Comments and Issues

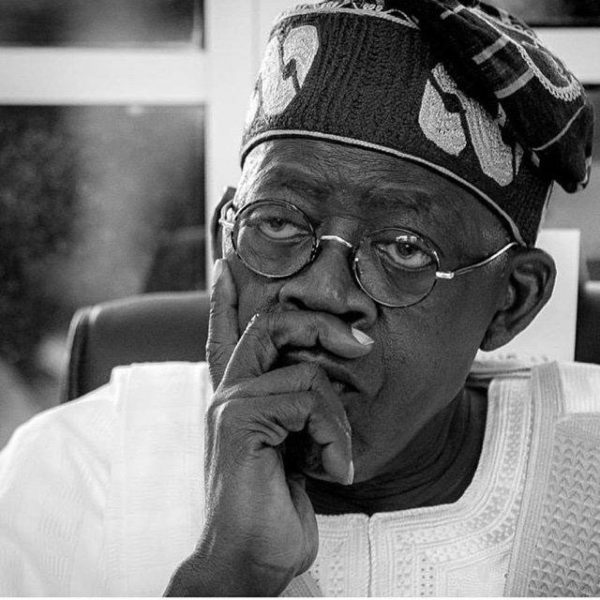

Tinubu’s Folly – Lagos Is Not Nigeria

Published

1 year agoon

Tinubu and his proponents pointed to his term as Governor of Lagos State and promised Nigerians that the transformations that he enabled when he led Lagos would be replicated on the national stage.

Seventeen months into the presidency of Bola Tinubu, even his most strident supporters and defenders will agree this is not the Nigeria they imagined we would have under his leadership.

By every objective measure, the president has failed to deliver on the promises that he made to Nigerians. Inflation is in double digits, the currency has devalued by over 100% since he took office, unemployment has remained high, industries that have been in Nigeria for decades are deciding that it is best to exit the market, local industries are collapsing. In the last few months, harrowing videos of people taking to social media to share their pain and woes have become common place. There is simply no way to sugar coat the reality of the dire economic challenges that Nigerians are going through.

Even at the best of times, Nigeria is not an easy place to lead. But those who raise their hands to run for the office of president are not to be pitied. They are willing applicants for the job, fully aware of its challenges. And in Tinubu’s case, he arguably fought longer and harder for this job than any other person that has been president of Nigeria. He made many arguments along the way as to why he was the most qualified person to lead Nigeria. Key among these was that he was a tested leader, who had a verifiable record of accomplishment that Nigerians could look upon as the case study for how he would transform Nigeria. Tinubu and his proponents pointed to his term as Governor of Lagos State and promised Nigerians that the transformations that he enabled when he led Lagos would be replicated on the national stage.

Nigeria’s seemingly intractable slide towards the economic abyss has people wondering about when that much touted Lagos like transformation of Nigeria will begin. Where is the man that supposedly made Lagos? Why are Nigerians yet to see Tinubu’s “Lagos magic” replicated across the country?

A more appropriate question that many do not ask, but which should be top of mind for most Nigerians is with regards to what exactly Tinubu did in Lagos, which translates to the national stage.

Tinubu’s standout achievement in Lagos was that he transformed Internally Generated Revenue (IGR), the taxes that the state government collects, from about N13 billion when he took over in 1999 to N83 billion by the time he left office in 2007. That translates to an almost five hundred fold increase and a salutary year on year growth of about 60%. No other state even came anywhere close to Lagos’ spectacular IGR growth achievement in the Tinubu era.

However, it is one thing to grow IGR, but it is another thing entirely to actually grow an economy. IGR can be increased without any growth in the economy if the tax collection base was poor to start with.

If IGR grew 500% between 1999 and 2007 under Tinubu’s watch in Lagos, did the economy of the state grow by that same amount in that time frame? The answer is a definite and unequivocal No! The economy of Lagos did not grow by 500% when Tinubu was governor – and neither he, nor his supporters have ever made such claims. In any case, Tinubu and his team must have convinced themselves that collecting more taxes, without commensurately growing an economy provides transferable skills that can be applied to a complex, structurally challenged economy like Nigeria’s.

It was with some chest puffing that Tinubu arrived in Abuja with largely the same team with whom he worked in Lagos almost two decades ago. Nigerians have now waited for seventeen long months to see the Lagos miracle translated to Nigeria. And so far, what we have seen does not inspire any confidence. The administration’s policies have been poorly implemented. And the chaotic approach to policy making began on his very first day in office, when with no plan and no team in place, the president on what he himself admits was a whim, announced consequential policies during his inauguration. The whiplash approach to policy making and implementation has continued since then.

