As part of its effort to build a healthy savings culture amongst young Nigerians, Wema Bank visited several public schools across the country to educate students on the benefits of growing their financial knowledge and nurturing healthy investment habits which will serve them well in the future.

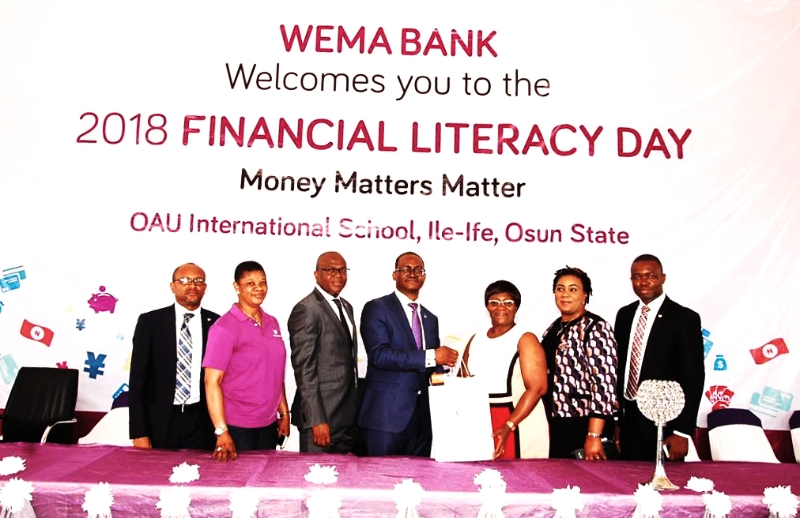

Over 25 schools, spread across all six geographical zones of the country were visited by senior officials of the bank including OAU International School, Ile-Ife, Osun State, which was visited by the Bank’s Deputy Managing Director, Ademola Adebise and the Executive Director, South Bank, Wole Akinleye.

The initiative was part of the Bank’s activities to celebrate the 2018 Financial Literacy Day which seeks to highlight the importance of financial literacy and teach Nigerians how to establish and maintain healthy financial habits.

During his visit, the Deputy Managing Director lectured the students on the important of imbibing a healthy savings culture at an early age, which he said makes it easier to achieve set life goals and puts them on the right path to attaining financial freedom.

Adebise also advised young people to learn the art of budgeting, noting that it helps in distinguishing between wants and needs. “This way you can set your priorities right, regardless of how little you have” he said.

Most of the students present at the interactive session admitted to having learned some useful saving tips and were keen to test their knowledge once they open a savings account.

In a bid to help them kick start their savings programme, Mr. Adebise agreed to fund the first 50 students who open an instant Wema Bank Savings Account during the session.

In addition, the Bank’s Executive Director Mr. Akinleye said students should imbibe the culture of going on excursions to financial institutions and engaging in internships during the holidays to further grow their financial knowledge and money management skills.

Wema Bank, the pioneer of Nigeria’s first fully digital bank ALAT, offers a range of retail, SME banking, corporate banking, treasury, trade services and financial advisory to its customers.

The Bank is one of the few Nigerian banks with NPL ratio below 5% with a robust coverage ratio (including risk reserve) of over 100% in the face of asset quality pressures across the banking industry.

Business6 days ago

Business6 days ago

Business6 days ago

Business6 days ago

Education6 days ago

Education6 days ago

Crime6 days ago

Crime6 days ago

Covid-196 days ago

Covid-196 days ago

Business6 days ago

Business6 days ago

Latest4 days ago

Latest4 days ago

Featured1 week ago

Featured1 week ago