Business

CBN: Checking financial impunity through naira re-designing

The implication, according to some analysts, is that this unhealthy relationship may be responsible for the lack of synergy between the fiscal and monetary policies in the country over the years.

Published

2 years agoon

By

Publisher

Danjuma Okpanachi

Some Nigerians believe that the country is in dire straits and are asking themselves how we got to this low level of economic decay.

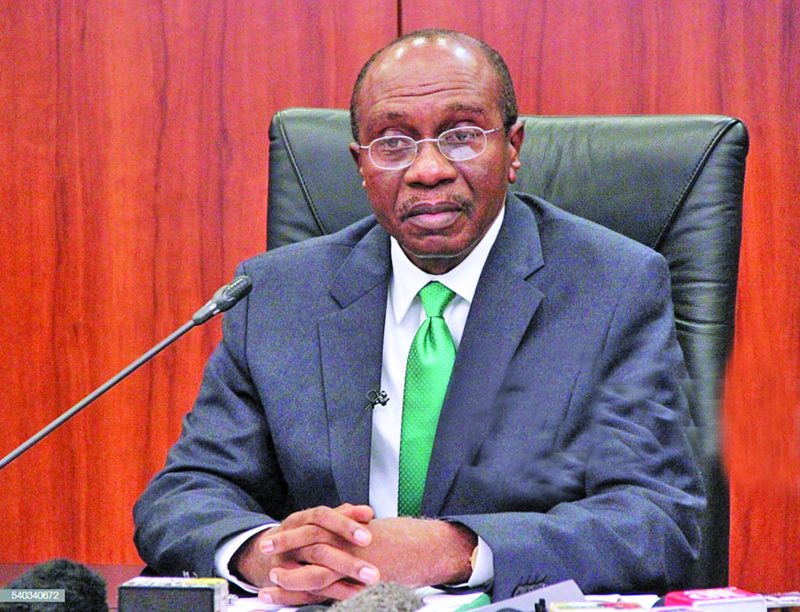

While some believe that the country is not an island and as such, is susceptible to external influences and shocks such as the ripples of the Russian-Ukraine war, the economic crisis in some developed countries, that could adversely affect some economic indicators, recent happenings, which manifested in open disagreement occasioned by the alleged frosty relationship between the Central Bank of Nigeria, (CBN) Governor, Godwin Emefiele and Minister of Finance, Budget and National Planning, Zainab Ahmed may have brought to the fore the undercurrents that may be working against the progress of the Nigerian economy.

The implication, according to some analysts, is that this unhealthy relationship may be responsible for the lack of synergy between the fiscal and monetary policies in the country over the years.

Consequently, they believe that the issue may be more of an ego trip and preservation of personalities as well as interests, laced with incompetence and lack of finesse needed in public affairs, particularly on the part of Ahmed. Nigerians who bear the brunt of all these are faced with frustration, desperation and near hopelessness, even as the personality clash rages on.

The economy is confronted with many challenges, including the poor exchange rate of the local currency against the dollar, Pound Sterling, and others; slow growth rate; rising inflation, high debt, rising poverty and unemployment, and recently, the dollarization of the economy.

More worrisome is the fact that there seems to be a lack of synergy between the fiscal and monetary policy measures, a development that may have resulted in the two agencies (the CBN and Ministry of Finance) working at cross purposes.

In point of fact, rather than the minister working with the CBN to initiate the much-needed policy measures that would improve the lives of Nigerians, she has kept herself as a ‘boss’ that must be consulted on any and every issue on the economy.

But not too long ago, Nigeria had witnessed purposeful leadership, when it was blessed with not just a finance minister, but also one that was in charge of the economy, and Nigerians were better for it.

It is noteworthy that, Ngozi Okonjo-Iweala as finance minister, was not just preparing papers for mounting debts and payment of subsidies (as is the case today) that have brought the country to its knees; she was an adviser to the president, who was articulate and vocal in advising and raising alarms when necessary, especially in the area of savings through the Excess Crude Account, (ECA).

For instance, with less than seven weeks to Christmas 2022, many Nigerians are living practically on a shoestring whilst those who cannot afford to, are emigrating in large numbers (Japa-ing).

According to Bismarck Rewane, Chief Executive of the Financial Derivatives Company, “the season appears gloomy, especially with elevated food prices. For example, the price of a 50kg bag of rice has surged to N48,000 and could spike further as floods ravage food-producing areas in the country. Worse still, fuel scarcity has resurfaced in many states. This has driven the cost of PMS to N300/liter in some filling stations.

In addition, the CBN recently announced a redesign of three of the country’s currency denominations. This could potentially weigh on festive demand and supply as market women will be constrained to exchange goods for a currency that will soon cease to be legal tender. Meanwhile, the naira has continued its free fall, depreciating to N818/$ and could tank further as people go long on the dollar in response to economic uncertainty.”