If the challenge Tinubu faced in Lagos was how to collect more taxes from a state that already had a dynamic economy, that certainly is not Nigeria’s problem. The larger issue in Nigeria is how to grow the economy. How to put tens of millions of people to work. Nigeria’s problems are not a tax collection issue. They are a revenue generation and wealth creation issue. Taxes are easy to collect. Enabling the economic growth that creates those taxable incomes is much harder to enable.

We may not see any meaningful progress in Nigeria’s economic fortunes unless the Tinubu government makes certain course corrections to its current economic trajectory. There are four (4) key areas that such revisions of thought and action must focus on:

First, the President and his team must acknowledge that Lagos is Not Nigeria. The president and his Lagos team must begin to acknowledge that being able to collect more taxes in a State that is full of industrious people, who thrive in spite of, and not because of government, might not have many lessons that can be directly applied to a nation that is in dire need of policy makers who understand how to create jobs, provide an enabling environment for businesses and support entrepreneurship. Many people seeking to fulfil their dreams in Nigeria, head to Lagos. It is the City of opportunity, bursting at the seams with tens of millions of self-driven and ambitious people. If the jobs are there they take them. If they are not there, they create them. If the conditions are enabling, Lagosians create booming enterprises. If the conditions are crippling, the average Lagosian keeps moving and still works to make something happen. A person who governs Lagos might be fooled into thinking that the progress that they see is due to their efforts, forgetting that Lagos has a dynamism that government has nothing to do with.

The dominant economic activity in Lagos is in the service industry, which makes up about 90% of the economy of the state. Services only make up about 40% of the Nigerian economy, and so structurally the economy of Lagos state is not at all similar to the national economy which is dominated by the agricultural and industrial sectors. A service driven economy is somewhat self-propelling. A large metropolis full of hard working people, who are constantly hustling and bustling, must feed itself, provide lounges for relaxation, restaurants for feeding, hotels for lodging, clubs for leisure, concerts for enjoying music, theatres for movies and galleries for the arts. There must be barbers and hairdressers to make people look good, schools for children and youth, mechanic workshops to repair vehicles, electricians to mend appliances, clinics, and hospitals to treat ailments and dispense drugs. In short, a city like Lagos has a life and energy of its own that no government can claim to enable. And collecting more taxes from the industrious people of Lagos, is certainly not a feat to be heralded ad nauseum.

The team that Tinubu took with him to Abuja might be skilled at tax collection, but they do not have a track record for job creation and economic growth, and it shows. One of the Tinubu administration’s first acts in office was not to boost job creation, but to change how unemployment is measured in Nigeria. In one fell swoop, they adopted a formula that turned an unemployment rate of almost 40% to 4%, soothing themselves with low unemployment metrics, while tens of millions of Nigerians still wallow around in unemployment and writhe in the throes of underemployment. The fact that the policies of the government have caused long term players in the Nigerian economy like PZ Cussons, GlaxoSmithKline, Sanofi, and P&G to either exit the market, or stop manufacturing locally to focus on import only models, is evidence of how crippling the Tinubu administration’s policies have been. To lead Nigeria, the Tinubu team must put on the hat of job creators and not tax collectors.

Secondly, the energy sector must be urgently transformed. Nigeria has about 5,000 MW of power that reaches its people, and about 18,000 MW of generation capacity. This translates to about 22 Watts per person, enough to power a dim incandescent bulb for each Nigerian. To provide a simple comparison for how terrible our power availability situation is, South Africa has 50,000 MW of delivered energy and 59 million people, translating to about 850 Watts per person. Their power availability is almost 37 times more than Nigeria’s and even they still suffer from occasional black outs. Without power, there will be no economic growth. The Tinubu government has stopped pretending it has the means or the ability to solve Nigeria’s power issues and has passed the challenge of providing power to the states, while the federal government has taken on the role of managers of the paltry 5,000 MW of energy that is currently available. If Nigeria is plagued with ineptitude at the federal level, the states are even more terribly resourced. Every nation that has drawn itself out of poverty and onto the path of economic growth has begun by first addressing the challenge of energy availability, access, and affordability.

The cost of energy must be significantly lowered if Nigerian manufacturing is to be revived. A simple example will drive home the critical nature of energy cost in job creation and economic growth.

