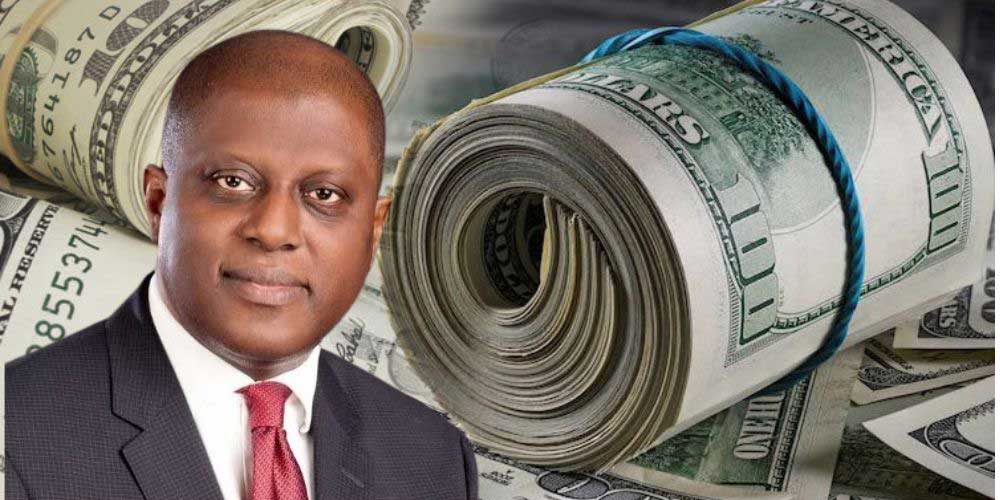

As part of efforts to curb currency speculation and hoarding in the country, especially by banks, the Central Bank of Nigeria (CBN) has issued new guidelines aimed at reducing the risks associated with these practices.

The circular, titled “Harmonisation of Reporting Requirements on Foreign Currency Exposures of Banks,” highlights the CBN’s concerns over the growing trend of banks holding large foreign currency positions.

According to the circular, the apex bank said it has noted with concern the growth in foreign currency exposures of banks through their Net Open Position (NOP).

“This has created an incentive for banks to hold excess long foreign currency positions, which exposes banks to foreign exchange and other risks. Therefore, to ensure that these risks are well managed and avoid losses that could pose material systemic challenges, the CBN issues the following prudential requirements”

To address these issues, the CBN has issued prudential requirements that banks must follow. A key focus of these requirements is the management of the Net Open Position (NOP).

READ ALSO: Analysts predict contrasting outcomes for businesses as FX crisis worsens

The circular mandates that the NOP must not exceed 20 per cent short (owning more than owning) or 0 per cent long (owning no more than the bank’s shareholder funds not reduced by losses) of the bank’s shareholders’ funds.

Furthermore, banks with current NOPs exceeding these limits are required to adjust their positions to comply with the new regulations by February 1, 2024.

Additionally, banks must calculate their daily and monthly NOP and Foreign Currency Trading Position (FCT) using specific templates provided by the CBN.

The circular also stipulates that banks should maintain adequate stocks of high-quality liquid foreign assets, such as cash and government securities, in each significant currency.

“Banks are also required to have adequate stock of high-quality liquid foreign assets, i.e. cash and government securities in each significant currency to cover their maturing foreign currency obligations. In addition, banks should have in place a foreign exchange contingency funding arrangement with other financial institutions.”

READ ALSO: Scarcity hits black market as Naira falls to N1,460/$1

Other requirements outlined in the circular include practicing natural hedging by borrowing and lending in the same currency to avoid currency mismatch risks.

With respect to Eurobonds, any clause of early redemption should be at the instance of the issuer, and approval obtained from the CBN in this regard, even if the bond does not qualify as tier 2 capital reporting on a timely basis.”

Banks are also advised to ensure that the basis of the interest rate for borrowing matches that of lending, thereby mitigating basis risk associated with foreign borrowing interest rate risk.

The CBN emphasizes the importance of compliance with these guidelines, warning that non-adherence will result in immediate sanctions and possible suspension from participating in the foreign exchange market.

Health & Fitness4 days ago

Health & Fitness4 days ago

Aviation7 days ago

Aviation7 days ago

Aviation5 days ago

Aviation5 days ago

Aviation5 days ago

Aviation5 days ago

Aviation5 days ago

Aviation5 days ago

Aviation4 days ago

Aviation4 days ago

Featured2 days ago

Featured2 days ago

Crime2 days ago

Crime2 days ago