Business

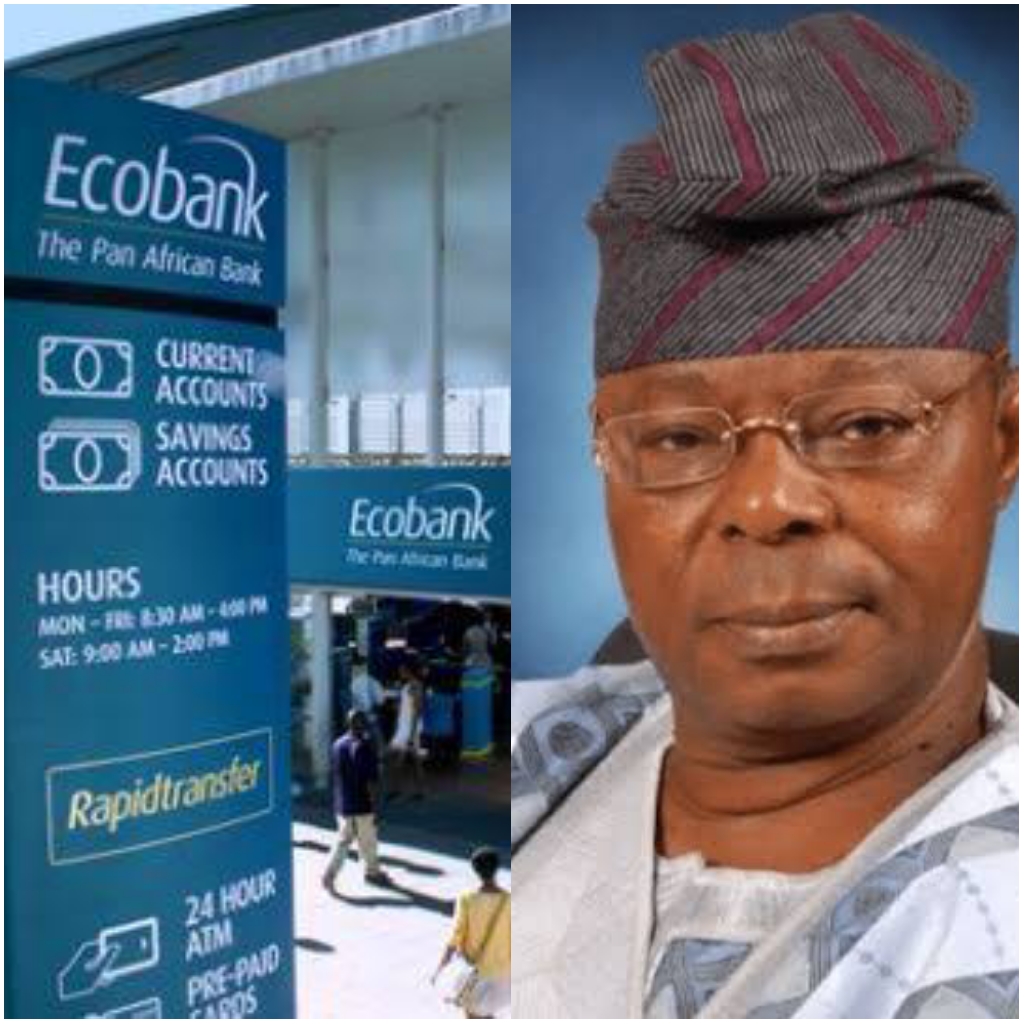

Oba Otudeko’s N13.5bn ‘corporate heist’

Published

3 years agoon

The recent acquisition of 4.7 billion shares of FBN holdings shares worth N87.8 billion by Oba Otudeko has ignited a fierce power struggle among major shareholders of FBN Holdings on one hand and Ecobank Nigeria on the other side.

The acquisitions raised his shareholding to 14 per cent of the bank’s outstanding market value.

Adding to the complexity of the situation, Ecobank Nigeria Limited has demanded the rejection of the acquisition based on an N13.5bn debt.

National Daily gathered that the money, disbursed in 2013 was originally N5.5bn, and was actually loaned to Honeywell, a fast-moving consumer goods company that Otudeko founded, and personally guaranteed the loan.

It was also learnt that having run out of options on how to recover the N5.5 billion as of that time, Eco Bank approached the Federal High Court in Lagos, praying for the court to grant their prayers and help them recover the money owed.

In January, the Supreme Court of Nigeria, in a landmark decision, ordered the liquidation of Honey Well and Oba Otudeko in order for Eco Bank to get their money back.

READ ALSO: Shareholders weigh options as Otudeko displaces Otedola as FBNH majority investor

Meanwhile, Flour Mill of Nigeria bought the company from Oba Otudeko for a sum of N82 billion, so technically, the company does not belong to Oba Otudeko again; it belongs to Flour Mill of Nigeria.

EcoBank Nigeria in desperation to recover the money, dragged Flour Mill of Nigeria to court, and the case is going on at the moment.

The Bank was in this state of urgency only for the news to break on Friday that the person owing them and who does not want to pay just consolidated his shares by buying First Bank shares worth N82 billion naira and is therefore the new major shareholder of First Bank.