Let us assume an imported product that is sold for N100 per unit in Nigeria has an energy component cost of 50%. This means about N50 of the cost of that product is from energy. Energy costs across much of the developed world is about $0.05 per kWh for industrial users. At an exchange rate of about N1,500 per USD, this would be N75 per kWh. Nigeria’s power cost is about N225 per kWh for Band A customers and about the same for those who choose to generate their own power. Nigeria’s power cost is therefore about three times the cost of energy in the nations that we import our goods from. It means that the N50 per unit in energy cost for our hypothetical product, will be about N150 per unit for just the energy cost component if it was manufactured in Nigeria. Assuming all other costs are the same, the Nigerian manufacturer can only deliver such a product at N200 per unit vs the N100 per unit that it is imported for. There is little wonder therefore that manufacturers that have significant energy input in their production process are leaving the Nigerian economy in droves.

Energy generation, transmission and delivery must be prioritized. Programs and policies to reduce the cost of energy must be developed and urgently rolled out. These can include rebates on energy cost for manufacturers, or the granting of tax free periods to local manufacturers to allow their energy cost effectively come to a value of about N75 per kWh or less to provide energy cost parity with global competitors. The economic growth, jobs created and multiplier effects of industrial capacity development that will be unleashed will more than make up for any short term dips in government revenue that would result from such stimulatory policies.

Just to get to South African levels of energy availability, Nigeria must generate, transmit and distribute an additional 200,000 MW. One idea for doing this is to set a 5 year goal of reaching this milestone and closing 20% of the deficit per year. This translates to putting in about 50 MW of decentralized power in each Local Government Area per year. 2 MW of power generation capacity can be placed in a container. So already built, plug, and play power units delivered in about 25 containers per year can be installed in each LGA and within 5 years, attain the goal of making over 200,000 MW of useable power available in Nigeria vs the 5,000 MW we have today. By localizing and decentralizing the installations, the challenge of transmission will be minimized.

Thirdly, the Tinubu government must stop playing games with monetary and fiscal policy. Since Tinubu took office, Nigeria’s inflation rate has gone from 22% to about 33%. In that time, Cardoso’s CBN has raised monetary policy rates (MPR) 6 times, in a misguided attempt at using rate hikes to tame inflation. The theory behind raising interest rates is that inflation is caused by having too much money in circulation which raises demand for goods and services. In a market where such goods and services have fixed or dwindling supply, there will then be excess naira chasing limited goods, and prices will then rise. That rise in prices between periods is what economists term as inflation. According to the textbook theory, which works for nations with textbook economies, by reducing the amount of money in circulation, demand should drop and if supply does not change, then prices should drop as well. Cardoso’s interest rate hikes are intended to encourage Nigerians to be so “seduced” by the promise of high interest rate returns from saving their money instead of spending it, that they then start moving money from their wallets and purses into long term savings – to benefit from the 0.5% rate increases imposed by the Central Bank.

ALSO READ: The President should read this…

That is the textbook theory. The reality in Nigeria is that while Cardoso was busy raising interest rates using monetary policy to try to reduce the amount of naira in circulation, the Tinubu government was busy borrowing and printing money using fiscal policy and injecting even more money into the Nigerian economy. The end result has been that after six rate hikes, inflation has increased by 50%. It has been moving in the exact opposite direction to what textbook economics would expect. Yet, the CBN has continued to double down on raising interest rates.

The result has been chaos and even more worrying is the cooling effect that high interest rates has on business. The exceedingly high interest rates have made borrowing prohibitive. Current borrowing rates in Nigeria are now about 30%. This means that a business that borrows from the banks must make profits of at least 30% just to break even. We are talking about profits here and not revenues. How many legitimate businesses can generate such usurious levels of returns?

The Tinubu economic team should get themselves into a corner and get aligned. The fiscal and monetary policy wings of the team must be better coordinated and the confusing signals they are sending out to the market should stop. Furthermore, the CBN should recognize that the simplistic raising of rates and the expectation that this will curb inflation might work in the US and Europe but will not work in Nigeria for a variety of reasons. For starters majority of Nigerians do not have any monies that can be moved into savings because of higher interest rates. Most Nigerians live paycheck to paycheck. Much of the “excess” money in Nigeria is held in a few hands and a meager 0.5% change in interest rates will not convince such folks to put their money in savings. Also, Nigerian inflation is largely driven by forex devaluation and food scarcity due to insecurity. There is no interest rate increase that will erase the fact that we import many of the things we use, and there has been a 100% devaluation of the naira over the last year, which naturally translates to at least a 100% increase in prices for imported goods. The bandit and kidnapping crisis that has forced our farmers away from their lands has greatly reduced food supply, which drives up prices and causes food inflation. To seriously curb inflation, government should address those levers that have a clear impact and stop this obsession with raising interest rates. Again, it is worth nothing that in the last 17 months, the government has raised rates six times, and inflation has ballooned by 50%. Why the CBN continues to double down on an approach that has clearly failed is troubling.

