The Central Bank of Nigeria (CBN) is contemplating a downward review of the lending rate as a buffer against the current economic austerity occasioned by the coronavirus outbreak.

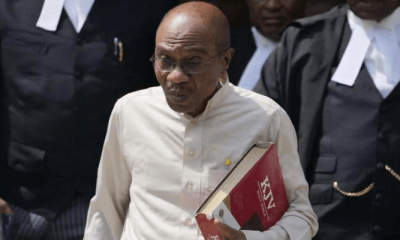

Governor of the CBN, Godwin Emefiele gave the indication at the Going for Growth session in Abuka during the weekend.

He said central banks in the major economies of the world are responding to the global economic crisis by making reforms that foster growth and cushion the effects of the coronavirus outbreak.

Emefiele noted that the conference was timely considering that the economy is currently battling the external vulnerabilities posed by lower oil receipt triggered by the oil price war between Saudi Arabia and Russia and the sweeping hazards of the pandemic on global trade as a whole.

“The impact of the coronavirus across over 100 countries, has affected global supply chains, as well as demand for goods and services. Commodity prices have also been affected, as crude oil prices have plummeted by over 45 per cent since January 2020.

“The CBN fortunately had already embarked on similar measures which have resulted in significant reduction in lending rates, as part of our efforts to boost growth. Working with the fiscal authorities, we will not hesitate to deploy additional measures to strengthen our buffers and insulate the economy from the global headwinds,” the CBN chief said.

He reiterated that the International Monetary Fund (IMF) had at the beginning of this year estimated global economic growth for 2020 to be 3.3 per cent compared to 2.9 per cent in 2019.

He went further to say that “with the onset of the virus, global growth is expected to decline in 2020, but the extent of the decline would depend on how the epidemic is contained over the next few months.”

The CBN chief observed that the resolution of the apex bank to raise banks’ Loan to Deposit Ratio (LDR) from 60 per cent to 65 last year was instrumental in sustaining growth in 2019.

“We also imposed restriction on access to Open Market Operation (OMO) auctions to encourage banks to lend to the real sector. Indeed, the banking sector has responded positively with the rise in aggregate industry credit from N15.3 trillion May 2019 to over N17.4 trillion in January 2020.

Featured1 week ago

Featured1 week ago

Aviation1 week ago

Aviation1 week ago

Business4 days ago

Business4 days ago

Aviation6 days ago

Aviation6 days ago

Business4 days ago

Business4 days ago

Featured1 week ago

Featured1 week ago

Education4 days ago

Education4 days ago

Crime4 days ago

Crime4 days ago