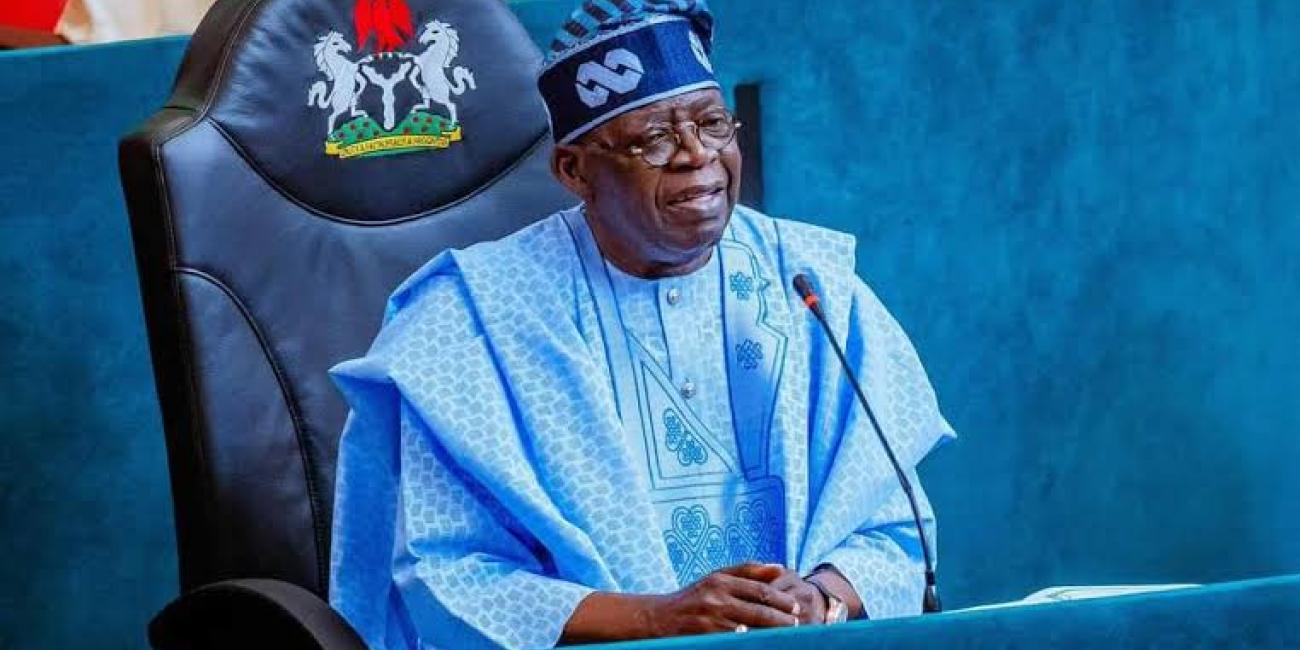

The presidency has formally addressed the concerns raised by the governors of the 19 Northern states regarding the tax reform bill currently under consideration in the National Assembly.

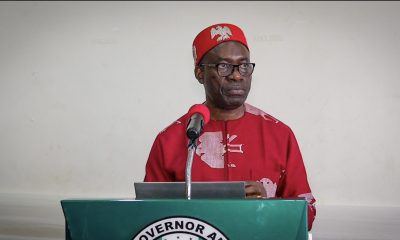

In a press release issued on Thursday, presidential spokesman Bayo Onanuga emphasized that the proposed legislation is designed to create a more equitable tax system that benefits all states across Nigeria.

Onanuga outlined the primary objectives of the tax reform bill, stating, “President Tinubu and the Federal Executive Council have endorsed policy initiatives aimed at streamlining Nigeria’s tax administration processes, enhancing efficiency, and eliminating redundancies.” He highlighted three key components of the proposed reforms:

Simplification of Tax Obligations: The bill seeks to make tax compliance easier for citizens and businesses nationwide.

Enhanced Efficiency: The reforms aim to improve the operational efficiency of tax collection and administration.

Correction of Inequities in VAT Distribution: The legislation is designed to address imbalances in the distribution of Value Added Tax (VAT) revenues among the states.

READ ALSO: Presidency confirms Tinubu’s readiness to reshuffle cabinet

Onanuga assured stakeholders that these reforms were the result of an extensive review of existing tax laws and are crucial for enhancing the quality of life for Nigerians. He emphasized, “These reforms were not proposed to undermine any part of the country, and tax rates remain unchanged, focusing on equitable distribution.”

The National Assembly is currently considering four key executive bills that could significantly transform Nigeria’s tax landscape:

Nigeria Tax Bill: Aims to eliminate multiple taxation issues faced by taxpayers.

Nigeria Tax Administration Bill (NTAB): Seeks to harmonize tax processes across various levels of government.

Nigeria Revenue Service (Establishment) Bill: Proposes to rename the Federal Inland Revenue Service (FIRS) to better reflect its role.

Joint Revenue Board Establishment Bill: Aims to create a Joint Revenue Board to enhance collaborative tax efforts among states.

The Northern Governors Forum had previously expressed opposition to the derivation-based VAT model, raising concerns about potential job losses as a consequence of the proposed changes.

In response, Onanuga clarified, “While we commend the governors and traditional rulers for their support of President Tinubu’s security successes, we want to address the misunderstandings surrounding the tax reform.”

President Bola Tinubu reassured citizens and stakeholders, stating, “For those concerned about the tax reform, rest assured it’s designed for fairness and growth.” Onanuga concluded by reiterating the presidency’s commitment to transparent governance, emphasizing the importance of these reforms in ensuring Nigeria’s progress.

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Health6 days ago

Health6 days ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Education1 week ago

Education1 week ago

Football6 days ago

Football6 days ago

Aviation7 days ago

Aviation7 days ago