Point Blank

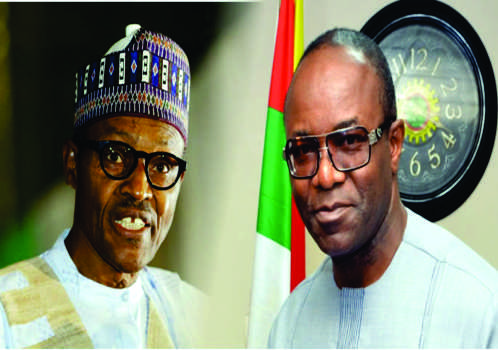

Buhari and NNPC JVs Financial Autonomy: The start of something new

Published

9 years agoon

By

Publisher

BEYOND rhetoric, President Muhammadu Buhari has taken what could be rightly described as his first major step towards overhauling the Nigerian National Petroleum Corporation (NNPC) by granting its exploration joint ventures control over their own budgets as a way of overcoming the lingering cash call and other funding bottlenecks.

Under this new model, the joint ventures will be turned into private companies that control their own budgets. They are expected to source for their own funding and then pay taxes, royalties and, also dividends to the federal government similar to the Nigeria LNG (NLNG) funding model.

Also, it is expected that the NNPC would reduce its stake in joint ventures to below 50 per cent from 55 per cent by selling assets to local companies to bypass time-consuming National Assembly approval. The initiative will save the federal government cash calls running into several billions of dollars for funding the joint venture oil blocks.

As reported, the decision of the Federal Government in this regard followed the proposal as contained in a letter to the president by Emmanuel Kachikwu, Group Managing Director of the Nigerian National Petroleum Corporation, NNPC, on the need to revamp several joint ventures involving production and exploration arm of the NNPC starting with local operators as pilot scheme.

The letter states that this plan will apply to five oil blocks sold by Shell in 2011-2012 to local companies Shoreline Natural Resources Nigeria Ltd (OML 30), First Hydrocarbon Nigeria Ltd (OML 26), ND-Western Ltd (OML 34), Elcrest E&P Nigeria Ltd (OML 40) and Neconde Energy Ltd (OML 42). It also covers West African Exploration and Production Co, which bought two oil assets in 2015 from Shell. These would serve as pilot scheme to test the efficacy and workability of the reform initiative.

The model adopted by the president for the oil industry, called Incorporated Joint-Ventures (IJV), is aimed at overcoming chronic cash shortages facing the NNPC financing of joint venture operations.

It will be used in revamping several joint ventures, particularly five oil blocks sold by Shell in 2011-2012 to local companies; Shoreline Natural Resources Nigeria Ltd, First Hydrocarbon Nigeria Ltd, ND-Western Ltd, Elcrest E&P Nigeria Ltd and Neconde Energy Ltd.

Nigeria produces about 2.2 million barrels per day of oil with foreign and local companies through production sharing contracts and joint ventures. But projects have been held up because NNPC needs parliamentary and regulatory approvals to spend fund.

Without doubt, the new joint venture structure as proposed is a sign that reforms are finally underway in the nation’s oil and gas sector and it’s no longer going to be business as usual.

If the federal government can successfully incentivise the upstream joint venture operations especially with local private operators by insisting on their independently funding their operations, this would resolve the plethora of existing operational and funding issues between the joint venture companies and NNPC. By this also, a major chunk of burden would have been removed from the NNPC by helping the corporation reduce its obligations and piles of unpaid or rather unreconciled bills. Unsurprisingly, NNPC’s under performance rests precisely on the recipe that makes it miserly government’s outstretched arm in the nation’s oil and gas sector.

It is a well know fact that critical projects have been held up because NNPC as mandated by law must get approval from the Ministry of Petroleum Resources and the National Assembly before it can spend anything. And as hinted by industry operators, government officials and lawmakers do not usually see any urgency in granting such approvals and this has been making proposals irrelevant as costs exceed the original budgets when approved months after. This is one of the reasons why NNPC have piled up unpaid bills.

It is expected that under this new arrangement the Incorporated Joint Ventures (IJVs) will on their own sought and raise funding more easily as it is a model international investors can be easily convinced to stake their monies without fear of “lost in transit.”

Without doubt, this new arrangement in principle is very good as it passes for an important early indicator of the determination, as voiced by the president, to reform key aspects of the policy governing our oil sector. However, rather than a piecemeal approach, the federal government should put in sincere efforts at passing the PIB into law. The approval to corporatise the NNPC joint ventures is one of the crucial reforms proposed in the version of the Petroleum Industry Bill (PIB) which has been pending before the National Assembly for several years.

The PIB provides for the incorporation of the joint venture assets into companies, enabling them to raise funds independently from financial markets and control their budgets.

As rightly said in a recent media briefing by the Nigerian Association of Petroleum Explorationists (NAPE), investment uncertainties surrounding the long-delayed Petroleum Industry Bill (PIB) and absence of incentives to encourage exploration activities, have grossly curtailed oil exploration activities and impeded the country from advancing towards its target to grow reserve base and boost its production capacity.

The country’s crude oil reserves have declined from the 37.2 billion barrels it recorded in 2011 to 31.81 billion barrels as at December 2014. The nation’s oil reserves slumped from 38.5 billion barrels in 2008 to 37.5 billion barrels in 2010. In 2011, the reserves further dropped to 37.2 billion barrels transgressing to the current play figure of 31.81 billion barrels pegged as at December 2014.

If this bill is passed into law, it will provide a more holistic and longer term approach and solution to the problems of our all-important petroleum industry.

The perception of declining profitability and competitiveness of the Nigerian upstream operating environment has been exacerbated by the anxiety over the fate of the PIB. This is the truth, the whole truth and nothing but the truth!

IFEANYI IZEZE is an Abuja-based Consultant and can be reached on: [email protected]; 2s34-8033043009)

You may like

Bridging energy access gap vital for Nigeria’s economic growth, says NNPC Chief

NNPCL denies adjustment in price of fuel, diesel

NNPC Ltd will use gas to trigger Nigeria’s Industrialisation, Economic Devt. -Eyesan

Kyari calls for differentiated energy transition for Africa

NNPCL solicits EFCC’s support in fight against crude oil theft

NNPC highlights energy security’s role in wealth creation

Trending

Health & Fitness3 days ago

Health & Fitness3 days agoMalaria Vaccines in Africa: Pastor Chris Oyakhilome and the BBC Attack

Featured7 days ago

Featured7 days agoPolice reportedly detain Yahaya Bello’s ADC, other security details

Education1 week ago

Education1 week agoEducation Commissioner monitors ongoing 2024 JAMB UTME in Oyo

Aviation5 days ago

Aviation5 days agoWhy some airlines are avoiding Nigeria’s airspace–NAMA

Business1 week ago

Business1 week agoMaida, university dons hail Ibietan’s book on cyber politics

Business7 days ago

Business7 days agoDebt servicing gulps 56% of Nigeria’s tax revenue, says IMF

Crime1 week ago

Crime1 week agoPolice take over APC secretariat in Benue

News6 days ago

News6 days agoOndo APC guber hopefuls reject primary poll