ICT

Reps direct NCC to embark on audit of telcos

Published

7 years agoon

By

Olu Emmanuel

The House of Representatives has directed Nigerian Communications Commission (NCC) to immediately embark on integrity test and financial audit of all telecommunication companies operating in the country to avert imminent collapse of the industry.

Saheed Akinade-Fijabi, chairman, House Committee on Telecommunication issued the directive during an emergency meeting held with NCC and other stakeholders, following the recent takeover of Etisalat over $1.2 billion indebtedness by a consortium of Nigerian banks.

He further informed journalists that the Committee will hold separate meeting with all the banks within the consortium next week.

According to him, the new Board is expected to determine the financial status and state of health of the firm, while the regulatory agency will determine the next line of action.

When asked on the injection of fund by the apex bank, Akinade-Fijabi noted that there was no plan for injection of funds into the company.

Akinade-Fijabi warned the regulatory agency against abuse and arbitrary intrusion in the operations of the telecom firms and explained that the step taken by the Committee was aimed at preventing further loss of revenue to the Federal Government and jobs by Nigerians in the sector.

“As the elected representatives of the people, we have to wade into this matter in order to prevent further massive loss of revenue by the government and jobs by Nigerians, government needs revenue from the taxes paid by these operators to provide the needed amenities by the people and Nigerians on their employments also need to keep their jobs to earn living.

“So, this is where we as lawmakers come in, in order to ensure that the operators operate according to the rules of the game, we will get into the root of what led to this mess, those responsible for it will not go unpunished.

“We will have to invite the necessary anti-graft agencies, especially the Economic and Financial Crime Commission (EFCC), to look into the matter and fish out those behind it and get them punished.

“We have been informed that there is a new management for the Etisalat now, this Committee has resolved to give the new management few weeks to look into the books of the company and brief us its findings on true position of things.

“After this, we will then invite the Central Bank of Nigeria, CBN and the new management to chant a way forward, we will not allow the public money to go down the drain just like that,” Akinade-Fijabi said.

The NCC Commissioner, Sunday Dare commended the National Assembly on the timely intervention, assuring that the Commission as the regulatory authority was already on the top of the situation to bring about an amicable resolution.

Dare noted that the NCC as a responsible Commission, met with the stakeholders including the Company, the CBN and consortium of banks involved in the transactions.

Apart from the normal auditing of the operators financial books and ensuring quality services and adhering to rules, the Commission also took necessary steps to prevent future occurrence.

According to a NCC report the take over of Etisalat which has over 21 million subscribers was due to breakdown of negotiations between Central Bank of Nigeria (CBN), the consortium of banks and other stakeholders.

“By the letter dated 16th February, 2017, the CEO of EMTS informed the Commission of a proposal to restructure its shareholding in order to make the company more competitive and to engage its creditors towards the financial restructuring of its obligations.

“The Commission was subsequently informed that Etisalat had defaulted in its obligations to a consortium of banks through which it had raised a total sum of $1.2 billion to finance its operations.

“There were clear indications that the banks intended to exercise their contractual rights to recover the debt by taking over the company following Etisalat’s default. Options included winding-up of the Etisalat for inability to pay its debts pursuant to the Companies and Allied Matters Act,” the document read.

The Commission and CBN had ealier met on Friday, 10th March, 2017 to deliberate on the development, and held another meeting with Etisalat and the lender banks on the 16th March, 2017 to resolve the issue where the parties reached understanding that the loan would be restructed.

However, the Commission’s attention was drawn to a notice issued by Emirates Telecommunications Group Plc. (one of the controlling shares of Etisalat, Nigeria) on Tuesday, 20th June, 2017 that the ownership of Etisalat Nigeria was to be transferred to United Capital Trustees Limited (UCTL), the security trustee of bankers’ consortium, which is to hold the shares as enforcement of the security signed by Etisalat to secure the debt.

The Commission’s representative explained that the Executive Vice Chairman, Umar Garba Danbatta’s swift intervention led to CBN’s intervention to restrain the banks from shutting down Etisalat’s operations.

“The Commission has taken proactive steps to cushion the impact of the takeover, this is without prejudice to the ongoing effort between Etisalat and the banks toward a negotiated settlement,” Danbatta informed a House Committee on Communication that sat on the matter.

According to him, the banks were prohibited from taking over the banks in line with the provisions of section 38(1-2) of Nigerian Communications Act, 2003, which provides that: “The grant of license shall be personal to the licensee and the license shall not be operated by, assigned, sub licensed or transferred to another party unless prior written approval of the commission has been granted.”

