.58% rise in capital spending.

The federal government also plans to borrow an additional N31.24 trillion over the next three years to bridge budget deficits, which are projected at N13.08 trillion in 2025, N12.14 trillion in 2026, and N13.76 trillion in 2027.

If realized, this could push Nigeria’s debt stock close to N170 trillion by 2027, up from N134.3 trillion as of June 2024. The borrowing strategy emphasizes domestic sources, with domestic debt expected to contribute N24.98 trillion of the total, while foreign debt will account for N6.26 trillion over the three years.

Concerns have been raised by the Debt Management Office (DMO) regarding the sustainability of Nigeria’s rising debt and servicing obligations.

The DMO warns that this trend could strain public finances and potentially destabilize fiscal management, undermining investments in essential sectors like infrastructure, healthcare, and education.

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues7 days ago

Comments and Issues7 days ago

Health6 days ago

Health6 days ago

Education1 week ago

Education1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Football6 days ago

Football6 days ago

Aviation7 days ago

Aviation7 days ago