By Odunewu Segun

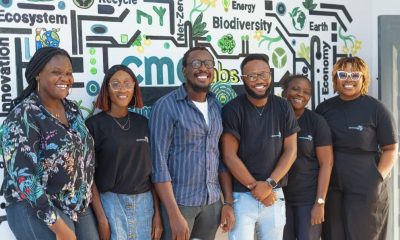

Sterling Bank, in partnership with Leap Africa, a non-governmental organization is set to bring awareness to the plight of young entrepreneurs in the country, and also empower them through capacity building at the 11th edition of CEOs Forum.

Speaking at media briefing in Lagos on Tuesday, Executive Director, Finance and Strategy, Sterling Bank, Abubakar Suleiman, reiterated the importance of SMEs to the development of Nigeria’s economy, adding that sterling was commitment to driving this growth through capacity building.

“What we have been doing is focusing on training entrepreneurs to understand the value of documenting what they do. For me, taking this approach of bringing different funding options to the table and hopefully by the end of this event they would be able to see the step by step process to which they approach.”

ALSO SEE: Sterling Bank sets to enhance services with new IT upgrade

He said one of the reasons why most entrepreneurs are not able to get funding to grow their businesses was because of inadequate documentation. Suleiman however, commended Leap Africa for taking the initiative of enlightening entrepreneurs on how to attract funds and investors.

Also speaking on the importance of SMEs, Executive Director, Leap Africa, Mrs. Iyadunni Olubode, commended Sterling bank for partnering with Leap, Africa. “We have realized that a lot of entrepreneurs that we interact with are looking for opportunities to grow and expand their business.”

She said in other to achieve this, Leap Africa is bringing together a team of experts and entrepreneurs who have been able to expand their businesses to come and share the wealth of their knowledge with the audience.

Speaking further, Olubode said the Forum is expected to present a whole range of financing options from angel investors, “We have speakers who are experts in their respective fields that would talk on venture capital and private equity and challenge funds,” she added.

Business6 days ago

Business6 days ago

Business6 days ago

Business6 days ago

Education6 days ago

Education6 days ago

Crime6 days ago

Crime6 days ago

Business1 week ago

Business1 week ago

Covid-196 days ago

Covid-196 days ago

Business6 days ago

Business6 days ago

Latest4 days ago

Latest4 days ago