The Central Bank of Nigeria (CBN) says the country’s external reserves no longer come from selling crude oil.

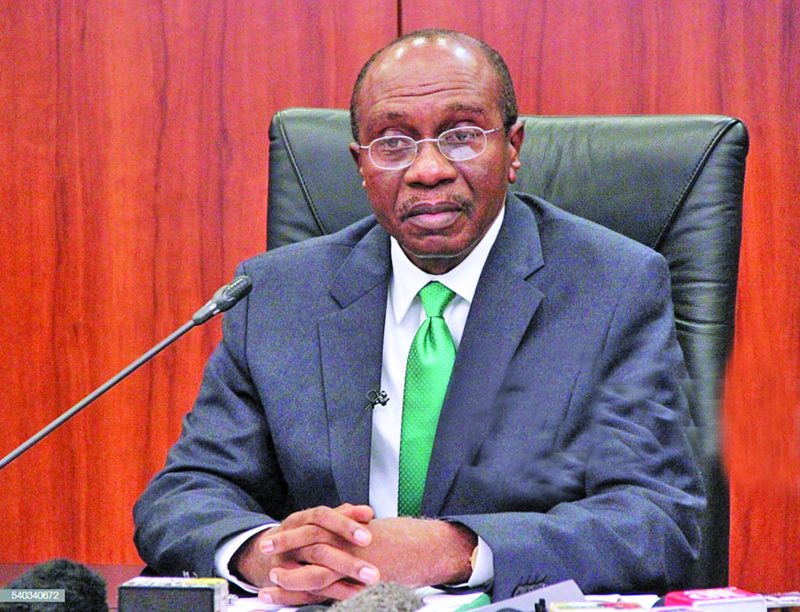

Godwin Emefiele disclosed this at the 57th annual bankers’ lecture organised by the Chartered Institute of bankers of Nigeria (CIBN) in Lagos on Saturday.

Emefiele said due to the struggle in naira as well as the increase in the demand for forex, there has been a huge decline in foreign reserves.

He said Nigeria’s foreign reserves receipts declined from US$3.0 billion monthly to zero in 2022.

The CBN governor, however, expressed optimism that the short-term outlook of the Nigerian economy remained sound, adding that diversity was important.

“The official foreign exchange receipt from crude oil sales into our official reserves has dried up steadily from above $3.0 billion monthly in 2014 to an absolute zero dollars today,” he said.

Emefiele also said increasing non-oil proceeds led to Nigeria’s inflow of foreign currency.

READ ALSO: CBN Governor blames Nigerian students seeking foreign education for the perpetual fall of Naira

“The bulk of the money in Nigeria’s foreign reserves comes from the export of gas and oil to other nations. But increasing instances of crude oil theft have hurt Nigeria’s ability to export enough crude oil. Consequently, its foreign exchange reserves are falling,” he added.

“Nigeria’s external reserves fell to $37.17 billion as of November 15, 2022, data from the CBN confirms. This is the lowest level of the external reserves this year and the lowest level since September 30, 2021, when the country faced a barrage of currency depreciation.”

Speaking further on the naira redesign policy, Emefiele said the apex bank’s move to redesign the three different denominations of Nigerian banknotes had a good reason.

He also said inflation rate will remain elevated and above the 12.5 percent growth-aiding threshold.

“We will maintain the current tight monetary policy stance in the near term, especially in view of rising inflation expectations and exchange market pressures,” he added.

Meanwhile, Emefiele lauded the impact of the RT200 programme, adding that it has helped the bank to meet official demands for dollars.

“The number of student visas issued to Nigerians by the United Kingdom alone has increased from an annual average of about 8,000 visas as of 2020 to nearly 66,000 in 2022, which implies an eight-fold surge to about $2.5 billion annually in study-related foreign exchange outflow to the UK alone,” he added.

“It is against the backdrop of the worsening mismatch between foreign exchange market demand and supply, and the need to boost foreign exchange earnings that the CBN and the Bankers’ Committee initiated the RT200 programme in February 2022.

“So far, we have recorded and continue to record resounding success with the RT200 programme.

“Inflows through the programme in 2022 rose to about $1.6 billion and it could surpass $2.5 billion by year-end.”

Football1 week ago

Football1 week ago

Health & Fitness1 day ago

Health & Fitness1 day ago

Featured5 days ago

Featured5 days ago

Education6 days ago

Education6 days ago

Comments and Issues7 days ago

Comments and Issues7 days ago

Business6 days ago

Business6 days ago

Business5 days ago

Business5 days ago

Crime6 days ago

Crime6 days ago