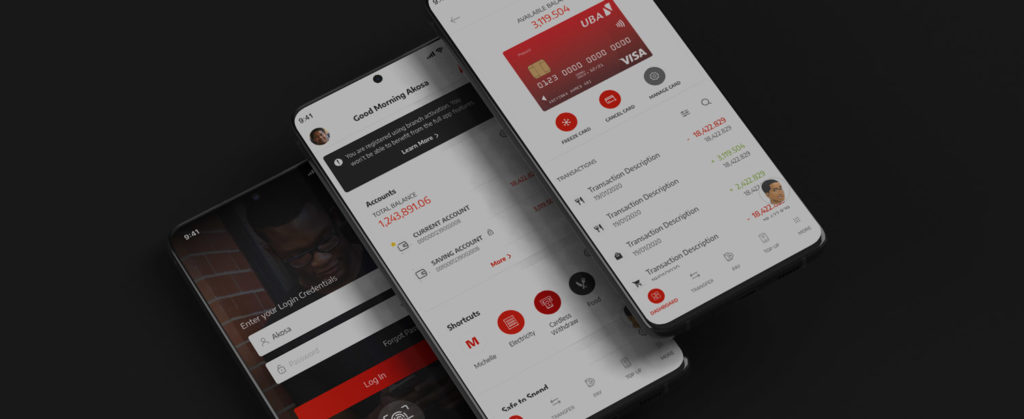

United Bank for Africa (UBA) Plc, has upgraded and enhanced its mobile banking application, with exciting new features designed to empower its customers with increased control, convenience, and ease in conducting their transactions.

With the upgrade, customers are now armed with more tools to carry out transactions with ease from the comfort of their phones, without having to visit the branch or leave their comfort zones.

Research has shown that overtime, disputed transactions have been one of the major challenges which makes customers flock to the banking hall despite having digital apps, and UBA has introduced the Transaction Dispute Menu feature on the mobile app to address this.

It allows customers to report any failed transactions from the Mobile App’s home page. Customers can also carry out other self-service features like Block Card, Block Account, Check transaction status, and more.

Another interesting upgrade is that UBA customers now have Extended Transaction History in their mobile app, where they can easily view and access up to six months of their transaction history. This aids better financial tracking, facilitates informed decisions about their spending habits and budgeting.

UBA’s Group Head Retail and Digital Banking, Shamsideen Fashola, said the upgrade of the mobile banking app, emphasises the bank’s commitment to providing cutting-edge solutions that align with the evolving needs of its customers.

READ ALSO: Zenith Bank delivers on promise to shareholders, pays N125.59bn as dividends

“Our goal is to ensure that banking with UBA remains seamless, secure, and intuitive, and these new features represent a significant step in achieving that objective. By placing greater control and flexibility in the hands of our customers, we are empowering them to bank on their own terms, anytime, anywhere.”

In response to user feedback and technological advancements, UBA has also implemented an Enhanced PIN Pad, with size adjustments tailored specifically for smart phones. This improvement ensures a smoother and more user-friendly experience for customers accessing banking services on various device types, enhancing inclusivity and accessibility across board.

UBA’s Head, Digital Banking, Olukayode Olubiyi, expressed the bank’s excitement to introduce these enhancements to its mobile banking app, reflecting its ongoing commitment to delivering best-in-class digital solutions to customers.

Comments and Issues2 days ago

Comments and Issues2 days ago

Business6 days ago

Business6 days ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business5 days ago

Business5 days ago

Education7 days ago

Education7 days ago

Comments and Issues5 days ago

Comments and Issues5 days ago

News6 days ago

News6 days ago