While giving update on the steps taken to address the concerns on the crisis, the Commission announced that as a result of its intervention (along with the CBN), Etisalat has remained a going concern, providing uninterrupted services to its customers throughout Nigeria.

“In fulfilment of its statutory obligations under Nigerian Communications Act, 2003 (NCA), the NCC is focused on ensuring that Etisalat remains a going concern while parties continue to engage with the aim of reaching solutions that neither jeopardize the smooth functioning of the industry nor compromise subscribers’ interests.

“The Commission is also pleased to note that the CBN aligns with these objectives and has been working with the banks to achieve a resolution that guarantees uninterrupted telecoms services by Etisalat, investor assurance and industry stability.

“We believe that it is in the national interest that this course of action be supported by all stakeholders.

“In this regard, the CBN on 29 June, 2017 convened an emergency meeting between Etisalat and banks with NCC in attendance. Decisions critical to the continuation of Etisalat’s operations were reached, viz: to keep Etisalat as a going concern; to pay trade creditors whose services are critical to keeping Etisalat functional; to constitute a new management board and to meet in the coming days to decide on systematic funds injection.”

He explained that the commission is in constant touch with the apex bank on the issue, while monitoring the progress of the negotiations.

To ensure that the entire industry remains viable and sustainable, the Commission is pursuing the following initiatives including: conduct of regular/robust health checks on all licences (including financial, technical and commercial dimensions); monitoring of business continuity and recover plans as well as embark on aggressive enforcement of the NCC’s code of corporate governance.

According to the commission, the code was designed and made mandatory since November 2016, seeks to enhance business prosperity and corporate accountability, help in consolidating on the gains of the telecoms sector to the nation’s economy and gain stronger stakeholders’ support.

In the bid to protect the industry from growth-inhibiting factors, he emphasised the need for the apex bank to grant the telecoms industry the same status on foreign exchange, noting that the “industry is still unable to meet its critical forex-based OPEX/CAPEX requirements.”

He also stressed the need to address the problem of increasing demands for Right of Way fees and other taxes by multiple state government agencies which contribute to costs and curtailing efforts to roll-out required communications infrastructure across the country.

Similarly, the NCC helmsman argued that non-harmonisation of taxes and charges and approval regimes by agencies of federal and state governments, makes it difficult to make investment projections and necessary commitments.

“These issues are seriously hampering the industry’s long-term sustainability and our inability to meet the National Broadband Plan targets. The NCC will shortly make a presentation to the National Economic Council (NEC) on harmonisation approval regimes, charges and taxes by federal and state government agencies,” the document stated.

You may like

$500k Otedola Bribe: Supreme Court affirms ex-lawmaker, Farouk Lawan’s 5yrs jail term

Reps orders reversal of increase in DSTV/GOTV tariff by MultiChoice

Reps discovers leakages in TSA, trillions of funds unaccounted for

House of Reps reject the motion to suspend hike in fuel price

We aren’t as rich as you think — Reps’ speaker Abbas tells Nigerians

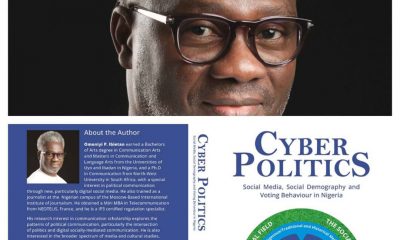

Ibietan’s book on cyber politics for public presentation 25 July

Trending

Featured1 week ago

Featured1 week agoCoalition of Media, CSOs demand investigation into unlawful arrest, detention, torture of Segun Olatunji, Editor FirstNews, by military

Aviation1 week ago

Aviation1 week agoKeyamo clarifies FG’s position on trapped airlines funds

Business4 days ago

Business4 days agoDollar crashes further against Naira at parallel market

Aviation6 days ago

Aviation6 days agoForeign airlines using lower price to force Air Peace from Nigerian-London route–Onyema

Business4 days ago

Business4 days agoRecapitalisation: Zenith Bank to raise funds in international capital market

Featured1 week ago

Featured1 week agoPelumi Nubi : London-to-Lagos solo driver honoured by Sanwo-Olu

Education4 days ago

Education4 days agoArmy reveals date for COAS 2024 first quarter conference

Crime4 days ago

Crime4 days agoFleeing driver injures two on Lagos-Badagry expressway