By Odunewu Segun

After months of sticking to its gun of not reducing interest rate to avoid worsening inflationary pressure on the economy, the Central Bank of Nigeria has said it is working on adjusting conditions for lending to micro, small and medium enterprises (MSMEs) in the country.

This is coming against the calls by stakeholders in the real sector, agencies as well top government officials on the CBN to reduce interest rates, particularly for small businesses.

According to National Daily findings, lending rates in the country currently hover around 28 and 30 per cent, making the cost of finance high for companies, especially small businesses.

Rising from the Bankers Committee meeting recently, the CBN and chief executives of banks said they plan to de-risk SMEs so as to make it easier to lend to them.

Acting Director, Corporate Communications of the CBN, Isaac Okoroafor, there was a consensus to look into ways to bring down interest rate “as a complimentary measure to bring about prosperity, especially through the SME and agriculture.”

“This would involve finding ways of de-risking SMEs, because people argue that SMEs are too risky to lend to and so the bankers committee is working in collaboration with the CBN to ensure that that segment of business is de-risked by way of risk sharing and trying to tweak some of the conditions even as the CBN works to ensure that the macroeconomic impediments to low interest rate are addressed over time”, he added.

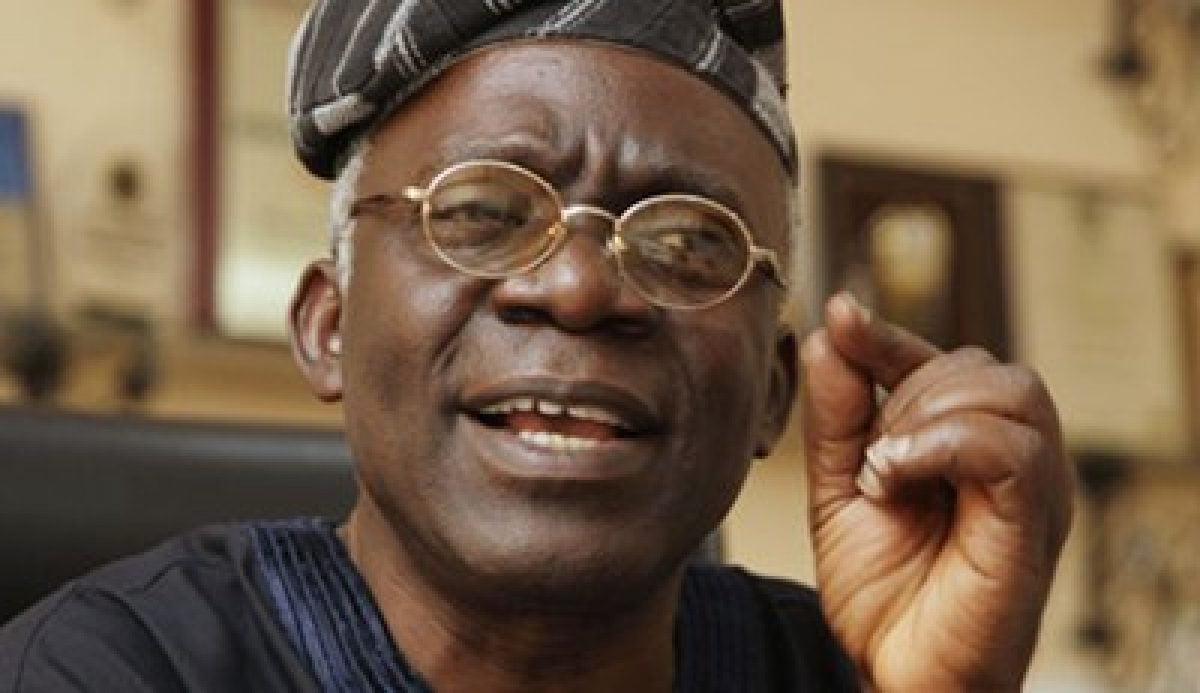

Recall that at a round-table between the Senate and interest groups in the country’s financial and business sectors in Abuja, the Senate President, Bukola Saraki, frowned at the decision to keep lending rate unchanged, saying it was stifling businesses.

Saraki however noted that “it is inconceivable that businesses anywhere can survive on a 25 to 30 per cent interest rate regime.

ALSO SEE: BVN registration is free, says CBN

“How can investors anywhere survive on these rates? How can they create jobs and make returns on their investment? But, this is the situation our businesses currently live with”, he queried.

During the last Monetary Policy Committee (MPC) meeting, the CBN left the benchmark lending rate, also known as Monetary Policy Rate (MPR), unchanged for the seventh successive time at 14 per cent.

Comments and Issues2 days ago

Comments and Issues2 days ago

Business6 days ago

Business6 days ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business5 days ago

Business5 days ago

News6 days ago

News6 days ago

Comments and Issues5 days ago

Comments and Issues5 days ago

Education7 days ago

Education7 days ago