NCC

Govt won’t lose N1.1bn revenue to Etisalat transfer – NCC

Published

6 years agoon

By

Olu Emmanuel

The Executive Vice Chairman of the Nigerian Communications Commission (NCC) , Prof. Umar Dambatta has assured that new investors expected to take over 9mobile telecommunications will pay all outstanding debts, including the N1.1bn spectrum band fee to the federal government.

The House of Representatives committee on Telecommunications mandated the commission to submit copies of CAC registration form of Etisalat, financial audit of the company from 2011 to date, and the report of the Task Force set up to conduct the health status of all the telecommunication companies for further legislative action. The committee is investigating public the circumstances which led to the collapse of Etisalat in 2017.

Dambatta who was represented at the investigative hearing by a National Commissioner, Mr. Sunday Dare, maintained that the Commission does not interfere with non-licensee as provided in the extant law. Chairman of the committee, Hon Saheed Akinade-Fijabi during the investigative hearing insisted that former members of the Etisalat musst appear before the Committee to assist in unravelling the remote and immediate cause of the collapse.

Meanwhile, no fewer than 17 bidders expressed interests in the transaction which commenced on 7th September, 2017; following the exit of core investors into Etisalat. Managing Principal of Barclays Africa, Hasnea Varawalla, disclosed this during theinvestigative hearing.

According to him, Barclays Africa had on the 26th January, 2018 met with the two selected top bidders to finalize the structuring of the transaction, adding that 26th February 2018 for the bidders to conclude and sign the transaction documents after due approval by Nigerian Communications Commission (NCC) and Securities and Exchange Commission (SEC). Some of the lawmakers who expressed concerns over petitions on the transaction which was not publicized in the national dailies as contained in the public procurement Act, argued that the ongoing transactions may result into litigations.

Akinade-Fijabi noted that failure to conduct due diligence may result into series of litigation after the take-over of the company by other aggrieved parties including those who pulled out over alleged “hidden things”, just as he warned on the need to ensure adhere to international best practices in the bid to avert eventual take-over by Asset Management Corporation of Nigeria (AMCON).

The lawmakers also frowned at the failure of the Financial Adviser to conduct independent due diligence into the financial status of the company and other stakeholders’ interest. In his intervention, Diri Douye (PDP-Bayelsa), member of the Committee who frowned at the earlier submission of NCC that it was not involved in the ongoing financial process, warned that misleading the Parliament attracts five years imprisonment without option of fine. On his part, Kehinde Odeneye (APC-Ogun) queried the rationale behind non-placement of adverts and alleged disregard for other creditors apart from the consortium of banks. While responding to the issues raised by the lawmakers, Varawalla explained that all the parties involved in the Syndicate Owners (consortium of banks) unanimously agreed that the transaction should be closed and extended to the best investors across the world. The Barclays representative added that all the parties involved in the ongoing transaction were given opportunity to interface with the creditors and aware of the amount owed Federal Government to the tune of N1.14 billion. In a swift reaction to his submission, the lawmakers argued that the funds invested into the telecom firm as well as the banks belong to over 20 million Nigerian subscribers, stressing that such as guided transaction fell short of extant laws.

On his part, Ahmed Abdullahi, CBN Director of Banking and Supervision, disclosed that the 13 consortium of banks had N130 billion exposure to the troubled Etisalat, hence the resolve for the apex bank’s intervention. According to him, the resolve to place Etisalat on receivership was the last resort, adding that the UAE investors who pulled out of the company failed to honour their promise to inject $500 million at a meeting midwived by the CBN. He added that the $500 million ought to be escrowed in CBN pending the conclusion of the terms of payment of loans to the consortium. He also denied knowledge of the sum of $2 billion allegedly invested by the UAE investors into Etisalat before its eventual collapse.

You may like

9mobile remains biggest loser as Nigeria’s internet subscriptions drop

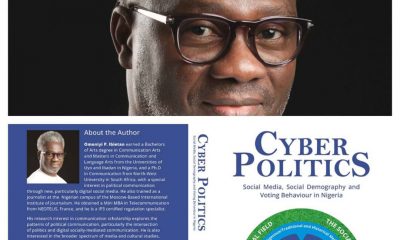

Ibietan’s book on cyber politics for public presentation 25 July

Tinubu holds meeting with MTN Group Chairman, NCC Vice Chairman

9mobile unveils 9TV in Lagos

9mobile launches safety app to improve security

9mobile unveils mentorship programme for entrepreneurs

Trending

Health & Fitness3 days ago

Health & Fitness3 days agoMalaria Vaccines in Africa: Pastor Chris Oyakhilome and the BBC Attack

Featured6 days ago

Featured6 days agoPolice reportedly detain Yahaya Bello’s ADC, other security details

Education1 week ago

Education1 week agoEducation Commissioner monitors ongoing 2024 JAMB UTME in Oyo

Business1 week ago

Business1 week agoMaida, university dons hail Ibietan’s book on cyber politics

Aviation5 days ago

Aviation5 days agoWhy some airlines are avoiding Nigeria’s airspace–NAMA

Business6 days ago

Business6 days agoDebt servicing gulps 56% of Nigeria’s tax revenue, says IMF

Crime1 week ago

Crime1 week agoPolice take over APC secretariat in Benue

News6 days ago

News6 days agoOndo APC guber hopefuls reject primary poll