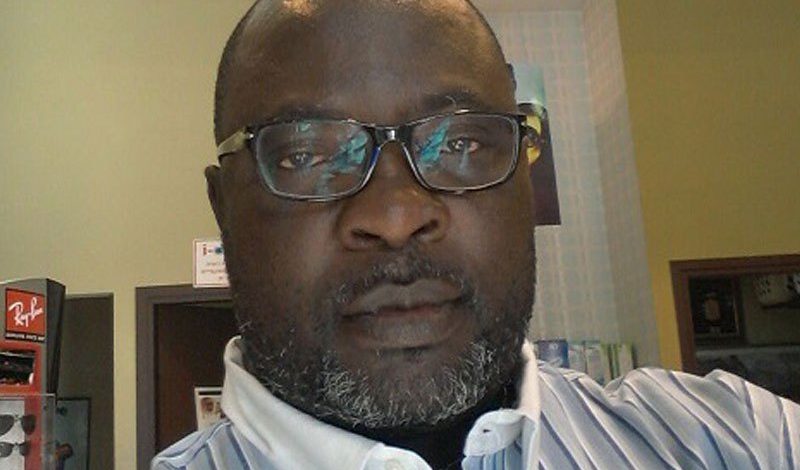

The former MD/CEO of Comet Merchant Bank, Chief Ted Inegbedion has urged the federal Government to grant amnesty to looters to fast track the process of funds recovery.

The retired banker in an interview said amnesty for alleged looters of the nation’s funds would yield better results when adopted as the current strategy is too cumbersome and a waste of scarce resources due to endless and endless court processes.

“Many of those who allegedly looted the country’s treasury have more than enough resources to fight on which brings unnecessary delays in the litigation process. When amnesty is granted they will be willing to return a part of such stolen funds back to the country rather than stashing it abroad .This will in turn boost the economy.

The retired chattered accountant who decried the poor impacts of community banks now known as microfinance banks said they have not served the purpose for which they were created advocating a new structure of financing to increase funding of the banks to enhance their capacities to support small, micro and medium enterprises

“I believe they have not their purpose very well .The environment has not been very ripe. They couldn’t compete with the big banks to raise deposits so when they raised deposits, their own interests’ rate is higher and so couldn’t survive.

“Particularly at this time of COVID-19, we need to think differently how we deal with community banks [microfinance bank] to bring then to the service of the people to stimulate the economy from the base .So I want to suggest to the federal government of Nigeria particularly the Central Bank of Nigeria, from the NDIC records they should be able to know the banks that are viable maybe 500 or whatever figure they can come up with.

Chief Inegbedion disclosed that with the new structure of financing micro finance banks, the benefits to the economy are countless.

“The benefits are plenty, look at this, all of a sudden the microfinance bank is no more begging for deposits competing with the big banks, even the big banks will come down on their own rates seeing that the smaller banks can lend at lower rates as against their own rates.”

He maintained that there is urgent need to encourage private investment in mass transportation to develop the sector and make it more competitive and comparable with what obtains in other climes in the world.

Comments and Issues2 days ago

Comments and Issues2 days ago

Business6 days ago

Business6 days ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business5 days ago

Business5 days ago

News6 days ago

News6 days ago

Education7 days ago

Education7 days ago

Comments and Issues5 days ago

Comments and Issues5 days ago