The number of bad loans arising from lackluster economic performance in Nigeria has continues to increase with banks accumulating non-performing loans of over N1.6 trillion as at June 2016, National Daily investigation has gathered.

According to the latest figures from the Central Bank of Nigeria, CBN, at the end of June 2016, non-performing loans grew by 158 per cent from N649.63 billion at end of December 2015 to N1.679 trillion at end of June 2016.

In the Financial System Stability Report, the apex bank also observed that the industry ration of non-performing loans net of provision to capital increase significantly to 30.9 per cent at end of June 2016 from 5.9 per cent at the end of December 2015.

National Daily gathered that this depicted weak capacity of the sector to withstand the adverse impact of non-performing loans, hampering infrastructural base and security challenges in the country that was expected to be championed by the sector.

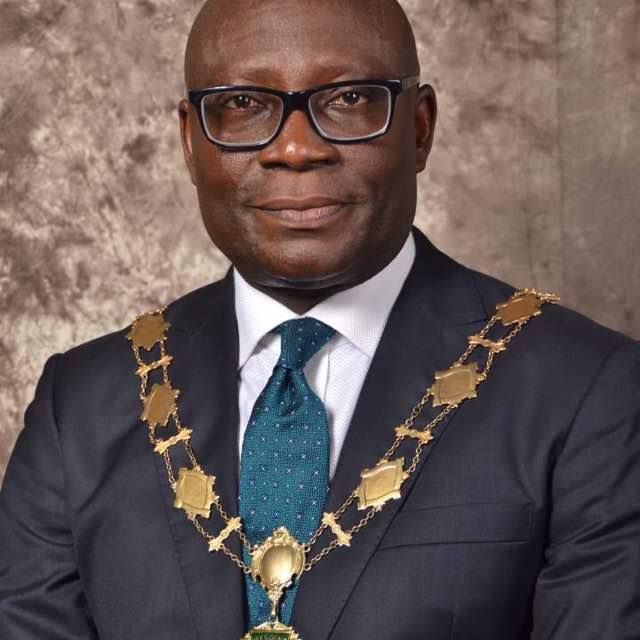

Professor Segun Ajibola, President, Chartered Institute of Bankers of Nigeria (CIBN), urged the Federal Government to support the banking sector with incentives, such as waiving a percentage on tax for institutions in the financial services sector that deployed a minimum of 70 percent local content in their various activities.

“The government should also provide an enabling policy environment for commercial banks to take advantage of the vast opportunities in retail banking. There is also the need for both the government and the banking sector to go into public-private partnership agreements in the provision of infrastructural facilities and security that would encourage banks to set up retail banking facilities and cater to the unbanked and under-banked.”

The CIBN chief also canvassed the creation of a national innovation hub for financial technology to further enhance the operations of the Nigerian banking sector.

“This hub would go a long way not only in enhancing the banking sector but also providing a space where ideas and innovative concepts would flow freely.”

Entertainment5 days ago

Entertainment5 days ago

Health1 week ago

Health1 week ago

Health4 days ago

Health4 days ago

Football1 week ago

Football1 week ago

Football1 week ago

Football1 week ago

Crime4 days ago

Crime4 days ago

Education6 days ago

Education6 days ago

Crime1 week ago

Crime1 week ago