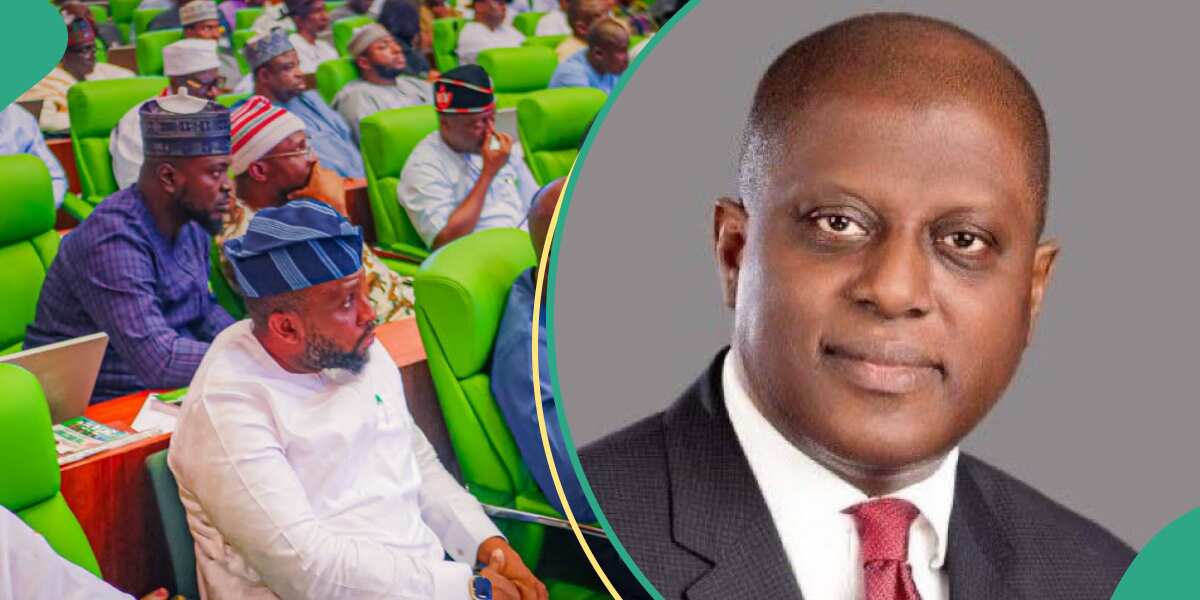

The House of Representatives on Wednesday claimed that four banks are holding approximately $5 billion in surplus foreign exchange, signaling concerns about the volatility in Nigeria’s foreign exchange market.

Responding to this, the House directed the joint Committees on Banking Regulations and Banking Institutions to undertake an investigative hearing into the failure of banks and financial institutions to adhere to Central Bank of Nigeria (CBN) directives regarding Net Open Position Limits.

This decision was reached following the adoption of a motion addressing an urgent national concern regarding the imperative for banks to adhere to the CBN’s guidelines on excess long foreign exchange holdings and net open position limits.

The motion, sponsored by Hon. Babajimi Benson, Chairman of the House Committee on Defence, underscored the importance of enforcing CBN policies to maintain financial stability.

During the debate, Hon. Benson emphasized the CBN’s role in regulating the country’s monetary policies as mandated by the CBN Act. He expressed dismay at the blatant disregard for existing financial regulations, urging swift action to address the issue and ensure compliance with regulatory frameworks.

He said: “Records show that GTB, Zenith Bank, UBA, and First Bank have a cumulative excess holding of over $5 billion as of January 2024. The only fully compliant bank is Stanbic IBTC, which has made all FX in its reserve available to its clients.

“It is important to note that these banks often obtain foreign exchange either through purchase, borrowing, or allocation from the CBN at the official rate of N461.5 to a dollar for their various customers but hoard them as part of their bank balances or reserves. They eventually sell at higher rates to make extra profit.

READ ALSO: CBN orders banks to sell all excess dollars in their domains today

“It is this speculative practice that has prompted the CBN to issue a fresh directive centred around the Net Open Position (NOP) for all commercial banks. Simply put, the NOP measures the difference between a bank’s foreign currency assets (what it owns) and foreign currency liabilities (what it owes). Investigations have shown that banks hold far more forex than they require, thereby creating artificial scarcity and an increase in the exchange rate.

“The new CBN directive will help limit how much foreign exchange banks can hold and for how long. The aim is to discourage hoarding of forex, thereby making it available for intended users at reasonable rates.”

Hon. Benson highlighted provisions within Section 8 (4) and (5) of the CBN Act, which mandate the CBN Governor to provide updates to relevant Committees of the National Assembly during semi-annual hearings, along with periodic reports on the economy’s performance.

Expressing disappointment over the lack of adherence to existing legislation, Hon. Benson pointed out there has been a steady increase in the dollar’s value compared to the naira. He further lamented that the House is concerned about the significant surge, attributed to various market forces and government economic policies, including the liberalization of the dollar.

Moreover, Hon. Benson raised concerns regarding the tendency of commercial banks and certain financial institutions in Nigeria to withhold a substantial portion of acquired forex, obtained through purchasing, borrowing, or CBN allocation, rather than lending it to customers.

The Net Open Position (NOP) represents the net balance of all assets, liabilities, and off-balance sheet items in a particular currency.

In a circular dated January 31, 2024, referenced ED/FEM/PUB/FPC/001/001 and jointly signed by Hassan Mahmud, Director of Trade and Exchange, and Rita Sike, acting on behalf of the Director of Banking Supervision, the CBN instructed all banks to adhere to NOP limits.

These limits, according to the circular, stipulate that NOP should not exceed 20% short or 0% long of shareholders’ funds unimpaired by losses, using the Gross Aggregate Method.

Banks with current NOP levels exceeding these limits were instructed to bring them within prudential limits by February 1, 2024.

Comments and Issues1 week ago

Comments and Issues1 week ago

Education1 week ago

Education1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Energy1 week ago

Energy1 week ago

Comments and Issues7 days ago

Comments and Issues7 days ago

Comments and Issues7 days ago

Comments and Issues7 days ago

Football1 week ago

Football1 week ago

Health6 days ago

Health6 days ago