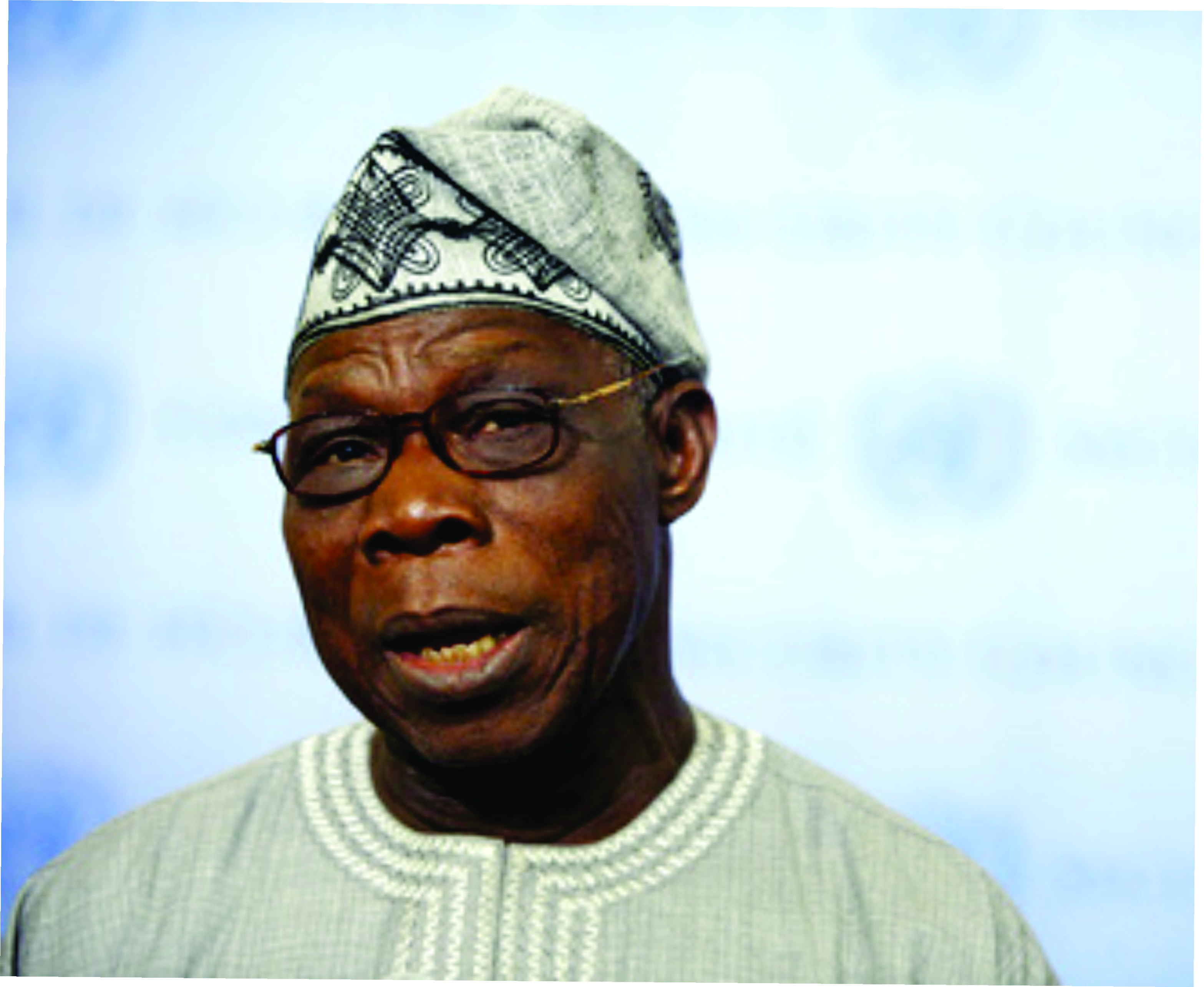

As Nigeria continues the execution of economic recovery plans, the current interest rate has raised a lot of eyebrows as Former President, Olusegun Obasanjo has said the current rate will slow the pace of development in the sector.

During an entrepreneurial programme in Abeokuta, the Ogun State capital, Obasanjo pressed on the need for urgent review of interest rate, he called on the Central Bank of Nigeria (CBN) to review the interest rate given on agricultural loans.

According to him, “America’s agriculture was developed on an interest of two and half percent. Central Bank should act as the catalyst and they can do it.

“There are few countries that progress without taking Agriculture seriously. The way the Central bank is going is not the way. ”

This call by the former president is coming few days after Monetary Policy Committee, MPC, retained the basic interest rates unchanged benchmarking it at 14 percent.

ALSO SEE: CBN in another T-bills auction exercise as FG raises N243.8bn

Speaking to the young entrepreneurs at the event, Obasanjo said, “There are entrepreneurs by desire, entrepreneurs by accident, entrepreneurs by inheritance.

“There is entrepreneurship in you, and we must develop it. The purpose of our being here today is to assure you that you can develop it and we will make you develop it.”

Recall that the MPC voted to maintain status quo for the seventh consecutive session by retaining the Monetary Policy Rate (MPR) at 14.0%; Asymmetric corridor around the MPR at +200/-500bps; Cash Reserves Ratio (CRR) at 22.5%; and Liquidity Ratio (LR) at 30.0%.

The MPC members were faced with the choices of maintaining status quo, tightening, or easing monetary policy. Amid strong arguments for the three positions, the choice to support growth without jeopardizing recent gains around prices (particularly exchange rate) culminated into a decision (6 votes to 1) of holding policy rates constant, while allowing for policy flexibility as developments unfold in the macroeconomic space.

Health & Fitness2 days ago

Health & Fitness2 days ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Featured6 days ago

Featured6 days ago

Education1 week ago

Education1 week ago

Business1 week ago

Business1 week ago

Aviation4 days ago

Aviation4 days ago

Business6 days ago

Business6 days ago

Crime1 week ago

Crime1 week ago