Business

Zenith bank leads as NGX Banking index showcases remarkable growth

Published

3 months agoon

Zenith Bank leads other banks on the NGX as Nigeria banks emerged most formidable profit generators, propelled by a substantial upswing in interest income and gains resulting from the Naira’s devaluation in the second quarter 2023.

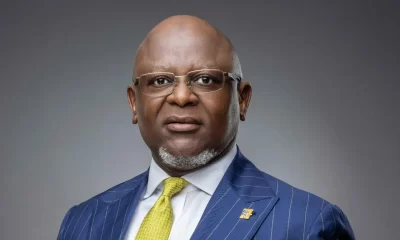

Zenith Bank with a market capitalization of N1.43 trillion as of Janaury 19, 2023, demonstrated the highest performance in the 2023 third-quarter results.

The pre-tax profits for the three months ended September 30 reached N154.67 billion, a 113 percent Y-o-Y quarter growth, propelling the nine-month pre-tax profit to N505.036 billion, a 149.34 per cent increase when compared to the period in 2022.

Gross earnings reached N1.329 trillion, a 114.17 percent increase from the previous year, while the group’s profit after tax hit N434.17 billion, a 149.05 per cent increase compared to N174.33 billion recorded within the same period in 2022.

The bank’s total assets increased 47.82 per cent to N18.161 trillion as of September 2023.

GTCO which has a market capitalization of N1.30 trillion as of January 19, 2023 with its total assets increased by 33.65 per cent to N8.616 trillion as of September 2023.

The pre-tax profit soared to N105.8 billion, a 59.17 per cent YoY surge, with the third quarter profit before tax reaching N86.93 billion, marking a 64.68 per cent YoY increase.

READ ALSO: FBNH rejoins UBA, Dangote, Zenith, others as Nigeria’s most valuable listed companies

This stellar performance propelled the group’s pre-tax profit in the first nine months of 2023 to N433.20 billion, a staggering 155.24 per cent YoY growth from N169.72 billion in the corresponding 2022 period.

Access Holdings which is third on the list has a market capitalization of N1.07 trillion as of January 19, 2023.

The group’s profit after tax reached N250.4 billion during the nine months, showcasing an 83 per cent year-on-year surge from the same period in 2022. The bank’s total assets increased 49.98 per cent to N21.257 trillion as of September 2023.

UBA’s third-quarter results for 2023 showcased a remarkable 86.64 per cent year-on-year growth in pre-tax profits, totalling N98.444 billion. The nine-month pre-tax profits surged to N502.901 billion, a substantial increase from N138.493 billion in the corresponding period last year.

The bank’s gross earnings reached N327.086 billion, marking a 38.64 per cent year-on-year increase, with interest income reaching N237.999 billion, up by 46.13 per cent year-on-year.

Their total assets increased 49.54 per cent to N16.236 trillion as of September 2023.

UBA has a market capitalization of N1.06 trillion as of January 19, 2024.

READ ALSO: Zenith Bank, Access, others set to declare 2023 dividends to shareholders

FBN Holdings which recently unveiled its third-quarter financial statements for the period ending September 30, 2023, has a market capitalization of N955 billion as of January 19, 2024

The Group’s profit before tax surged by an impressive 156.3 per cent to N270.3 billion from the previous year, driven by robust growth in interest income. The company’s profit after tax (PAT) reached N236.4 billion, marking a substantial 159.2 per cent increase compared to the corresponding period in 2022.

Stanbic IBTC Holdings witnessed an 87.77 per cent increase in pre-tax earnings for the 9 months to September 2023, reaching N129.46 billion from N68.95 billion.

During the same period, its post-tax profits increased by 97.97 per cent to reach N109.25 billion from N55.19 billion, with a total asset of N4.67 trillion, a 54.32 percent increase from 2022, under Adeniji’s leadership.

Ecobank Transnational Incorporated (ETI) reported a pre-tax profit of N262.2 billion for the nine months ending September 2023, reflecting robust 55 per cent year-on-year growth.

In the 9 months to September 2023, it recorded gross revenue of N1.21 trillion, representing a 59 per cent increase from the same period in 2022, and a total asset base of N20.7 trillion, a 55 per cent increase when compared to 2022.

Fidelity Bank’s 2023 third quarter results showcased remarkable growth, with pre-tax profits surging by 172.60 per cent year on year to reach N34.658 billion.

The third quarter profits took the nine-month pre-tax profit to N110.992 billion, a substantial 193.69 per cent increase from N37.792 billion in the same period of 2022.

READ ALSO: No need for panic withdrawals, CBN tells Banks’ depositors

The bank also closed with a total asset base of N5.414 trillion, indicating an increase of 35.71 per cent.

FCMB Group recorded a remarkable 108 per cent Y-o-Y growth in pre-tax profit, reaching N55.1 billion in the first nine months of 2023.

Additionally, in the first nine months of 2023, the group achieved a profit after tax of N49.15 billion, representing a YoY growth of 114.4 per cent from the corresponding period in 2022, and a total asset base of N3.88 trillion, indicating an increase of 30.03 per cent.

For Sterling Bank, it witnessed an impressive 206.4 per cent share price appreciation in 2023, closing at N4.29 from N1.40.

The bank reported a commendable net income of N16.5 billion in the first nine months of 2023, reflecting a 23.04 per cent Y-o-Y growth.

Its asset base stands at N2.24 trillion according to its 9-month ended September statement, a significant 20.9 per cent increase from N1.85 trillion recorded within the same period in 2022.

You may like

Banks net interest margin can dampen consumer spending, investment—analysts

Stakeholders welcome CBN’s fresh minimum capital requirements for banks

Banks suggest alternatives to mobile, internet banking as downtime enters day 2

Bank customers express frustration as NIN-BVN linkage deadline expires

Factors that will influence Banking Sector’s performance in 2024—analyst

Four banks hoarding $5bn excess FX, Reps allege

Trending

Health & Fitness3 days ago

Health & Fitness3 days agoMalaria Vaccines in Africa: Pastor Chris Oyakhilome and the BBC Attack

Featured1 week ago

Featured1 week agoPolice reportedly detain Yahaya Bello’s ADC, other security details

Aviation5 days ago

Aviation5 days agoWhy some airlines are avoiding Nigeria’s airspace–NAMA

Business1 week ago

Business1 week agoDebt servicing gulps 56% of Nigeria’s tax revenue, says IMF

Aviation4 days ago

Aviation4 days agoJust in: Dana airline crash lands in Lagos

Aviation4 days ago

Aviation4 days agoNSIB begins investigation into Dana Air after crash-landing incident

News7 days ago

News7 days agoOndo APC guber hopefuls reject primary poll

Business1 week ago

Business1 week agoAdesola Adeduntan steps down as FirstBank CEO