By CHIOMA OBINAGWAM

THE Securities and Exchange Commission (SEC) has said that it has set aside the sum of N5 billion for the National Investor Protection Fund (NIPF).

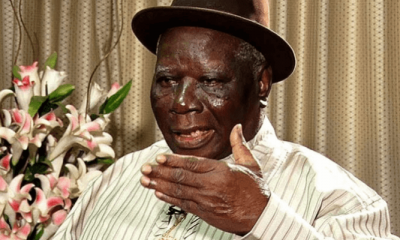

The Director General of SEC, Mounir Gwarzo disclosed this at the post Capital Market Committee (CMC) press briefing held at the weekend.

“A sum of N5 billion has been set aside for the NIPF to help investors that lose their funds in the capital market. Apart from the inauguration of the board, the verification committee was also inaugurated,” he said.

“We have also set aside some of our key initiatives for this year, including our workers’ training in order to raise the initial funds. As we move forward it’ll be funded by the market,” he added.

NIPF is a Fund set-up for the purpose of compensating investors whose losses are not covered under the Investor Protection Fund administered by Securities Exchanges and Capital Trade Points.

The DG also disclosed that the maximum money per claim that an investor is entitled to is N200, 000. Gwarzo is optimistic that the first beneficiaries will be paid before the end of December this year.

He, however, advised investors to familiarise themselves with the new rules on the NIPF posted on the SEC website.

A look at Part nine, Section 13 K of the Investments and Securities Act 2007 showed that the board shall set up a Verification Committee, which shall be charged with the responsibilities of reviewing the claims of investors and making recommendations to the Board.

SEC further disclosed in the rule that the Compensation of an investor shall begin with an application from an investor to the Fund.

An application, it disclosed, shall be brought within 12 months after the investor became aware or ought reasonably to have become aware of the status of the investments.

The Commission also stated that the application should be accompanied by evidence of investments with the Capital Market Operator as well as contains accurate materials and facts to prove the claims of the applicant.

It also noted that the decision of the Board on the recommendation of the Verification Committee shall be final. Meanwhile, the DG said that the CMC would focus on seven to 10 initiatives within the master plan in the coming year.

Notable among the initiatives, Mounir noted, will be the reduction of transaction costs. “The Nigerian capital market is costly to trade. We are looking at ways that we can reduce the transaction costs, hopefully, towards the end of January,” he said.

He also said that the commission would endeavour to scale-up the liquidity in the capital market and would, among other things, work towards enhancing market making.

Latest4 days ago

Latest4 days ago

News1 week ago

News1 week ago

Health5 days ago

Health5 days ago

Business6 days ago

Business6 days ago

Politics4 days ago

Politics4 days ago

Latest3 days ago

Latest3 days ago

Business3 days ago

Business3 days ago

Latest3 days ago

Latest3 days ago