Fuel subsidy removal will go down as one of the biggest issues in the Nigerian economy in 2023, triggering a nearly 200 per cent surge in the price of fuel across the country.

The price change led to a revision of the pricing structure across goods and services, with transportation costs rising as much as 200 – 300 per cent higher.

Also, the issue of cash scarcity will remain indelible in the minds of Nigerians in 2023.

A spill-over from 2022, Nigerians will not in a hurry forget the harrowing experience of the cash scarcity brought about by the naira redesign policy of the then Godwin Emefiele-led Central Bank of Nigeria (CBN).

POS merchants—who would usually provide cash for a small fee—marked up their prices, with some collecting as much as 10 – 15 percent of withdrawn funds as a fee.

This continued until sometime in March 2023, after the Supreme Court had earlier that month ruled that old banknotes remain legal tender until the end of the year.

On November 29, the Court ordered that the old N200, N500, N1000 notes should continue to co-exist with the new notes till further notice.

READ ALSO: Cash scarcity bites harder in Lagos, Ogun, other major cities

The harmonization of the Foreign Exchange window will also go down in history as one of the water-shed moments in the Nigerian economy in 2023.

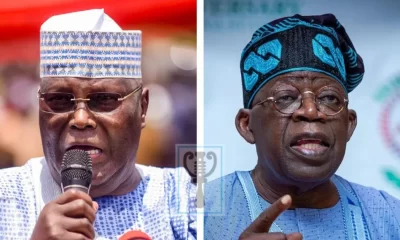

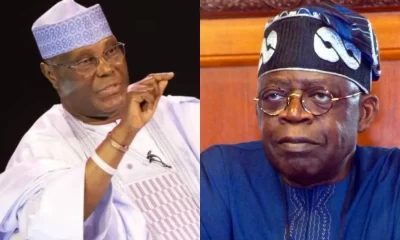

On June 14, 2023, a few weeks after President Bola Ahmed Tinubu assumed office, Nigeria’s apex bank began making a series of decisions to tighten the grip on the country’s forex.

The first of these decisions was to stop defending the Naira at the foreign exchange market, meaning that the currency’s value would no longer be fixed but would instead “float” and be determined according to market forces.

Months later, this remains unachieved. The price of foreign exchange on the official market still varies—at times greatly—from that of parallel markets. This decision also exacerbated the already skyrocketing inflation rate.

Nigeria also grappled with rising inflation. The Consumer Price Index (CPI), which measures the rate of change in prices of goods and services, rose to 27.33 per cent in October 2023 — up from 26.72 per cent in the previous month.

To date, that represents the worst year-on-year increase.

READ ALSO: Is fuel subsidy in Nigeria gone or not?

Also, in 2023 alone, no fewer than seven indigenous and multinationals packed up in Nigeria over unfavourable economic situations, throwing thousands into the unemployment market. Coys like P&G, GSK, Sanofi-Aventis Nigeria Ltd, Equinor, Jumia Foods, Bolt Food, NABISCO Biscuit amongst others exited the country.

The exit of pharmaceutical companies like Glaxo SmithKline also led to a further skyrocketing of the cost of essential medicines used by everyday Nigerians. In some cases, prices rose by as much as 700 per cent, currently, Nigeria is rated by the World Health Organisation, WHO, as one of the eight countries in the world with exceptionally exorbitant drug prices.

The ouster of Godwin Emefiele as Governor of the Central Bank of Nigeria (CBN) and the delisting of Union Bank from NGX after 52 years on the Stock Exchange which chalked chalked off a whopping N132bn from the market capitalization also affected the business community in 2023.

Finally, after $1.5 billion cost and three years of repairs, the 210,000 barrels per day (bpd) Port Harcourt Refinery became operational and is expected to boost the county’s local refining capacity to dissuade importation and conserve FOREX deployed to importation of refined crude.

Health & Fitness3 days ago

Health & Fitness3 days ago

Featured7 days ago

Featured7 days ago

Education1 week ago

Education1 week ago

Aviation5 days ago

Aviation5 days ago

Business1 week ago

Business1 week ago

Business7 days ago

Business7 days ago

Crime1 week ago

Crime1 week ago

Aviation4 days ago

Aviation4 days ago