Emefiele had last week Wednesday, said the CBN arrived at the decision to redesign N200, N500, and N1000 denominations following a request from the federal government.

He said the new notes will be in circulation from December 15, 2022, while existing currencies will no longer be legal tender from January 31, 2023. But Ahmed, on Friday, kicked against the policy, saying that she and her officials were neither informed nor consulted by the CBN.

But, President Muhammadu Buhari, through his spokesperson, Garba Shehu, on Sunday, said he indeed approved the redesign of the three largest denominations of the naira, bringing the issue to a close in favour of Emefiele.

However, while there are varying views and reactions to the proposed redesigning of the notes, most Nigerians have applauded the exercise, which they believe would reduce the level of impunity from politicians and the elite that have formed the habit of flaunting their wealth while the majority are finding it difficult to eat.

Friday Ameh, a Lagos-based energy analyst was of the opinion that CBN should be given enough encouragement to carry out the exercise, adding that ‘there seems to be light at the end of the corner.’ According to him based on the reasons adduced by CBN, and considering the prevailing circumstances, there is a need for some drastic measures to be taken to arrest the slide.

For Kingsley Moghalu, a former deputy governor of CBN, Emefiele doesn’t need to inform the finance minister before changing naira notes. Moghalu, who was featured on the Channels Television program, ‘Politics Today’, expressed his support for the bank’s decision to redesign some of the country’s currency notes.

According to him, CBN does not need the permission of the finance ministry or any other agency of government before making such a decision.

He further argued that the decision is within its statutory duty which does not need any external approval, except that of Nigeria’s president.

His words, “They (CBN) were affirming their statutory responsibility as the sole institution responsible for the issuance and management of the legal tender currency of Nigeria which is the naira. Note the emphasis on the sole institution, that responsibility is not shared with anyone else. So the CBN is doing its job in saying they have come to a judgment that the time has come to redesign the naira notes and there are a number of reasons behind that which I’m sure we will discuss.

“The ministry of finance does not supervise the CBN. It is part of the offices that supervise the economy. The Ministry of Finance, the Central Bank of Nigeria, national planning, the Ministry of Trade, Industry, and Investment: these are all parts of the government but the Central Bank of Nigeria, as the central bank of most civilized nations is or should be independent of any external influence. So, this is the context in which you will have to see what is going on.

“The central bank fulfilled the requirements of it, which under the Act is that you cannot change the currency of the country without approval from the President. They sought approval and they got it. And so I think they were well within their rights.”

The central banker went further to explain the “two decision-making phases in the CBN and the role of the federal ministry of finance. On this board, he added, are five internal and seven external members, one of which is the permanent secretary of the Federal Ministry of Finance.” With this structure in place, Moghalu said it is the duty of the permanent secretary of the finance ministry to brief Ahmed, not that of Emefiele or any official of the CBN.

“The permanent secretary of the Federal Ministry of Finance must have been there. Did he or she, I don’t know who the permanent secretary is, not inform the minister that this sort of decision was taken by the board? I don’t know the answer to that. So, there is an institutional mechanism and I’m sure it is respected. For if you are talking about going personally to brief the minister, it is not required and it is not necessary,” he said.

Also commenting on CBN’s determination to redesign the notes, Aminu Gwadabe, president of the Association of Bureau De Change Operators of Nigeria, (ABCON) said “the issue of naira redesign is an orthodox policy of monetary authorities to usually check illegal economic behaviour in the economy like hoarding of currency, currency substitution, rent-seeking, popularly known as round tripping and therefore as a responsible organization guiding the set measures of anti-money laundering and terrorism financing for our members will have our backing.”

You may like

Interpol places 3 Nigerians on Red Alert for stealing $6.2m from CBN

Breaking: Banks to pay diaspora remittances in Naira

HURIWA demands DSS, EFCC to investigate CBN over Naira scarcity

CBN Investigator highlights Emefiele’s gross financial offences

Court grants Emefiele bail

Emefiele’s Naira redesign policy responsible for currency’s scarcity–Falana

Trending

Comments and Issues2 days ago

Comments and Issues2 days agoAs Ariwoola takes the judiciary to the top of the grease pole

Business6 days ago

Business6 days agoNMDPRA Chief faces backlash over comment on Dangote Refinery

Business1 week ago

Business1 week agoGlobal cyber outage disrupts flights, Banks, telecoms, Media

Business1 week ago

Business1 week agoKPMG criticizes FG’s 50% windfall tax, foresees legal disputes

Business5 days ago

Business5 days agoZenith Bank retains position as Nigeria’s Tier-1 capital leader

News6 days ago

News6 days agoPhilip Shaibu officially joins APC, dumps PDP

Education7 days ago

Education7 days agoJAMB reacts to allege age limit by ministry of education

Comments and Issues5 days ago

Comments and Issues5 days agoOnanuga and the Surprise from Joe Igbokwe