A financial expert, Bode Agustor has warned that Nigeria’s local currency, the Naira would continue to suffer in the parallel market if additional liquidity is not brought into the market through the Bureau De Change operators.

Agusto who gave the warning during webinar at the weekend, projected that if the Central Bank of Nigeria maintains its current stands not to sell dollars directly to the Bureau De Change (BDC) operators, the Naira to exchange rate would depreciate to N620/$1 in the parallel market before the end of 2022.

Recall that at the Monetary Policy Committee (MPC) meeting on Tuesday, July 27, 2021, the Central Bank of Nigeria hit at the Bureau De Change (BDC) for illegal forex trading and stated that it will henceforth discontinue the sale of forex to the Bureau operators in Nigeria.

READ ALSO: Naira falls to record low at peer-to-peer parallel market

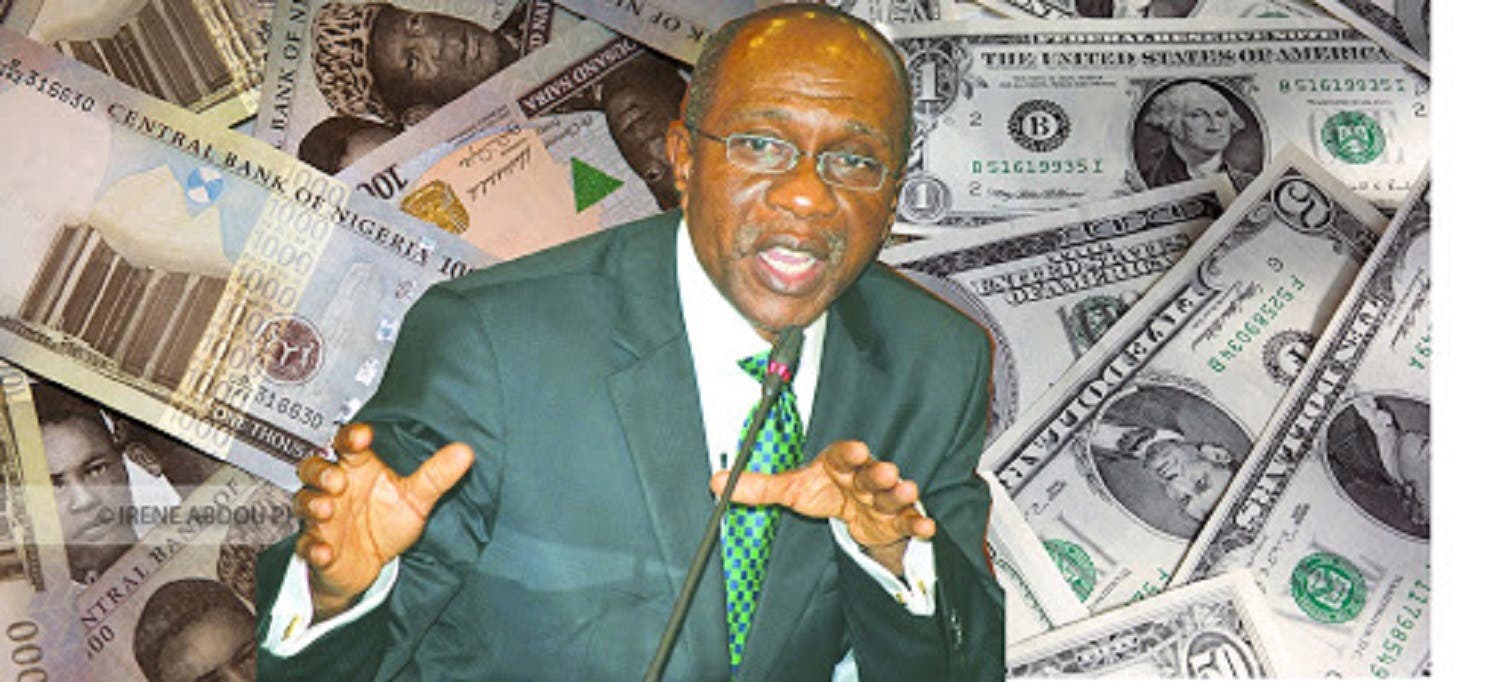

The CBN Governor, Godwin Emefiele, also announced a halt on the licensing of new Bureau De Change (BDC) operators and further processing of BDC applications for forex across the country.

The CBN had directed Deposit Money Banks (DMBs) to set up teller points in designated branches for the sale of foreign exchange to meet legitimate forex requests of their customers.

“We see continued pressure on the parallel market exchange rates. And the only way to reduce pressure in the parallel market is to throw money thereby selling dollars to the BDCs. If there is no additional funding to the BDCs from the CBN then the parallel market rate will be between N610 and N620 in 2022. It will be fueled by scarcity and the difference between inflation rates of the dollar and the Naira.”

READ ALSO: Naira strengthens against Dollar at black market

He also predicted that the much-anticipated rate convergence in the foreign exchange market would take longer than expected since the central bank would be hell-bent on pegging the official rate.

He stated that a convergence would make Nigeria have a single exchange rate, where the parallel market premium is less than 3.0% of the official rate.

In complying with the CBN’s directive, deposit money banks in the country swiftly moved to set up teller points within their banking halls to attend to the forex needs of customers.

The Central Bank of Nigeria has stated that travelers who purchase foreign money from banks for travel purposes but do not depart two weeks after their scheduled departure date must return the currency to the banks.

Entertainment6 days ago

Entertainment6 days ago

Health1 week ago

Health1 week ago

Health4 days ago

Health4 days ago

Football1 week ago

Football1 week ago

Football1 week ago

Football1 week ago

Crime5 days ago

Crime5 days ago

Education6 days ago

Education6 days ago

Health6 days ago

Health6 days ago