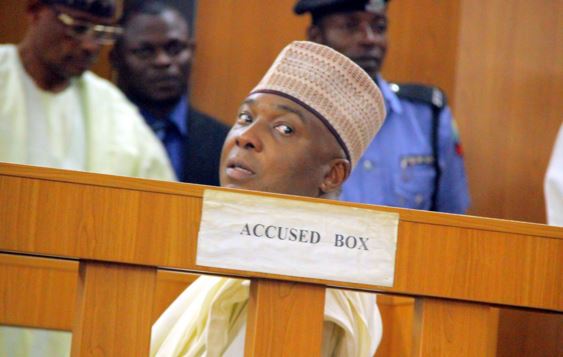

The cash haul of N1.4 billion traced to Senate President Bukola Saraki as part of the Paris Club refund has been forfeited temporarily to the federal government.

Justice Cecelia Mojisola Olatoregun of the Federal High Court, in Ikoyi, Lagos, gave the order on Friday.

The fund was stashed away at Access Bank Plc and Guaranty Trust Bank (GTBank),

The funds were traced to Senate President Bukola Saraki and his aides who took the funds from the Nigeria Governor’s Forum and laundered most of it through jewelry sellers in Dubai.

According to the EFCC investigating the fund disbursement, the company linked to Saraki moved the fund between December 2016 and January 2017.

Justice Olatoregun made the order on Friday in accordance to an exparte application filed and argued by the Economic and Financial Crime Commission (EFCC) through its lawyer, E. E. Iheanacho.

Apart from the order of temporary forfeiture of the above-stated amount, the court also ordered the EFCC to notify whoever is interested in the said money to appear before the court and show cause why the money should not be finally forfeited.

She directed the commission to publish the temporary forfeiture order in a national newspaper for the respondents or anyone who is interested in the money to appear before the court and show causewithin 14 days before the final forfeiture order will be given.

Listed as respondents in the suit are: Melrose General Services Limited, WASP Networks Limited, and Thebe Wellness Services.

Comments and Issues2 days ago

Comments and Issues2 days ago

Business6 days ago

Business6 days ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business5 days ago

Business5 days ago

Education7 days ago

Education7 days ago

News6 days ago

News6 days ago

Comments and Issues5 days ago

Comments and Issues5 days ago