Africa’s leading integrated payments and digital commerce company, Interswitch has advocated for the increased adoption of innovative solutions such as digital wallets, Buy Now Pay Later (BNPL) services and Point-of-Sale (POS) solutions to strengthen the payment landscape and deepen financial inclusion in the country.

The firm made this known during the Nigeria Fintech Forum held recently at the Civic Centre, Victoria Island, Lagos.

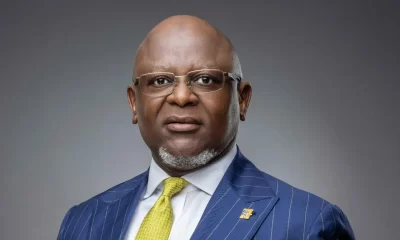

Delivering the keynote address tagged ‘The Race Towards the Future of Digital Payments’, Akeem Lawal, Managing Director, Payment Processing & Switching (Interswitch Purepay) explained how innovative payment solutions have transformed the retail landscape, enabling seamless and secure payment experiences for customers and businesses.

He revealed that in today’s evolving digital payment landscape, Interswitch recognizes the pivotal role that innovative payment solutions play in driving financial inclusion and economic prosperity.

READ ALSO: Interswitch debunks suspension order on dispute management operations

He said “Digital wallets, POS solutions and BNPL services have emerged as game-changing solutions in the digital payment ecosystem. With advancements like contactless payments and mobile wallets, the convenience and speed of transactions have reached unprecedented levels, propelling Nigeria towards a cashless society.”

Lawal also pointed out that there was a spike in the use of POS terminals in the first quarter of the year; resulting from the naira scarcity. He said data from Inter-Bank Settlement System (NIBBS) revealed that POS transactions increased to N807.16 billion in January 2023 because of the naira redesign policy and cash crisis, representing a 40.68 percent year-on-year increase from N573 billion in 2022.

He further said “As customers increasingly embrace digital payment solutions, we believe that the adoption of these solutions will strengthen the payment ecosystem. This is why we will continue to design cutting-edge solutions to enhance business development and provide seamless solutions to customers”.

Speaking during the panel session tagged ‘Nigerian Fintech so far, assessing trends, opportunities, and obstacles’, Olufemi Davies, Portfolio Manager, Interswitch Purepay said it is important for players in the payment space including banks, fintechs and telecommunications operators (telcos) to collaborate to provide unique offerings and world-class digital payments solutions to customers.

He said, “As a leading advocate for innovation, Interswitch remains committed to collaborating with key stakeholders, regulators, banks, fintechs and industry players to foster a robust and secure payment ecosystem”.

READ ALSO: Interswitch reignites plans to raise $1Bn from IPO

Further stressing on Davies’s statement, Tyoyila Aga, Group Head of Financial Services, Digital Infrastructure & Managed Services (Interswitch Systegra) urged deeper collaborations between fintechs and regulatory agencies to boost the security of data and funds of Nigerians. This he said, was crucial in the face of rising fraud attempts associated with digital payments.

He said, “It is vital that players in the fintech ecosystem forge closer partnerships with regulatory agencies. This way, more robust regulatory frameworks will be established to cut down fraud incidences as experienced today in the realm of digital payments.”

Tyoyila made the submission during the second panel session tagged “Redefining the fight against fraud and financial crimes in Nigeria’s fintech ecosystem”. He said Interswitch will continue to invest in robust systems as well as design solutions that will protect customers against digital payment fraud.

The Nigeria Fintech Forum which was sponsored by Interswitch, was attended by key stakeholders across the public and private sectors including, banks, fintechs and telcos.

Health & Fitness4 days ago

Health & Fitness4 days ago

Featured1 week ago

Featured1 week ago

Aviation6 days ago

Aviation6 days ago

Aviation5 days ago

Aviation5 days ago

Aviation5 days ago

Aviation5 days ago

Business1 week ago

Business1 week ago

News1 week ago

News1 week ago

Business1 week ago

Business1 week ago