The Chartered Institute of Bankers of Nigeria (CIBN) has urged the banking industry to display exemplary ethical conduct in the management of personal information.

CIBN made the call over concerns of data breach scandals which put millions of personal records in the hands of criminals.

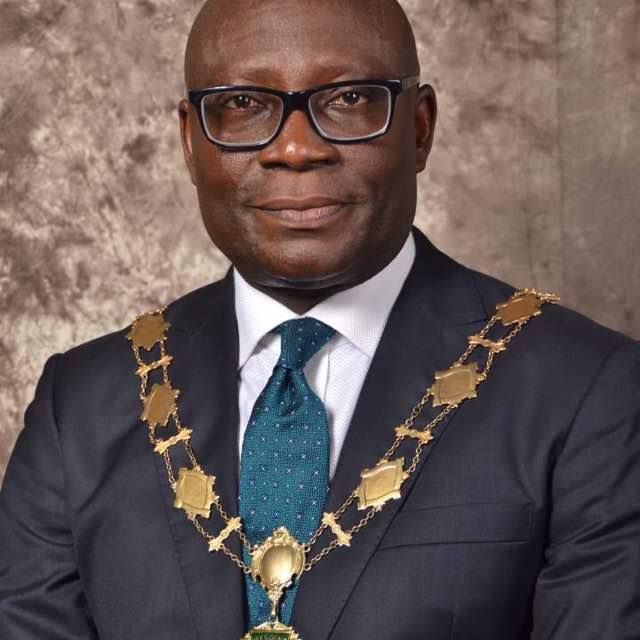

Dr Uche Olowu, president, CIBN, spoke during the breakfast session in Lagos, said, “Another issue of concern is that of consumer consent or rather ‘consent fatigue’ where organisations seeking legitimate use of data serve customers with several consent notifications or forms.

“Customers, without taking the time to fully understand these forms or notifications indicate agreement. It is my personal belief that we, the banking community must display exemplary ethical conduct in the management of personal information and act as shining beacons to other industries.

He said the centre, which was a wholly- owned subsidiary of the CIBN, was mandated to provide thought leadership and enlightenment on topical issues affecting the banking and finance industry, as well as the economy at large.

By organising the session, he said the institute aimed to bring to the consciousness of all stakeholders, the importance of data privacy and management via a robust panel discussion, providing measures/best practices to be taken in implementing such standards.

Olowu pointed that data management and protection issues should be of great concern to everyone

Breaches in data protection guidelines and laws had resulted in reputational damage and a higher risk of illicit activities, such as money laundering and identity fraud, he noted.

He said, “Additionally, McAfee, a global computer security software company, reports that 40 per cent of people worldwide feel they lack control over their personal data – and rightly so.

“On July 12, 2019, British Airways-Owner IAG is facing a record $230m fine for the theft of data from 500,000 customers from its website last year under tough new data-protection rules policed by the UK’s Information Commissioner’s Office.”

He said the banking and financial sector was not immune to these threats, particularly given the sensitivity of data the industry warehouses.

“For example, in 2014, JP Morgan Chase one of the largest banks in America in terms of assets reported a data breach which affected seven million small businesses and 76 million households,” he said.

Entertainment6 days ago

Entertainment6 days ago

Health1 week ago

Health1 week ago

Health4 days ago

Health4 days ago

Football1 week ago

Football1 week ago

Football1 week ago

Football1 week ago

Crime4 days ago

Crime4 days ago

Education6 days ago

Education6 days ago

Crime1 week ago

Crime1 week ago