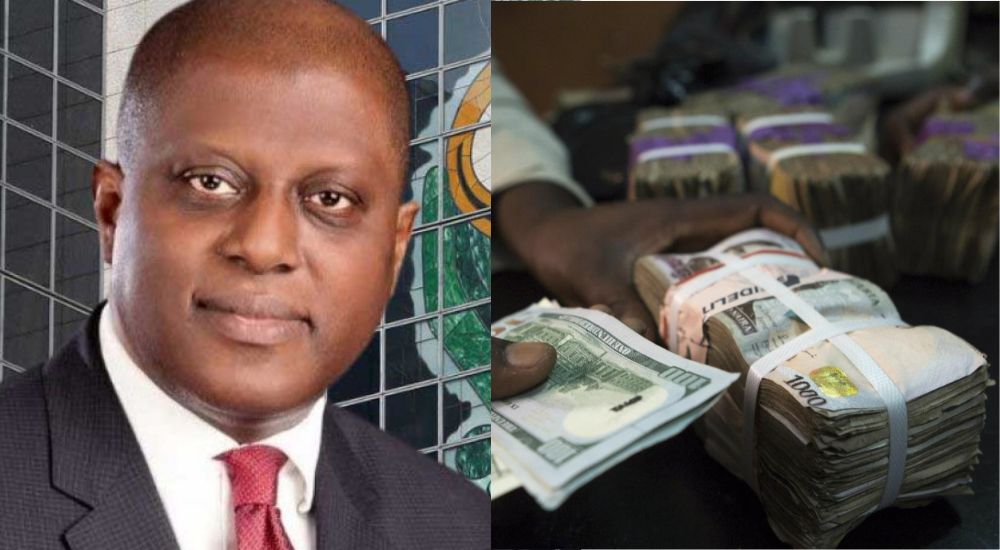

The Central Bank of Nigeria (CBN) announced that it sold a total of $543.5 million to authorized dealer banks between September 6 and September 30, 2024.

This significant intervention aimed to stabilize the foreign exchange market during a period of heightened demand for commodity imports and seasonal foreign exchange needs.

In a statement released by Omolara Duke, the Director of the Financial Markets Department at the CBN, it was revealed that the sales occurred over 11 dealing days through a two-way quote system at the Nigeria Foreign Exchange Market (NFEM).

Duke emphasized that these spot sales were crucial in mitigating market volatility, allowing for a more predictable trading environment.

The CBN’s statement clarified that one of the objectives of these sales was to educate the public regarding foreign exchange pricing, providing transparency by detailing the range of rates at which the currency was sold to authorized dealers.

The CBN reiterated its commitment to facilitating a steady supply of foreign exchange in the NFEM as part of its comprehensive strategy for managing foreign exchange in Nigeria.

The detailed breakdown of the CBN’s transactions included the assertion that the sales were made to address observed volatility linked to strong demand for imports. The value dates for all transactions were set at T+2, meaning that the transactions were settled two business days after the sale.

These foreign exchange sales positively influenced the Naira’s performance in the official market, where it closed at ₦1,541 in September 2024 on the official NAFEM window.

READ ALSO: CBN extends suspension of cash deposit fees to ease economic strain on Nigerians

This represented a slight improvement compared to the Naira’s performance in July and August of the same year. However, in contrast, the Naira experienced a decline in the parallel market, sinking to its lowest level in seven months, closing at ₦1,700/$—the weakest rate since February 2024.

According to data from Nairalytics, September 2024 marked the Naira’s strongest performance in the official market since June 2024, when it closed at ₦1,505/$.

In July, the currency ended at ₦1,608/$ in the official market and ₦1,600/$ in the parallel market. Similarly, in August, the Naira closed at ₦1,598/$ officially and ₦1,616/$ in the parallel market.

Looking ahead, the CBN has announced plans to introduce an electronic matching system for foreign exchange transactions in the Nigerian FX market, set to launch on December 1, 2024.

The apex bank indicated that it would provide real-time pricing and collaborate with the Financial Markets Dealers Association (FMDA) to establish operational rules for this new system.

This initiative aims to further enhance transparency and efficiency in the foreign exchange market, addressing ongoing concerns about volatility and accessibility to foreign currency.

Entertainment5 days ago

Entertainment5 days ago

Health1 week ago

Health1 week ago

Health4 days ago

Health4 days ago

Football1 week ago

Football1 week ago

Football1 week ago

Football1 week ago

Crime4 days ago

Crime4 days ago

Education6 days ago

Education6 days ago

Crime1 week ago

Crime1 week ago