Business

Risk of NPLs, a major threat to financial stability — CBN

Published

8 years agoon

By

Olu Emmanuel

By ODUNEWU SEGUN

WITH banks Non-performing loans (NPLs) rising above 70 per cent year-on-year to N649.63 billion in May, 2016, the Central Bank of Nigeria has stated that the state of bad loans in the banking sector remained a major threat to the financial stability of the country.

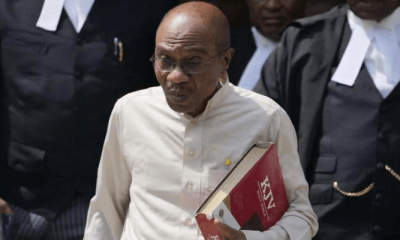

Speaking at the third National Credit Reporting Conference organised by the Credit Bureau Association of Nigeria (CBAN) in Lagos recently, governor of the CBN, Godwin Emefiele there is the need to double its effort in the area of credit information sharing in order to stem the worrisome trend.

Emefiele, who was represented by the Branch Controller at CBN Lagos Office, James Iyari, said the CBN had made it mandatory for all financial institutions to have data exchange agreements with at least two credit bureaux and that, all banks are required to obtain credit report from at least two credit bureaux before granting any facility to their customers.

He added that quarterly portfolio checks must also be carried out to enable the banks determine borrowers’ current exposure to the financial system, adding that the CBN had approved the payment of one-off sign on fees with Credit Bureaux for all the microfinance banks and other micro financial institutions licensed by the CBN.

In the view of President, Association of Banks, Insurance and Financial Institution (ASBIFI), Sunday Salako the rising bank debt is a result of current economic meltdown affecting businesses.

“Many people will borrow to import certain things with the hope to sell, make gains and return bank’s money. But the thing is that they have imported and people are not buying; some have produced, and cannot sell,” he lamented.

According to Divisional Head of Innovation and Products, Heritage Bank Ltd, Tobe Nnadozie, banks need to adopt innovative measures in the face of the economic downturn.

ALSO SEE: Interest rate rises as CBN tightens liquidity

“Certainly because of the prevailing economic challenges banks have to look at more creative ways to grow their bottom line. You know in the recent past, banks had to rely heavily on FX-related businesses to generate the highest deposits. However, what they can do now is to try to add value to customers beyond what they used to do.”

The CBN governor at the CBAN conference said the CBN will continue to supervise the credit bureau industry to ensure that the financial sector is robust and safer.

Speaking on the theme: “Credit Bureau and Access to Finance: Nigeria’s Success Story”, he said this year marks the 25th year anniversary for credit reporting in the country and no doubt, had contributed to the resilient financial system that is propelling the growth and development of the nation.

He disclosed that the National Assembly was considering a bill on National Credit Reporting that will bring all stakeholders under one regulatory platform. To make the proposed National Credit Reporting Bill meet international standards, the CBN, in collaboration with International Finance Corporation and CBAN reviewed the draft Bill and articulated some amendments to the document.

In her own reaction, the Chairman of CBAN, Mrs. Jameelah Sharrieff-Ayedun, said credit bureau remain critical in nation-building as it ensure that only people with integrity get access to credit.

According to her, credit bureau are key in stimulating economic growth through the provision of critical risk management and fraud prevention services to the financial services sector.

The sector, she added, is making it possible for more people within the population to have access to credit.

In the two years before crude oil prices began falling in mid- 2014, Nigerian banks reportedly lent an estimated $10 billion to local oil and foreign gas companies to buy assets from Royal Dutch Shell, Eni and Total as they retreated from the nation’s onshore industry.

At the time these loans were celebrated milestones for Nigerian finance and a boost to bank portfolios aimed at supporting greater domestic participation in the industry. Now that the price of Brent crude has fallen by nearly twothirds to the mid-$40s, much of that lending have become liabilities.

According to analysts, most of the country’s 22 licensed commercial banks are exposed to the industry through large syndicated loans, many of which were not hedged, and some of which were poorly collateralized.

You may like

Interpol places 3 Nigerians on Red Alert for stealing $6.2m from CBN

Breaking: Banks to pay diaspora remittances in Naira

HURIWA demands DSS, EFCC to investigate CBN over Naira scarcity

CBN Investigator highlights Emefiele’s gross financial offences

Court grants Emefiele bail

Emefiele’s Naira redesign policy responsible for currency’s scarcity–Falana

Trending

Business6 days ago

Business6 days agoDollar crashes further against Naira at parallel market

Business6 days ago

Business6 days agoRecapitalisation: Zenith Bank to raise funds in international capital market

Education6 days ago

Education6 days agoArmy reveals date for COAS 2024 first quarter conference

Crime6 days ago

Crime6 days agoFleeing driver injures two on Lagos-Badagry expressway

Business1 week ago

Business1 week agoLagos Calabar Coastal Road project will offer significant economic benefits–Umahi

Covid-196 days ago

Covid-196 days agoBritish legislator demands Bill Gates, other ‘COVID Cabal’ faces death penalty

Business6 days ago

Business6 days agoZenith Bank surpasses N2trn earnings milestone

Latest4 days ago

Latest4 days agoIsrael pounds Hezbollah with airstrikes after Iran attack