Nigeria’s Company Income Tax (CIT) collections surged by 73.14 per cent in 2023, amassing a total of N4.9 trillion.

This remarkable growth underscores the significant contribution of foreign firms to the Nigerian economy, with nearly half of this figure, precisely 49 per cent, being attributed to foreign CIT.

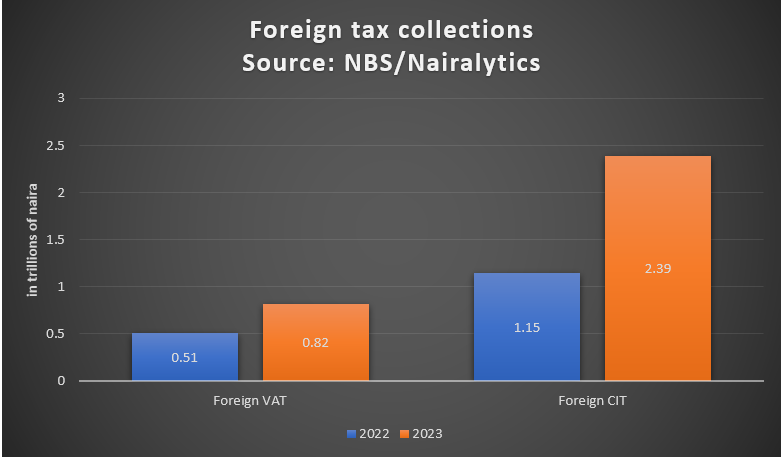

The latest data from the National Bureau of Statistics (NBS) for 2023 indicates that Nigeria’s revenue from foreign-related Value Added Tax (VAT) rose by 61 per cent, with figures reaching N824.6 billion, a significant increase from N510.8 billion in 2022.

There was also a surge in Corporate Income Tax (CIT) from foreign entities, which has seen a 107 per cent increase, climbing from N1.14 trillion in 2022 to N2.38 trillion in 2023.

Cumulatively, the total tax revenue from these streams rose by 93 per cent, from N1.66 trillion in 2022 to N3.21 trillion in 2023.

The current boost in tax earnings is significantly propelled by the naira’s weakness, which, while beneficial in the short term, may mask underlying vulnerabilities in the economic framework.

On the other hand, the Value Added Tax (VAT) collections painted a slightly different picture. While still noteworthy, the impact of foreign firms on VAT was less pronounced than in the CIT sector. Foreign entities contributed 23 per cent to the total VAT collections, which stood at N3.64 trillion for 2023.

READ ALSO: Breaking: CBN clears all FX backlog as external reserves rise to $34.11bn

In June 2023, the CBN announced the unification of all segments of the forex market, collapsing all windows into one.

AdvertisementThis was part of an effort to drive liquidity and stability in the forex market in Nigeria. However, this seems to have had a counter-effect, as it triggered further instability in the market.

The weakening naira has inflicted broad economic repercussions, including heightened import costs, surging inflation rates, diminishing purchasing power, and a deterrent effect on investment inflows.

Goldman Sachs analysts recently projected a significant appreciation of the exchange rate to N1,200/$ in 12 months. This amounts to a massive recovery from its perceived undervalued state.

The Economist Intelligence Unit (EIU), however, said that the CBN faces a significant liquidity crisis in supporting the naira, as nearly $20 billion of its $33 billion in foreign reserves is tied up in various derivative deals.

Regardless, the central bank has been actively addressing the forex issue in the country with some reforms, such as clearing the backlog of forex obligations which the CBN noted would be fully cleared in a few days.

Comments and Issues2 days ago

Comments and Issues2 days ago

Business6 days ago

Business6 days ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business5 days ago

Business5 days ago

Education7 days ago

Education7 days ago

News6 days ago

News6 days ago

Comments and Issues5 days ago

Comments and Issues5 days ago