By Odunewu Segun

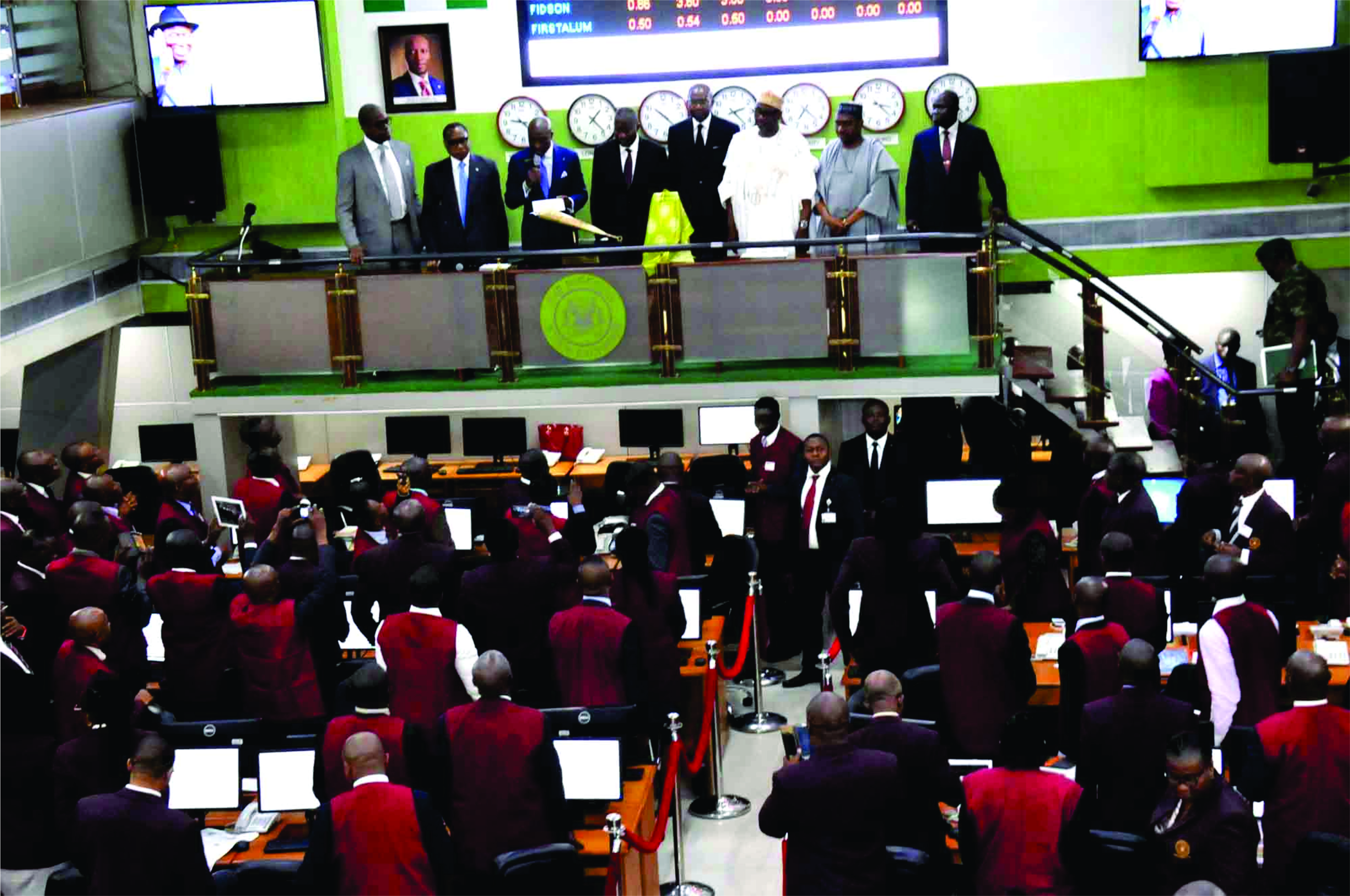

As parts of the consequences of the negative growth of the country’s Gross Domestic Product, the equity market trading on the floor of Nigerian Stock Exchange declined by N35 billion at the close of trading on Monday 23rd.

Similarly, the NSE market capitalisation dropped to N9.278tn from N9.313tn recorded on Friday last week. The NSE All-Share Index also shed weight to close at 27,015.97 basis points from 27,116.45 basis points. A total of 316.735 million shares worth N1.909bn exchanged hands in 3,924 deals.

Following the drop in the country’s GDP in the first quarter of 2016 and the much anticipated outcome of the Central Bank of Nigeria’ MPC meeting rounding off today, analysts had on Friday predicted that investors in the country’s capital market were likely going to exhibit negative sentiments.

ALSO SEE: Zenith Bank, others stock appreciate despite industrial action

The National Bureau of Statistics had on Friday released the first quarter real GDP report showing a 0.36 per cent year-on-year contraction in output. This comes on the back of the 0.81 per cent slowdown in the non-oil sector following declines in manufacturing, financial institutions and real estate activities.

The financial services sector (-201bps) was the biggest loser as declines in Zenith Bank Plc (-489bps), Access Bank Plc (-439bps) and Skye Bank Plc (-342bps) overwhelmed an advance in Stanbic IBTC Holdings Plc (+10.19 per cent). Likewise, the consumer goods (-41bps) and oil and gas (-9bps) sectors came under pressure with PZ Cussons Nigeria Plc (-497bps), Tiger Branded Consumer Goods Plc (-146bps), Nigerian Breweries Plc (-56bps) and Forte Oil Plc (-25bps) shedding weight.

Football1 day ago

Football1 day ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Education1 week ago

Education1 week ago

Crime1 week ago

Crime1 week ago

Covid-191 week ago

Covid-191 week ago

Latest5 days ago

Latest5 days ago

Business1 week ago

Business1 week ago