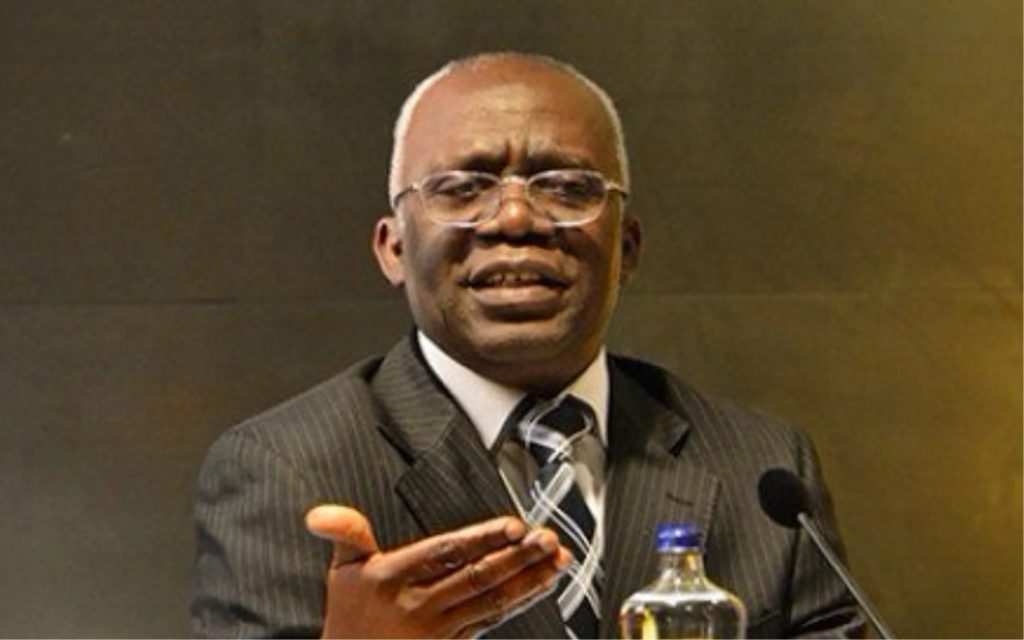

Human Rights Lawyer, Femi Falana, has kicked against any increase in Value Added Tax (VAT) until the National Assembly carry out an amendment into the VAT law.

According to him, the amendment would be by way of an executive money bill from President Muhammadu Buhari.

Falana, who stated this in Abuja on Saturday while speaking with journalists, also called on the Federal Government to propose a Money Bill to the National Assembly before the implementation of the increase in Value Added Tax.

According to him, the National Assembly erred by inviting the Minister of Finance and the Executive Chairman of Federal Inland Revenue Service to clarify issues of VAT increment, noting that provisions of the constitution states that the President ought to have presented a Money Bill to be passed by the NASS before the increment.

“It’s illegal. Under a democratic dispensation, you cannot impose tax or increase tax without a law made by the National Assembly or the State Assembly as the case may be.

“In this case, it has to be realised that we are not under a military dictatorship.

“By virtue of section 59 of the Nigerian Constitution, any increase, levy or tax will have to be presented to the National Assembly by way of Money Bill by the President, it has to be passed into law.

“The Senate erred in law by inviting them to come and clarify. The National Assembly has invited the Minister of Finance and the Federal Inland Revenue Services to come and clarify.

“No, the National Assembly must insist on its powers under Section 59 to pass a law to increase VAT or any tax, there can be no taxation without legislation.

“The Federal Executive Council has no power under the Constitution to increase VAT or any tax in the country,” Falana said.

It would be recalled that the Minister of Finance, Budget and National Planning, Zainab Ahmed had announced the planned increase after the Federal Executive Council approved the increase from 5 percent to 7.5 percent.

The minister however explained that the increase would only begin after the VAT Act was amended by the National Assembly and after consultations with the state and local government areas as well as the Nigerian populace.

Entertainment6 days ago

Entertainment6 days ago

Health1 week ago

Health1 week ago

Health4 days ago

Health4 days ago

Football1 week ago

Football1 week ago

Football1 week ago

Football1 week ago

Crime5 days ago

Crime5 days ago

Education6 days ago

Education6 days ago

Crime1 week ago

Crime1 week ago