Business

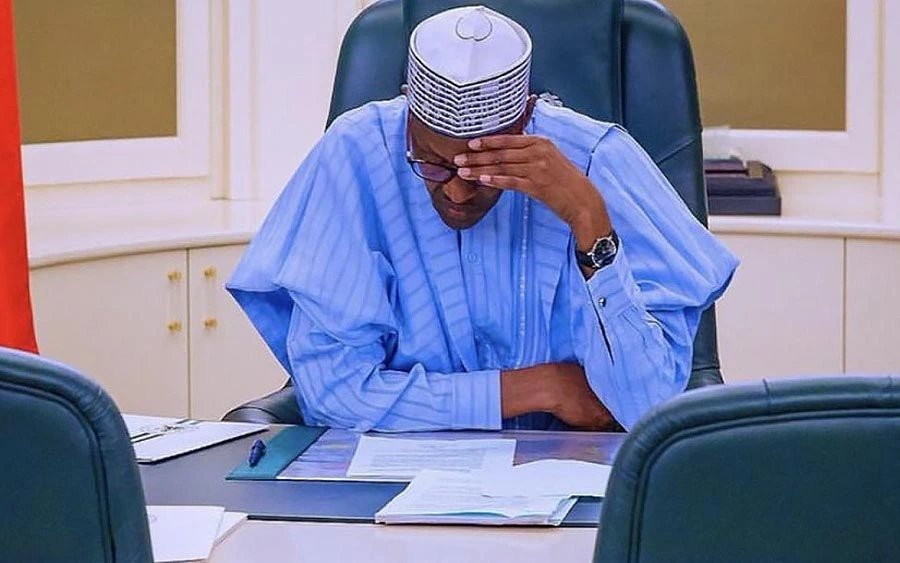

Nigeria rising inflation: The only buzzword in town, for Buhari’s near 8-year tenure

Published

2 years agoon

By

Publisher

By Eben Enasco

Reports say, Nigeria is ranked as the 27th-largest economy in the world in terms of nominal GDP, and the 24th-largest in terms of purchasing power parity but is deeply immersed in an inflation crisis.

With the high cost of commodities double jacking per second at every all-important next visit to the market, life has become difficult to cope with.

Nigeria according to bookmakers supposedly has the largest economy in Africa.

But the Country’s economic potential is constrained by many structural issues, including inadequate infrastructure, tariff and non-tariff barriers to trade, obstacles to investment, lack of confidence in currency valuation, and limited foreign exchange capacity.

Unemployment, corruption, non-diversification of the economy, income inequality, laziness, and a poor education system can be considered to be some of the key factors contributing to poverty.

For nearly eight years of President Muhammadu Buhari’s regime, no policy has been good enough to upturn the lingering economic situation in the country.

Nigeria has never been so deep in the inflation crisis except in the first coming of the man in Aso rock in 1987 when he first ruled as a military dictator.

A spate of inflation data if not checked might set the tone for Nigerians, ahead of the 2023 general election considering the level of borrowing embarked upon by the ruling party and government.

On a year-to-date basis, Nigeria’s inflation rate has increased by over 400 basis points from 15.63% recorded in December 2021 to 19.64% in the review month.

This suggests that the consumer price index has increased by 12.7% between January and July 2022.

Although Nigerians have had to deal with the rising cost of goods and services following the Russia-Ukraine war, which is seen as causing a significant rise in energy prices, spiraling into a global energy crisis and food supply issue, the government has not done enough to encourage local production

Nigeria, being one of the countries with a significant uptick in its cost of living as a result of high inflationary pressure, in basic terms, keeping income at a fixed level, means Nigerians will not able to purchase as much as they would have loved to with their monies.

It comes as no surprise, though, given the near-unprecedented inability of the government to proffer solutions.

The only thing the President Buhari administration has freely offered citizens is the murderous activities of Fulanis headers, multiple ripoffs of the economy yet fighting corruption, violation of human rights, and killings of Military personnel with media organizations gagged to report less of the real situation.

While this may seem true, an insight into the different dimensions of inflation will reveal why Nigeria’s inflation is particularly difficult to tackle and why the CBN’s policies have proven to be unsuccessful, at least in the short run.

As we all know, inflation, by definition, is a general increase in the prices of goods and services in an economy.

What most people do not know, however, is that there are two types and causes of inflation: demand-

pull inflation and cost-push inflation.

Demand-pull or demand-side inflation is what readily comes to mind when people think of inflation.

It is a phenomenon that occurs when an increase in demand encourages producers and sellers to raise their prices to maximize their profits.

It is measured using the consumer price index CPI. The 15.60% and 19.64% inflation rates stated earlier in this write-up are derived from the CPI.