Fourth, the Tinubu team must get serious about safeguarding the value of the Naira. Few people will argue with the need to float the naira. Nigeria simply did not have the $15 billion per year that it took to support the naira. The problem was not the flotation policy per se, but the terrible way in which it has been implemented.

When a currency floats, it means that the market forces of supply and demand determine its value. For a market to be efficient, all of the factors that can lead to manipulation of either demand or supply would need to be tightly controlled. The greatest threat to the value of a floated currency is speculation. In the context of foreign exchange, speculators are people who transact in forex, not because they have any immediate need of foreign currency to engage in any legitimate transactions, pay for school fees or travel for leisure, but simply to use it as a store of value. They treat forex transactions as investments in long term assets, not short term liquid transactions. Speculators are essentially making a bet that the naira will fall in value relative to foreign currencies like the dollar, and so they buy up all the dollars they can possibly lay their hands on and save it. Speculators who buy up dollars and keep it as a store of value effectively create “artificial demand.” In a market with fixed supply, higher demand always leads to higher prices, or in forex terms devaluation of the naira. But speculators do something which is even worse, they mop up the available dollars, or other foreign currencies, and completely remove them from the market. Which means they also reduce dollar supply in the forex market. Reducing supply when demand has not changed also leads to increase in prices, or naira devaluation.

Nigeria is now a big speculators’ market. The Nigerian government accused Binance, a foreign cryptocurrency platform of “moving” $26 billion in funds within just the last year. The banks have been major players in the speculative market, and the Tinubu government even recognizes this fact and has gone as far as passing new laws that impose a tax rate of 70% on so called forex “windfall gains” at banks. This action shows that the government is very much aware that the banks are gaming the system, yet they allow these shenanigans to continue, satisfied with imposing taxes on the backend and ignoring the devaluation and inflationary pressures that speculation causes. It is common knowledge that all of the printed and borrowed “ways and means” monies that the Tinubu government allocates to state governors and parastatals, first finds its way into the forex speculation market, generating yet more “artificial” demand, and mopping up forex supply, thereby making a bad situation even worse.

For Nigeria’s currency to be saved from the speculation induced buffeting it now suffers, the Central Bank must wake up to its responsibilities. Windfall gains from banks should not just be taxed, those financial institutions that are actively speculating must be called to order. The practice of allowing fiscal allocations which are borrowed funds from unbacked ways and means reserves, to be used for speculative purposes should be urgently curtailed.

The government must also do more to grow the economy and there are so many ways that this can be done. Here are two simple ones: Nigeria has a housing deficit of over 25 million units. There is more than a trillion dollars of potential value that can be unlocked in addressing just some of that deficit. Nigeria also has about 250 million acres of arable land mass much of which can be made available for agricultural entrepreneurship initiatives that will put tens of millions of youth to work.

But to realize these opportunities, the Tinubu government must first wake up to the realization that Lagos is not Nigeria, revamp their team accordingly and get to the business of doing the real work needed to better the lives of the Nigerian people.

Trending

Latest3 days ago

Latest3 days agoYoruba film industry mourns as popular actress aunty Ajara passes away

Trends4 days ago

Trends4 days agoTonto Dikeh reunites son with Churchill after decade-long split

Energy1 week ago

Energy1 week agoNNPC unveils gas master plan to boost Nigeria’s energy sector

Education1 week ago

Education1 week agoAchievers University expels 15 female students over indiscipline

Business6 days ago

Business6 days agoRite Foods positions industry as catalyst for Nigeria’s clean energy transition

Football6 days ago

Football6 days agoArsenal’s Osman Kamara completes permanent move to Blackburn Rovers

Featured6 days ago

Featured6 days agoMidnight raids, teargas: Lagos deploys military-era tactics in mass evictions

Health5 days ago

Health5 days agoControversial preprint revives vaccine–autism debate, draws sharp pushback from medical experts