Bureau de Change Operators have begged the Central of Nigerian to reconsider its ban on sales of forex to members, stressing that discontinuation of the sales may lead to massive job losses in the sector.

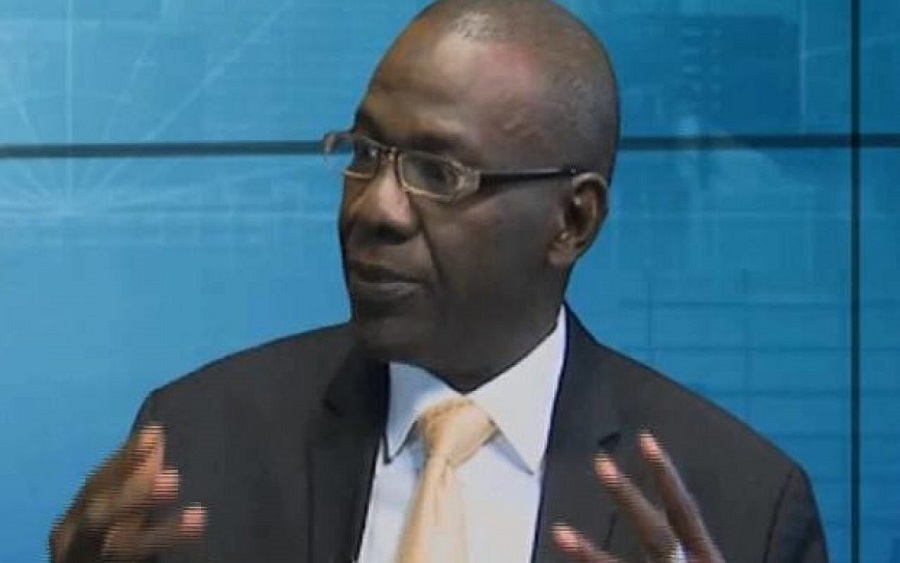

This was disclosed by the President, Association of Bureau de Change Operators of Nigeria, ABCON, Alhaji Aminu Gwadabe.

The CBN’s ban on sales to BDCs has greatly affected the business of the forex operators, leading to the laying off of workers, as admitted by the ABCON president.

Gwadabe said, “The majority of the licensed BDCs are in dire zero of supply sources since the CBN policy on the discontinuation of sales of forex with the attendant consequences of job losses in several thousands of both direct and indirect employment with a capitalisation value of N300bn to fade away.

READ ALSO: Naira dips to lowest point as BDCs call for collaboration

The CBN was supplying $10,000 to each BDC twice a week before the forex supply cut.

The CBN declared its decision after expressing disappointment that the BDCs had defeated their purpose of existence to provide forex to retail users, but instead, had become wholesale and illegal dealers.

Speaking on why the CBN should consider the BDCs as diaspora remittance agents, Gwadabe said, “Considering the BDCs potent notable roles in exchange rate management stability in 2006, 2017, 2020 and liquidity vehicles in the market, I think the CBN should review and consider BDCs becoming payout agents of International Money Transfer Services Operators in the remittance space as contained in their guideline of 2014 for BDCs reforms.

“The BDCs have over 15 years been strong allies of the CBN and effective in ensuring forex liquidity and price stabilisation discoveries.

“Excluding the BDCs from the payment agents of remittance companies in the remittance space and the reallocation of their supply is like throwing the baby with the bathwater or excluding the man who owns a water tanker that supplies water in the street from owning a water business.”

He added, “The BDCs in Bangladesh, India, Lebanon, Kenya play active roles in payout agencies. Therefore, Nigeria should not be an exception.”

READ ALSO: Speculative practices will erode Naira’s value, BDC operators warn

Gwadabe disclosed that ABCON had introduced innovations and platforms embraced by its members like SAAs master for rendering returns online real-time to CBN by the BDCs.

According to him, ABCON has also on-boarded BDCs on the Nigerian Interbank Settlement systems for BVN verifications.

He said that the BDCs were also on board of the Nigerian financial intelligence platform for rendering suspicious and cash transfers transactions.

Health & Fitness3 days ago

Health & Fitness3 days ago

Featured6 days ago

Featured6 days ago

Education1 week ago

Education1 week ago

Business1 week ago

Business1 week ago

Aviation5 days ago

Aviation5 days ago

Business6 days ago

Business6 days ago

Crime1 week ago

Crime1 week ago

News6 days ago

News6 days ago