The second major type of inflation is cost-push or supply-side inflation.

It occurs due to an increase in the cost of raw materials and the overall cost of production, which ultimately forces producers to pass the extra cost to their customers to remain profitable.

The rising cost of production can also force producers to reduce their output, thereby making their products rarer and, therefore, pricier.

The producer price index, PPI, can be used to measure inflation from the perspective of the producers.

Now that we are more familiar with inflation, it will become easier to understand why the CBN has not been so effective in controlling it in Nigeria.

Addressing demand-pull inflation requires contractionary monetary and fiscal policies by the government. It can raise the policy interest rate known as the Monetary Policy Rate or MPR in Nigeria, thereby making it costlier to borrow as banks will also raise their respective lending rates and more profitable to save as bank deposits will yield more interest.

In theory, a hike in the MPR reduces the volume of money in circulation and curbs demand, because people would rather save than spend or borrow, since saving now yields more returns.

The CBN can also tackle demand-pull inflation using open market operations, such as selling treasury bills and bonds, to “mop up” excess liquidity from the economy. If people buy more treasury bills and bonds, they will have less money to spend until the maturity periods of the financial instruments.

Fiscal policies like raising taxes or reducing government expenditure theoretically achieve the same inflation-curbing effects.

It, therefore, means that they will reduce the disposable income of consumers, the spending power of businesses, and, eventually, the demand for goods and services.

Local production, on the other hand, is hamstrung by several deep-seated factors, ranging from insecurity and poor power supply to weak transportation infrastructure and multiple taxations, all of which have conspired to make locally made products almost as costly as their imported counterparts.

Besides, In the first quarter of 2022, Nigeria’s public debt rose to N41. 6 trillion from N39. 56 trillion recorded at the end of December 2021, putting enormous pressure on debt servicing on July 22, 2022

The statistics reflecting the country’s debt were published by

Debt Management Office, DMO sometime in July.

As a sign of deficit, the Nigeria government only generates N1.6 trillion and spends N4.7 trillion

with the government likely borrowing N3.09 trillion in four months to finance its budget deficit.

Nominal GDP is an assessment of economic production in an economy that includes current prices in its calculation.

In other words, it doesn’t strip out inflation or the pace of rising prices, which can inflate the growth figure.

The Federal Government recently projected that Nigeria’s real GDP growth will rise to 3.75% in 2023, from a revised projection of 3.55% for 2022, adding that the growth rate will slow to 3.30% by 2024.22 Jul 2022.

While nominal GDP by definition reflects inflation, real GDP uses a GDP deflator to adjust for inflation, thus reflecting only changes in real output.

Since inflation is generally a positive number, a country’s nominal GDP is generally higher than its real GDP.

The oil sector provides for 5% of Nigeria’s foreign exchange earnings and 80% of its budgetary revenues.

Nigeria has an abundance of resources including oil and gas.

The fact Angola tends to overtake Nigeria, the Country holds the largest natural gas reserves on the continent and is Africa’s largest oil and gas producer

Yet, the administration of President Muhammadu Buhari is lethargic and has failed to end all negative influences dragging the nation’s Economy to disrepute.

Nigerians may have to wait for another five to six months for a new government, but not certainly from the current arrays of disappointment despite what seems to be a betrayal of the trust repose in them in 2015.

You may like

Customs fixes N1.130trn revenue target for Tincan port command

Nigeria’s economy still dwindling, says Soludo

Fitch expresses worries over Nigeria’s economy

Nigeria’s economy suffers worse ratings under Buhari

High lending rate, poor infrastructures is bane of Nigeria’s economy — Expert

Devaluation not favourable to Nigeria’s economy — Buhari

Trending

Health & Fitness2 days ago

Health & Fitness2 days agoMalaria Vaccines in Africa: Pastor Chris Oyakhilome and the BBC Attack

Comments and Issues1 week ago

Comments and Issues1 week agoNigeria’s Dropping Oil Production and the Return of Subsidy

Featured6 days ago

Featured6 days agoPolice reportedly detain Yahaya Bello’s ADC, other security details

Education1 week ago

Education1 week agoEducation Commissioner monitors ongoing 2024 JAMB UTME in Oyo

Business1 week ago

Business1 week agoMaida, university dons hail Ibietan’s book on cyber politics

Aviation4 days ago

Aviation4 days agoWhy some airlines are avoiding Nigeria’s airspace–NAMA

Business6 days ago

Business6 days agoDebt servicing gulps 56% of Nigeria’s tax revenue, says IMF

Crime1 week ago

Crime1 week agoPolice take over APC secretariat in Benue