Business

Economic recession: X-ray of Emefiele’s monetary policies

Published

8 years agoon

By

Olu Emmanuel

BY ODUNEWU SEGUN

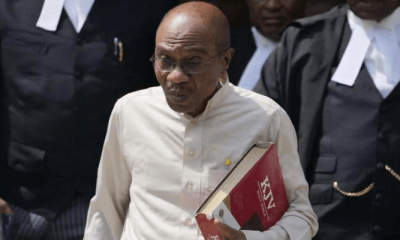

WITH Nigeria technically in recession, Nigeria’s chief banker, Godwin Emefiele appeared clueless as CBN’s series of disastrous monetary policies have weakened the economy, and the naira at its lowest in years.

His series of policy reversal has become one too many. More importantly was the negative outcome of fiscal policy measures the Monetary Policy Committee had taken in its past three consecutive meetings, leading to local and international investors expressing fears over the present administration’s lack of policy direction.

The Monetary Policy Rate (MPR), a tool for controlling and managing cost of funds was reviewed upward from 11 per cent to 12 per cent, while the Cash Reserve Rate (CRR), used to control money supply and ultimately inflation was pushed from 20 per cent to 22.5 per cent.

According to the Emefiele, reversal of earlier decisions was to starve off the negative effect of the spike in inflation rate, then to 11 per cent from 9.6 per cent. But now, inflation rate had since leaped to 17.1 per cent from the 7 per cent SanusiLamidoSanusi left it after reducing it from 15 per cent when he was appointed in 2007.

Altogether, the CBN boss seems overwhelmed. And he is struggling to impress, pulling strings at time Nigeria’s economic seems to be regressing at a very fast rate.

His failure to advise President Muhammadu Buhari on the dangers of pegging naira for months was responsible for the naira’s misfortune, and when he finally agreed to float the naira, paving the way for market forces to determine exchange rates, it was too late.

ALSO SEE: CBN threatens banks over Power Stabilization Fund

Between December 2014 and June 2016, the value of the naira has depreciated by nearly 40 per cent at the CBN window from N165 to a dollar which it was at the end of December 2014. Despite assurances by the CBN that floating the naira would curbed the free fall of naira to the dollar, the reverse has been the case.

Since the apex bank abandoned the controversial fixed rate in June 2016, the naira has also depreciated by almost 37 per cent, going for as low as N425 at the parallel market.

The head of research at Ashmore Group Plc, John Dehn, which managed over $60 billion of emerging markets assets confirmed this much when he stated that he was not convinced that President Buhari could hold the economy together as things seem to be drifting apart.

“So far the Buhari administration has done all the wrong things. Not only has he been incredibly slow in taking any action, when he finally does, the decision is diametrically opposed to sensible policy,” Dehn explained.

While Emefiele has consistently maintained that the apex bank is operating best policies needed to address the present economic crisis, critics argued that CBN’s fiscal regime inconsistencies has kept investors at bay.

This inconsistencies in policies has also heated the Nigerian Stock Exchange, which in a way is the barometer of the economy. Since August 30, 2015, the market capitalization and all share index have maintained a slide. For instance, while the market capitalization dropped by N1.8 trillion as it crashed from N11.2 trillion to N9.4 trillion, the all share index also dropped from 34,310.37 to 27,493.12 within the same period.

According to the President of Proactive Shareholders Association of Nigeria, Mr. Taiwo Oderinde, the lack of economic direction by the FG/CBN, which is seen in policy summersaults, is responsible for the sustained downturn witnessed in the bourse. He said that the indicators would crash further till the end of the year, adding that it they may go as low as 20,000 basis points (ASI) and N8 trillion, respectively.

“If there is a direction from the apex bank, the market and the economy would recover the loss recorded in the last year. The share prices can be better if things turn around economically and the regulator should ensure its policies are well thought out before making declarations in the public.”

In the opinion of Dr. KunleLawal, a financial expert, some of the actions of the government, especially CBN’s MPC decisions are not well thought through. “How can we diversify with increasing lending rate, unfriendly business environment and several cases of policy reversals? If these persist, the economy would deep further into depression,” he explained.

Two former governors of the CBN, Charles Solude and Emir of Kano, Sanusi Lamido Sanusi also agreed that Nigeria’s predicament was born out of endless policy summersaults. As usual, Godwin Emefiele, takes the brunt of their displeasure.

The Emir pointed out that many of the wrong economic decisions taken by those who believed that they had the acumen to perform wonders had abysmally ruined the economic potential of the nation at the expense of the national interest, regretting that there was a glaring systemic failure in the way economic policies were being implemented.

“What is happening at present is like giving a driving license to a driver that does not have the knowledge to drive a car. One should only expect to bear the unpleasant consequences. As a matter of fact, Nigeria as a promising developing economy is on the brink,” Sanusi said.

You may like

Interpol places 3 Nigerians on Red Alert for stealing $6.2m from CBN

Breaking: Banks to pay diaspora remittances in Naira

HURIWA demands DSS, EFCC to investigate CBN over Naira scarcity

CBN Investigator highlights Emefiele’s gross financial offences

Court grants Emefiele bail

Emefiele’s Naira redesign policy responsible for currency’s scarcity–Falana

Trending

Comments and Issues2 days ago

Comments and Issues2 days agoAs Ariwoola takes the judiciary to the top of the grease pole

Business6 days ago

Business6 days agoNMDPRA Chief faces backlash over comment on Dangote Refinery

Business1 week ago

Business1 week agoGlobal cyber outage disrupts flights, Banks, telecoms, Media

Business1 week ago

Business1 week agoKPMG criticizes FG’s 50% windfall tax, foresees legal disputes

Business5 days ago

Business5 days agoZenith Bank retains position as Nigeria’s Tier-1 capital leader

Comments and Issues5 days ago

Comments and Issues5 days agoOnanuga and the Surprise from Joe Igbokwe

Education7 days ago

Education7 days agoJAMB reacts to allege age limit by ministry of education

News6 days ago

News6 days agoPhilip Shaibu officially joins APC, dumps PDP