By ODUNEWU SEGUN

DISCORDANT views from the Finance Minister, Kemi Adeosun, and the Governor of Central Bank of Nigeria (CBN) governor, Godwin Emefiele, on key fiscal and monetary policy decisions last has deepened the cracks within the inner circle of President Muhammadu Buhari’s economic team and direction.

The decision of the Monetary Policy Committee of the Central Bank of Nigeria’s to retain the Monetary Policy Rate, the benchmark lending rate at 14 per cent despite calls by key members of President Muhammadu Buhari’s economic team has revealed a sharp difference within the top echelon of the President’s economic team.

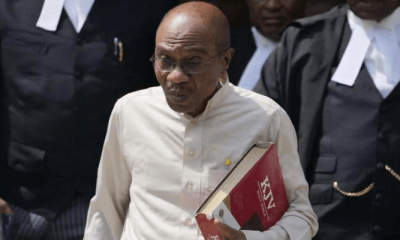

Godwin Emefiele, governor of the CBN, had publicly rebuffed call by Minister of Finance, Kemi Adeosun, that benchmark lending rate be lowered to support government stimulus plan to borrow cheap funds locally, to bail out the economy.

Adeosun said lowering the rates would afford the FG the opportunity to borrow domestically to boost the economy without increasing debt servicing costs. “We need lower interest rates. If we drive the economy and there is growth, that is the payback. I would rather seek growth, we can manage inflation, let’s stimulate the economy,” she said.

According to her the controversial double rates for the naira must be resolved and the spread narrowed. :“We need lower interest rates, because when we are borrowing and interest rates go up, it increases our cost of debt service and it reduces the amount of money that is available to spend on capital projects”.

But Emefiele said borrowing at lower rates to spend on consumption in an economy not backed by industrial capacity would further fuel inflation.

He said the decision which was unanimously agreed on by the 10 members of the committee also left the Cash Reserve Ration and the Liquidity Ration unchanged at 22.5 per cent and 30 per cent respectively.

Reacting to the division, a development economic and analyst, said the CBN was wrong not to have not to have reduced the lending rate, particularly at this period of economic recession.

He said the President must intervene and call the CBN governor to order, who seems to be protecting the interest of the banks, his primary constituency. “That the Minister of Finance suggested before the MPC meeting that there may be a lower interest rate and the CBN ignored it showed that there is a huge crack in the wall of government economic team,” he explained.

ALSO SEE: Recession: African Development Bank bails out Nigeria with $2.57bn

He said both the minister and the CBN governor are supposed to work in harmony at this time. “The CBN governor should be complimenting what the Finance Minister is saying and vice versa, to grow the economy. The confusion will bring confidence problems in the policy making by government”.

Director-General, Lagos Chamber of Commerce and Industry, Muda Yusuf, aligned with Adeosun on the need to lower interest rates, saying it will benefit the economy more than it will hurt it.

He said there the need for the country to agree on what the national economic objective should be, and for key actors in the fiscal, monetary and political governance space to agree on a common direction and strategy to rescue the economy.

According Bismarck Rewane, CEO of Financial Derivatives Limited, the ‘wait-and-see attitude adopted by the CBN by not lowering lending rates would not help the recession, but may forestall imbalances.

But the Head of Research and Investment Advisory, SCM Capital, Sewa Wusu, said if the CBN had listened and lowered the lending rates, the credibility of its monetary policy stand would be at risk.

He said the CBN had raised the MPR by 200 basis points at its previous meeting, bringing it down now would only portray it as being confused.

Health5 days ago

Health5 days ago

Entertainment7 days ago

Entertainment7 days ago

Crime6 days ago

Crime6 days ago

Education1 week ago

Education1 week ago

Health1 week ago

Health1 week ago

Comments and Issues6 days ago

Comments and Issues6 days ago

Football7 days ago

Football7 days ago

Latest6 days ago

Latest6 days ago