Ecobank in a letter to FBN holdings and made available to National Daily, argued that instead of taking steps to repay his indebtedness in line with the mandate of the Supreme Court, “it has come to our notice that Dr. Oba Otudeko (being the prime mover and alter ego of the debtor companies who personally guaranteed to repay the said debt) has taken steps to divert his assets and funds and those of the debtor companies.

The letter, dated July 7, 2023, which has been seen by National Daily, comes in the wake of a Supreme Court judgment obtained by Ecobank against Honeywell Group Limited regarding outstanding loans owed to the bank.

The letter, authored by Kunle Ogunba and Associates, provides notification to the MD/CEO of FBN Holdings about the Supreme Court judgment that Ecobank secured against Honeywell Group Limited.

READ ALSO: Court fixes July 4 for hearing of bankruptcy case against Otudeko

They claimed the judgment conclusively determined the indebtedness of the group to Ecobank and issued a directive for the repayment of the outstanding loans, including accrued interest.

The receiver manager also claimed Honeywell Group Limited, along with Siloam Global Services Limited, Anchorage Leisures Limited, Honeywell Flour Mills PLC, and Dr. Oba Otudeko, Chairman of Honeywell Group, had initially disputed their indebtedness to Ecobank.

It, however, pointed to a Supreme Court ruling on January 27, 2023, which it claimed affirmed the debt and ordered the defendants to settle the outstanding amount, which stood at N13.5 billion as of January 31, 2023.

“This he has done by using a company known as Barbican Capital Limited (a special purpose vehicle), which was recently and hurriedly incorporated after the judgment of the Supreme Court (specifically on the 9th day of March, 2023). We state that the said Dr. Oba Otudeko has via the said Barbican Capital Limited ‘allegedly’ purchased an aggregate of 4,770,269,843 shares of FBN Holdings Plc.” Eco Bank said

But the problem is that the new Majority owners of First Bank, Barbican Capital Limited, do not have the name of Oba Otudeko as the owner or director of the company; rather, the company belongs to Oba Otudeko’s two older kids, who are the directors.

The power struggle and litigations surrounding the acquisition underscore the magnitude of the situation and the differing interests among the major shareholders.

The response of regulatory bodies, including the Central Bank of Nigeria (CBN), the Securities and Exchange Commission (SEC), and the Nigerian Exchange (NGX), is crucial in determining the validity and acceptance of the recent acquisition of FBN Holdings shares.

The CBN has the authority, under its rules on “lifting the veil of beneficial owners,” to trace the sources of funding for the acquisition.

This investigation would determine the true beneficial owner of the shares, regardless of the registered owners or entities involved.

Rule 4.1 of the Guidelines for Licensing and Regulation of Financial Holding Companies in Nigeria outlines that when shares amounting to 5 percent of a holding company are acquired through the secondary market, the holding company must seek approval from the CBN within seven days of the acquisition.

This rule underscores the importance of regulatory oversight and notification for significant share acquisitions.

Meanwhile, Wole Olanipekun & Co, the legal representatives of Oba Otudeko, have issued a response to the letter from Ecobank Nigeria Limited regarding the recognition of shares transferred to Barbican Capital Limited.

The law firm, on behalf of Dr. Oba Otudeko, urged FBN Holdings PLC to disregard the requests made in Ecobank’s letter.

In the letter from Otudeko’s legal representatives, it is stated that the debt amount of N13. 5 billion mentioned in Ecobank’s letter is not supported by any court decision, including the ruling from the Supreme Court.

The response clarifies that no court has awarded such a judgment sum in favour of Ecobank against Dr. Otudeko or any of the Honeywell companies.

Consequently, Otudeko’s legal representatives urge FBN Holdings to dismiss and reject the requests made in Ecobank’s letter, highlighting the lack of a court order supporting the claims. The response expresses confidence in the FBN Holdings CEO’s understanding of the prevailing circumstances and their adherence to legitimate positions.

You may like

Ecobank alerts customers on Sim card fraud increase

Ecobank announces back-to-school packages for customers

Our diversified business model responsible for resilient balance sheet—Ecobank

Honeywell’s N72.2bn judgement claim is an exercise in Futility – Ecobank

Honeywell’s N72.2bn judgement can’t stand test of time–Ecobank

Selloffs in FBN Holdings, others wipe off N883.39bn from capital market

Trending

Entertainment5 days ago

Entertainment5 days agoSimi addresses resurfaced 2012 tweets amid online backlash

Health7 days ago

Health7 days agoSCFN, LUTH introduce bone marrow transplants as curative treatment for sickle cell

Health4 days ago

Health4 days agoDeclassified CIA memo explored concealing mind-control drugs in vaccines

Football1 week ago

Football1 week agoHarry Kane nets brace as Bayern edge Frankfurt 3–2 to go nine points clear

Football1 week ago

Football1 week agoLate Flemming header stuns Chelsea as Burnley snatch 1–1 draw at Stamford Bridge

Crime4 days ago

Crime4 days agoSenior police officers faces retirement after Disu’s appointment as acting IGP

Crime1 week ago

Crime1 week agoTwo killed, seven injured in early-morning shooting in Richmond’s Shockoe Bottom

Education6 days ago

Education6 days agoPeter Obi urges JAMB to address registration challenges ahead of exams