By Odunewu Segun

The poor economic mess presently facing Nigeria has been attributed to the high lending rate, lack of infrastructure and the poor power supply in the country.

Director General, West African Institute for Financial and Economic Management (WAIFEM), Prof Akpan Ekpo stated this at the Presidential Policy Dialogue organised by the Lagos State Chamber of Commerce and Industry (LCCI) in Lagos, faulting the decision of CBN to increase MPR from 12 per cent to 14 per cent, saying in other climes, interest rate is in single digit.

Reacting to the decline in Nigeria’s Foreign Direct Investment (FDI), which has declined from $395 million in first quarter of 2015 to $175 million by the first quarter of 2016, he said the high interest rate has made it practically impossible for local manufactures to compete with imported products because the cost of production and labour is far cheaper than what is obtainable in Nigeria.

‘‘With interest rates at 14 per cent, no domestic investor can borrow, invest and pay back. It is simply impossible to break even with interest rates at 14 per cent. Rather than the CBN reducing interest rates, it was increased.”

According to him, to reverse the trend, government must begin to introduce fiscal stimulus to get the economy back on track.

On his part, a don at the Bayero University, Kano, Prof. Badayi Sani, said the slides in FDI and FPI would have a negative effect on the growth of GDP.

ALSO SEE: LCCI holds dialogue session on economic integration in W/Africa

According to him, the other implication is that it may also affect the unemployment statistics because more people will be out of job, adding that some of the effects of poor FDI will also affect manufacturing firms because some supply materials to FDI firms also supply items to some other firms.

On why FDI is on the decline, Sani said two reasons could be adduced to this – decay in infrastructure and power.

A development economist, Mr. Odilim Enwegbara, said FDIs are not investing because of high cost of doing business, as a result of high infrastructure deficit and high interest rates, which ought to be falling rather than rising.

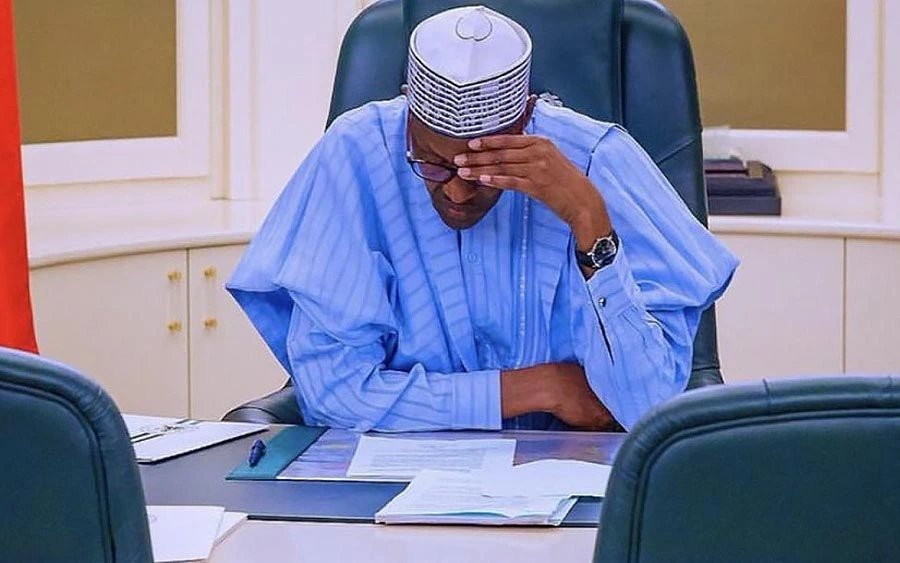

Also reacting, Vice President Yemi Osinbajo said government is aware of the challenges facing the economy, and has put in place some mechanisms to revive the trend. According to him, some of the steps included assisting states and local governments to pay salaries of workers, which were several months in arrears and the latest loan of N90 billion as part of a fiscal responsibility plan for states.

The Vice President equally said the Federal Government has already made capital releases of N332 billion, with another N100 billion set to be released in the next few days.

Health & Fitness2 days ago

Health & Fitness2 days ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Featured6 days ago

Featured6 days ago

Education1 week ago

Education1 week ago

Business1 week ago

Business1 week ago

Aviation4 days ago

Aviation4 days ago

Business6 days ago

Business6 days ago

Crime1 week ago

Crime1 week ago