The Central Bank of Nigeria (CBN) may change its monetary policy stance next year from the current tightening position to an easing stand that will see the benchmark interest rate come down from the current 14 percent.

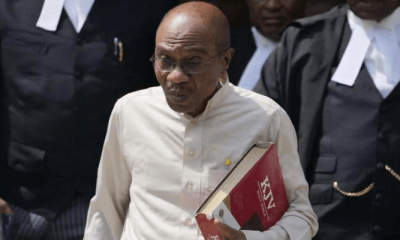

Governor of the bank, Godwin Emefiele made this known at an event organized by the Chartered Institute of Bankers of Nigeria (CIBN) Annual Bankers Dinner held in Lagos. The apex bank has left the interest rate unchanged at 14% since mid-2016.

Emefiele hinged his forecasts on the foreign exchange and exchange rate management policies of the apex bank in recent months, which has led to a drop of 65 per cent in the monthly food import bill of the country from an average of $5.5bn to $1.9bn as of June 2017. Foreign reserves have also recovered to over $34.3 billion as at the first week of November.

ALSO SEE: Fashola in the eye of the storm, denies diverting $350m

“We have also seen a significant appreciation of the naira from over N500/$1 to about N360/$1. In addition, we have seen stability in the rate for over six months now. I am glad to note that the exchange rate is not only stable, it is also converging across various windows and segments of the market,” Emefiele explained.

Meanwhile, as realistic as the Governor’s forecast is, significant risks abound. Nigeria’s fortunes are heavily dependent on oil. While global crude oil prices remain reasonably stable, militants in the Niger Delta have called off a ceasefire and threatened to resume attacks on oil installations.

Should this happen, Nigeria’s oil production volumes could decline, leading to a drop in foreign exchange revenue. This in turn, would lead to a drop in foreign exchange reserves.

Entertainment6 days ago

Entertainment6 days ago

Health1 week ago

Health1 week ago

Health4 days ago

Health4 days ago

Football1 week ago

Football1 week ago

Football1 week ago

Football1 week ago

Crime5 days ago

Crime5 days ago

Education6 days ago

Education6 days ago

Health6 days ago

Health6 days ago