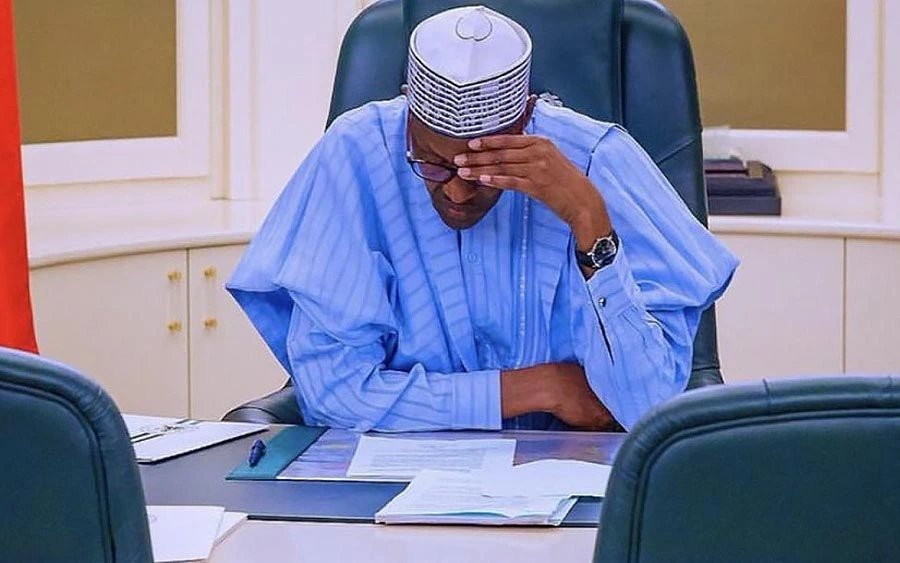

Rating agency Fitch in its just released ratings report has expressed worries about Nigeria’s economy. The agency rated the country Long Term Foreign Currency Issuer Default Rating B+ with a Negative Outlook.

While Fitch acknowledged the strengths of the Nigerian economy including its large and diversified economy and low external debt, the agency listed its concerns about the Nigerian economy.

They include a low per capita GDP, an exceptionally narrow fiscal revenue base and a weak business environment. Fitch also highlighted a possible reversal in foreign exchange liquidity and categorized the current economic recovery as weak.

Central Bank of Nigeria (CBN) Governor, Godwin Emefiele had at the last Monetary Policy Committee (MPC) meeting held in July last month expressed concerns regarding the economic recovery.

According to him, the recent economic recovery could relapse to a prolonged recession if the necessary monetary and fiscal policies were not activated to sustain it.

The CBN on the back of a sharp drop in foreign exchange earnings by the government last year, banned several items from the official foreign exchange market and reduced the amount of FX individuals and businesses could purchase. Nigeria is dependent on crude oil income for over 70% of its foreign exchange earnings and revenue for the government.

ALSO SEE: BPE lauds SAHCOL initiatives

National Daily gathered from the rating that future fund raised by the government could go at a higher interest rate, as foreign investors will put these factors in consideration when pricing Nigeria’s debt.

Minister of Finance, Kemi Adeosun recently signaled government’s intention to replace domestic debt with cheaper foreign denominated debt. Government had earlier embarked on a Eurobond raise this year, and was reportedly considering another one before year end.

Data from the recently released Q2 2017 Capital Importation Report by the National Bureau of Statistics (NBS) shows that foreign investors spent $770.5 million on portfolio investments between April-June 2017.

A massive 145% increase from the $313.61 million spent in the first quarter of 2017. The equity market received the lion share of the funds with investments by foreign investors moving from $101.99 million in Q1 2017 to $614.05 million in Q2 2017. The increase was also present year on year, with equity investment increasing from $279.81 million in Q2 2016 to $614.05 million in Q2 2017.

Football5 days ago

Football5 days ago

Aviation1 week ago

Aviation1 week ago

Aviation7 days ago

Aviation7 days ago

Featured3 days ago

Featured3 days ago

Comments and Issues5 days ago

Comments and Issues5 days ago

Education4 days ago

Education4 days ago

Business4 days ago

Business4 days ago

Education6 days ago

Education6 days ago